Navigating the Maze of Home Renovation Deductions

Table of Contents

- 1. Navigating the Maze of Home Renovation Deductions

- 2. The Power of Fresh Content: Elevating Your WordPress Site

- 3. Why Content freshness Matters

- 4. Keeping Your Content Alive: The Power of Regular Updates

- 5. Crafting compelling Content: A Recipe for Success

- 6. What specific criteria determine whether renovation expenses qualify for the 50% deduction for primary residences outlined in the recent Budget Law?

- 7. Navigating the Complexities of Home Renovation Deductions

- 8. Interview with Annalisa Moretti, Real estate Law Expert at confedilizia

- 9. How are renovation deductions affected by delays in moving into a recently purchased property?

- 10. Navigating the Complexities of Home Renovation Deductions

- 11. Interview with Annalisa Moretti,Real estate Law Expert at Confedilizia

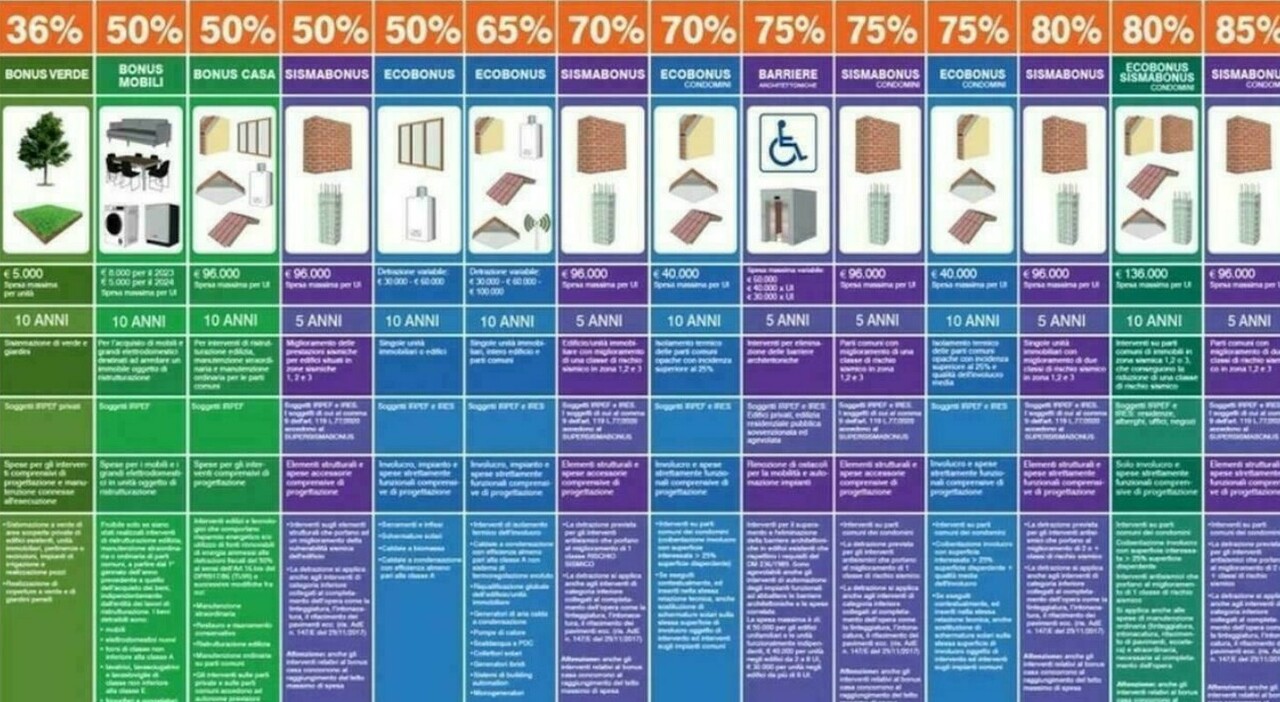

Italy’s recent Budget Law introduced a welcome boon for homeowners: a 50% tax deduction for renovations on primary residences, dropping to 36% for second homes. This incentive is aimed at encouraging home enhancement, boosting the economy, and enhancing living spaces.

However, a cloud of uncertainty hangs over this seemingly straightforward benefit. The law’s definition of “expenses incurred by owners for interventions on the real estate unit used as a main residence” leaves room for interpretation, raising concerns for homeowners who find themselves in unexpected situations.

What happens, for example, if a homeowner purchases a property wiht the intention of making it their primary residence, but unforeseen circumstances delay their move-in date? Could they be forced to except the lower 36% deduction, even though the property is intended as their main home?

Fortunately, experts offer some reassurance. Confedilizia,a prominent italian association representing property owners,clarifies that the Revenue Agency has addressed this issue. According to Confedilizia, “provided that the property is used as the main residence by the end of the renovation works, the full 50% deduction applies, nonetheless of the initial residency status.”

This interpretation aligns with the spirit of the law, which aims to support homeowners in improving their living spaces. it provides much-needed clarity for individuals purchasing pre-owned properties who require time to finalize renovations before moving in.

Confedilizia advocates for an even broader interpretation of the deduction, extending it to cover renovation work on common areas within condominiums, specifically for those who own properties used as their primary residence.

This proposed extension, Confedilizia argues, would foster a fairer system and encourage property owners to contribute to the overall improvement of their buildings.

