Not everyone is shocked by the first place on the list. Bitcoin price growth outpaced all other financial products in the first quarter of this year.

The week’s most important cryptocurrency news in one place

The US Securities and Exchange Commission (CFTC) sued the world’s largest cryptocurrency exchange, the Binance exchange. According to the CFTC, Binance offered unregistered crypto-derivative products and encouraged US customers to use VPNs to bypass compliance checks. In doing so, the company violated the laws on futures transactions.

The stock market seems to be under a lot of pressure lately. In the week of Binance announcedthat he is forced to suspend the services of the BSC network for an indefinite period of time. The BSC (Binance Smart Chain) network is not functioning due to a node error. According to the company, they are trying to fix the problem as soon as possible.

Payments to European customers of FTX EU can begin. The European company of the crypto exchange, FTX EU is one website launched to enable European customers to submit payment requests. This comes nearly five months following the global trading platform collapsed and went bankrupt in early November. Meanwhile, the bankrupt FTX crypto exchange its founder is accused ofthat he used the $10 million he transferred to his father while he was CEO to cover his legal expenses.

Bitcoin is the highest-grossing asset of the year

Bitcoin’s momentum in 2023 saw the digital asset thoroughly outperform all other investment products despite a gloomy economic outlook.

Bitcoin became the best-performing asset class in the first quarter of 2023, according to data from Bloomberg on March 31. During the last three months, the exchange rate was able to achieve an increase of around 70%.

This also means that this performance is also the digital currency’s best quarter since the first quarter of 2021. It is worth noting that in the first quarter of 2021, Bitcoin gained more than 100% at the start of the last rally.

Moreover, the digital currency’s most recent quarterly returns brutally undercut the performance of traditional asset groups. Big names like the S&P 500 (5.5%), the Nasdaq 100 (19%) and the iShares Core US Aggregate Bond ETF (2.2%) barely matched bitcoin’s quarterly gains.

The exchange rate of Bitcoin was also able to show a significant increase compared to the traditional safe havens, precious metals. In the first three months of 2023, precious metals were able to show a combined increase of 10%, of which gold was 8%, while silver’s yield was barely 0.3%.

Amid quarterly gains, investors seem to be flocking to the cryptocurrency market. On an annual basis, the total value of open positions increased by nearly 430%. Bitcoin’s ability to lead the market in terms of profits further adds to the optimism in the market.

Bitcoin, the savior of the (victims of) the banking system

However, market experts believe that Bitcoin’s performance is not a surprise in the current market environment. According to some analysts, the asset has already started building the foundation for a possible rally and breakout in late 2022.

An ever-strengthening price floor has been in place since last November, and it was only a matter of time before the liquidity narrative changed or longer-term investors saw the value opportunity in cryptocurrencies once once more.

Bitcoin’s bullish chart and gains have also coincided with the renewed possibility of further interest rate hikes as the Federal Reserve seeks to tame skyrocketing inflation. The cryptocurrency has taken advantage of the chaos in the banking sector as investors increasingly see the asset as an alternative to centralized monetary systems following the collapse of Silvergate, Signature Bank and Silicon Valley Bank.

In this sequence of events, Bitcoin’s fundamental resilience to centralized banking is prominent. It appears as an almost unique asset in the market as a safe haven at a time of skepticism regarding bank deposits and increased central bank bailouts.

The impact of the banking crisis is well illustrated by the fact that five leading US banks lost $108 billion in market capitalization in 2023 alone, while Bitcoin increased its market value by more than $200 billion during the same period.

Never chase green candles

Meanwhile, this week Bitcoin hit a new nine-month high overnight on March 30 when BTC/USD rose to $29,170 on Bitstamp. However, traders remain cautious. The rejection came almost immediately, which sent the trading party back to the starting point, so the $30,000 bitcoin exchange rate is still waiting. And with this, he gave a perfect example of a false outbreak.

“Nothing has changed – yes, we got a nice jump to the highs, but the pullback was expected,” one analyst called the situation on Twitter, referring to bitcoin moving within a specific price range.

