The United States closed the year 2022 with a modest drop in inflation. Consumer prices have seen the biggest monthly decline since the start of the pandemic they showed.

The consumer price index (CPI), which measures the prices of a broad basket of goods and services, fell 0.1% in the final month of 2022, in line with Dow Jones’ estimate. This is the biggest monthly drop since April 2020, when much of the country was locked down to fight Covid.

Despite the decline, the consumer price index rose 6.5% from a year ago, highlighting the heavy burden the rising cost of living is putting on American households.

The CPI indicator – which the whole world has been waiting for with bated breath – takes into account price movements from gasoline to eggs to the price of plane tickets.

The Federal Reserve prefers another metric that takes into account changes in consumer behavior. However, the central bank considers a wide range of information when measuring inflation, and the CPI is only one piece of the puzzle.

Markets are closely watching the FED’s moves as the institute actively fights once morest inflation, which has not so long ago set a record since it has not been this high in 41 years. Bottlenecks in supply chains, the war in Ukraine, and billions in fiscal and monetary stimulus have contributed to price increases across most areas of the economy.

Policymakers are now debating how to proceed with interest rate hikes used to curb inflation. The FED has so far raised the benchmark lending rate by 4.25 percentage points to the highest level in the past 15 years. Officials have indicated that the interest rate is likely to exceed 5%.

What does CPI have to do with cryptos?

There is a proven correlation between inflation and stock prices, and this is also true for cryptocurrencies. Those dealing with traditional financial markets pay particular attention to the consumer price index. It is very useful information for policy makers, brokers and small business owners in their decision-making, as inflation is closely related to the performance of stock markets.

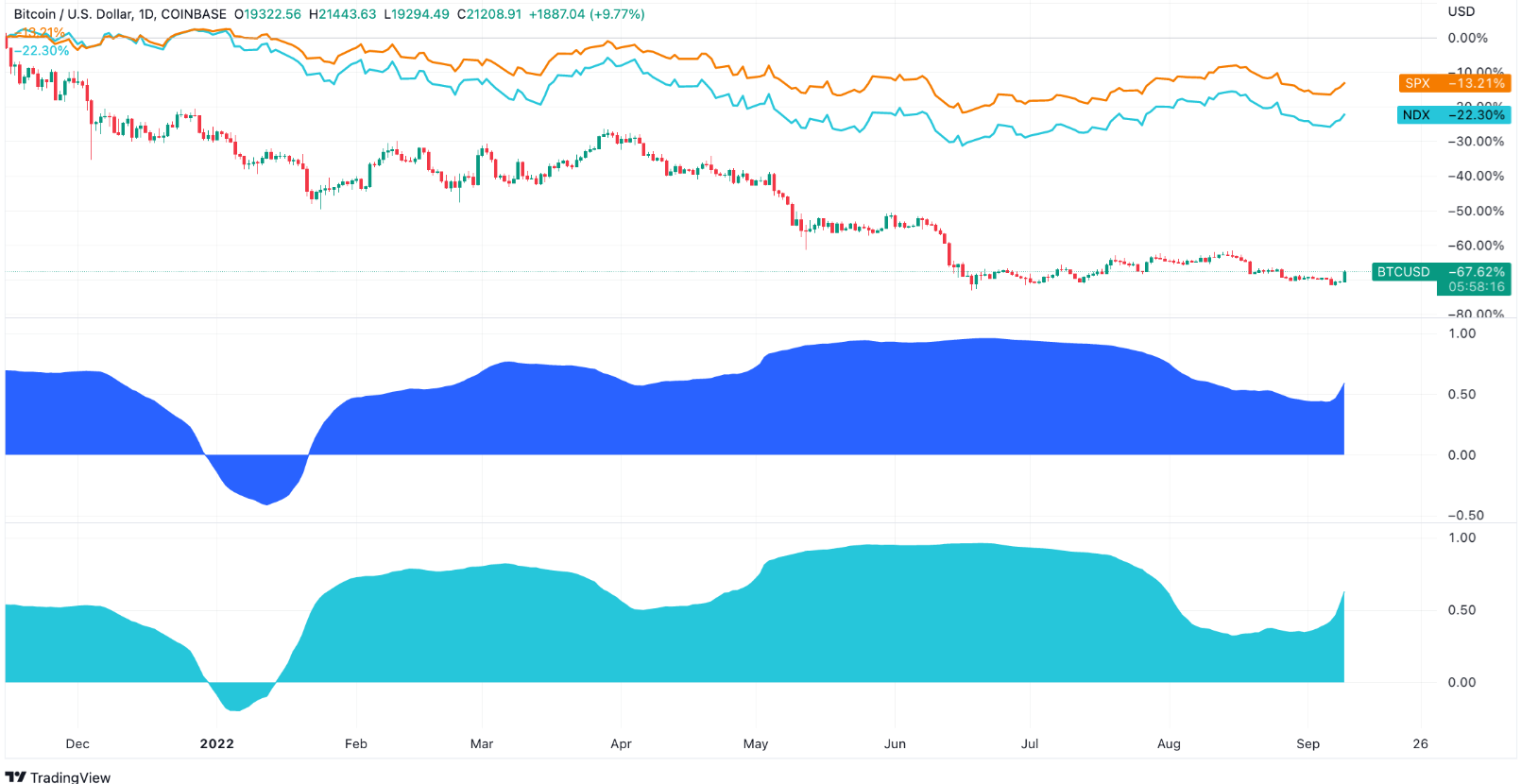

The US CPI data may mean a decrease in stock market demand and thus a decrease in the exchange rate of cryptocurrencies. With Trading View, you can compare the highs and lows between bitcoin and Nasdaq stocks over the past decade. We can discover many similarities between them. If crypto is correlated with stocks, then CPI does have an effect on digital currencies as well. In times of economic stress, cryptocurrencies can be very volatile. Most recently, the COVID-19 pandemic and the problems surrounding it caused large price fluctuations in the crypto space.

Certain categories, such as energy and food, are more closely related to crypto than others. These categories are necessities that people spend on regularly. If their prices rise, citizens will have much less extra income to spend on crypto. Several experts believe that the higher the CPI, the more pressure there is on cryptocurrencies. However, a rising CPI does not mean that the crypto market is turning negative. Some believe that cryptos are an effective hedge once morest inflation. They are decentralized, easily accessible over the Internet, and most cryptocurrencies have a constant supply. In the long term, it can therefore be used as an excellent value preservation tool.

Using CPI can also be beneficial for crypto daytraders who use short-term strategies to make profits. Instead of waiting years for their crypto to increase in value, traders take advantage of volatility.

Historical US CPI data and changes in crypto exchange rates can therefore offer valuable information to crypto traders.