The ongoing debate surrounding these deductions underscores the critical importance of understanding the nuances of legal frameworks and seeking expert advice to ensure homeowners receive the full benefits they deserve.

The Power of Fresh Content: Elevating Your WordPress Site

In the ever-changing digital world, getting your website noticed is crucial for success.Search engine optimization (SEO) is a key player in achieving this visibility.A vital part of a strong SEO strategy is creating and maintaining high-quality, relevant content. WordPress, with its user-kind platform and vast library of plugins, provides numerous tools to help you excel in this area.

Why Content freshness Matters

Think of your website as a living entity. Just like any living thing, it needs to evolve and adapt to stay current and engaging. Frequent content updates signal to search engines that your site is active, informative, and up-to-date. This can lead to improved search rankings and, ultimately, increased organic traffic.

Keeping Your Content Alive: The Power of Regular Updates

So how do you keep your content fresh and relevant? It all boils down to consistent updates. Refreshing existing content regularly can:

- Maintain its accuracy and relevance

- Boost your search engine rankings

- Provide ongoing value to your audience

Crafting compelling Content: A Recipe for Success

Beyond keeping your content fresh, it’s essential to create high-quality, engaging material that resonates with your target audience. Here are some tips:

- Know your audience: Understanding their needs, interests, and pain points will help you create content that is truly valuable and relevant.

- Conduct in-depth research: Go beyond surface-level information and delve into the topic to provide insightful and comprehensive content.

- Focus on providing value: Offer practical tips, actionable advice, or unique perspectives that your audience will find helpful and engaging.

What specific criteria determine whether renovation expenses qualify for the 50% deduction for primary residences outlined in the recent Budget Law?

Navigating the Complexities of Home Renovation Deductions

with the recent Budget Law introducing a 50% deduction for renovations on first homes and a 36% deduction for second homes, a crucial question arises for homeowners: when exactly does this deduction apply?

Interview with Annalisa Moretti, Real estate Law Expert at confedilizia

Annalisa moretti, a respected real estate law expert at Confedilizia, a national association representing Italian property owners, provides valuable insights into this complex issue.

Archyde News: Ms.Moretti, the new Budget Law offers attractive incentives for home renovations. However, the exact conditions for claiming the full 50% deduction for primary residences seem unclear. Can you shed some light on this?

Annalisa Moretti: The law states that deductions apply to “expenses incurred by owners for interventions on the real estate unit used as a main residence.” This wording can be ambiguous, notably for those who buy a property, begin renovations, but encounter unforeseen circumstances and cannot move in instantly. )

Archyde News: What is confedilizia’s interpretation of this legal nuance?

Annalisa Moretti: Based on our discussions with the Revenue Agency, we understand that as long as the property is intended to be the owner’s main residence and they move in by the end of the renovation works, the full 50% deduction applies, irrespective of when they initially took up residency.

Archyde News: That’s very reassuring for homeowners who may face temporary delays in their moving-in plans. Are there any other interpretations or discussions regarding these deductions?

Annalisa moretti: Yes, Confedilizia is also advocating for an extension of the 50% deduction to renovation work on common areas within condominiums for properties used as primary resThen come from a fantastic pre-tax plan, that’s crucial. It’s a good idea to remember that tax laws are always changing, so staying informed is crucial.

Seeking expert advice is always recommended.“The best advice is to consult with a qualified tax advisor or legal professional,” says Annalisa Moretti. “They can provide personalized guidance based on your specific situation and ensure you optimize your deductions according to current regulations.”

How are renovation deductions affected by delays in moving into a recently purchased property?

Navigating the Complexities of Home Renovation Deductions

with the recent Budget Law introducing a 50% deduction for renovations on first homes and a 36% deduction for second homes,a crucial question arises for homeowners: when exactly does this deduction apply?

Interview with Annalisa Moretti,Real estate Law Expert at Confedilizia

Annalisa moretti,a respected real estate law expert at Confedilizia,a national association representing Italian property owners,provides valuable insights into this complex issue.

Archyde News: Ms.Moretti, the new Budget Law offers attractive incentives for home renovations. However,the exact conditions for claiming the full 50% deduction for primary residences seem unclear. Can you shed some light on this?

Annalisa Moretti: The law states that deductions apply to “expenses incurred by owners for interventions on the real estate unit used as a main residence.” This wording can be ambiguous, notably for those who buy a property, begin renovations, but encounter unforeseen circumstances and cannot move in instantly. )

Archyde News: what is confedilizia’s interpretation of this legal nuance?

Annalisa Moretti: Based on our discussions with the Revenue agency, we understand that as long as the property is intended to be the owner’s main residence and they move in by the end of the renovation works, the full 50% deduction applies, irrespective of when they initially took up residency.

archyde News: That’s very reassuring for homeowners who may face temporary delays in their moving-in plans. Are there any other interpretations or discussions regarding these deductions?

Annalisa moretti: Yes, Confedilizia is also advocating for an extension of the 50% deduction to renovation work on common areas within condominiums for properties used as primary residences. .

Confedilizia believes this extension would incentivize owners to contribute to maintaining the overall condition of their buildings,ultimately benefiting the entire residential community. This proposal is still under discussion, but it reflects Confedilizia’s commitment to supporting homeowners and enhancing the quality of residential living.