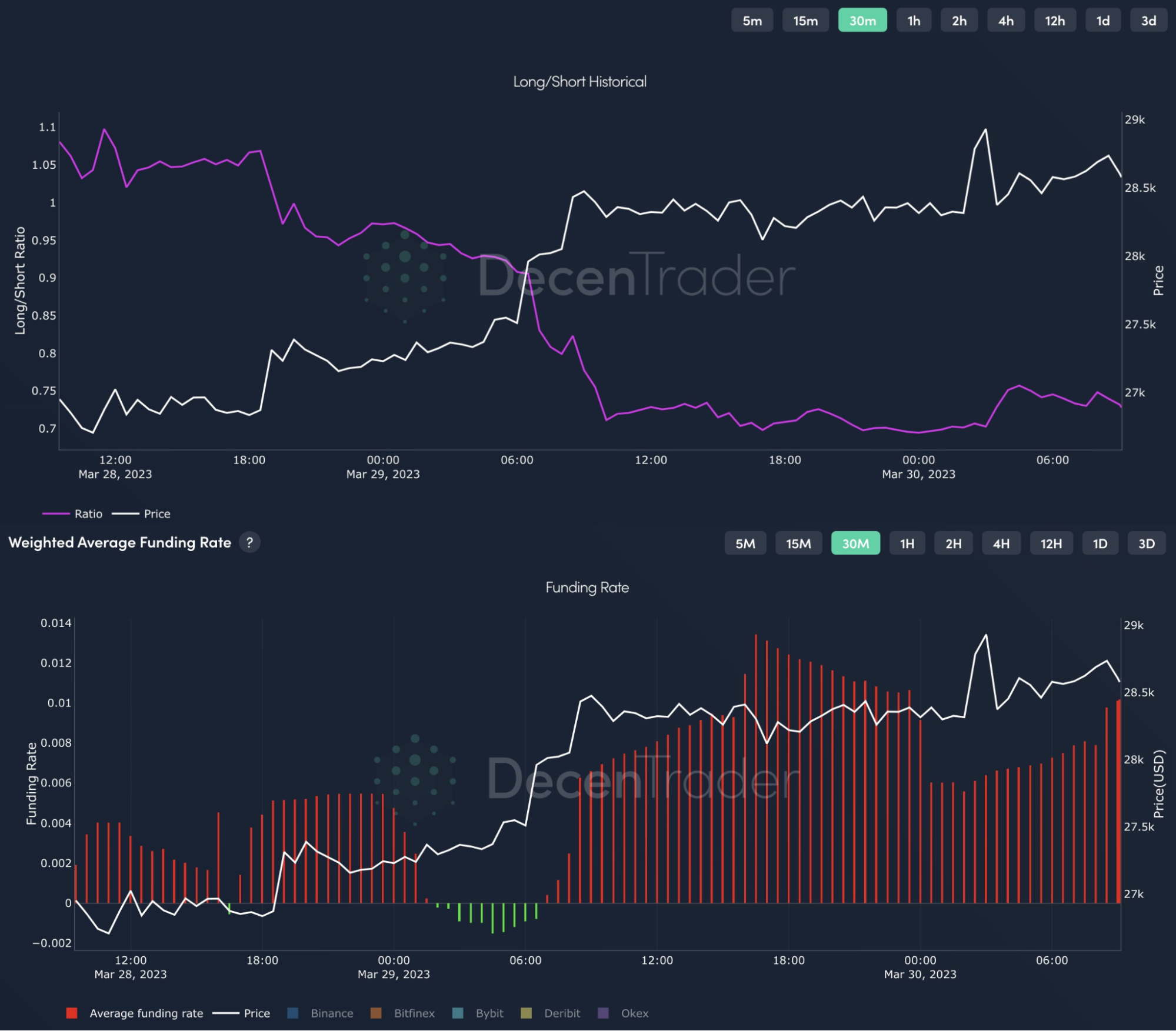

Analyzing the situation of the derivative exchanges, the DecenTrader analyst found that shorts are currently in the lead. The funding rate continues to rise, while the long/short ratio remains unchanged. With falling prices and positive funding, shorts become potentially profitable. And all of this is financed by those holding long positions.

So we may have to wait for the real exchange rate rally in the short term. Especially if we take a closer look at the current trading turnover. Another possible warning sign is that the current price breakout was actually seen with trading volume as low as last seen last year.

The last time a similar one was observed on the bitcoin chart was in June 2022. Paradoxically, just when the price of BTC fell from 30,000 to the bottom.

Altcoin News

Ethereum developers confirmed the Shapella fork timeline. Ethereum validators will soon be able to withdraw their ethers from the Beacon Chain following the Shapella hard fork is activated on the Ethereum mainnet on April 12th. Allocations will be made possible by Ethereum Improvement Proposal EIP-4895. The staked ethers are then “pushed” from the Beacon Chain to the Ethereum Virtual Machine (EVM) layer, also known as the execution layer.

MetaMask, which provides crypto wallets, recently warned its users that the upcoming MetaMask airdrop is just fake news. The rumor that an airdrop is expected on Friday, i.e. March 31, was quite widespread on social media. However, none of this is true – confirmed a few days ago the company.

The Cardano blockchain is a is preparing for complete decentralization, which means that the Voltaire era is coming. The goal of the Voltaire era is to create a self-sustaining system by introducing voting and treasury systems, which allows network participants to influence the future development of the network with their shares and voting rights.