Jackson Hole speech… Reconfirmation of austerity stance

“It is more painful when price stability fails”

“Until there is confidence that inflation can be controlled, the Fed should keep raising rates and keep rates high,” said Jerome Powell, chairman of the Federal Reserve. The Fed’s annual symposium (Jackson Hall Meeting) was held in Jackson Hole, Wyoming, USA on the 26th.

Chairman Powell said, “A hike in the key interest rate will inevitably cause pain for businesses and households.”

Global financial markets have been paying close attention to the level of Chairman Powell’s remarks. When the US personal consumption expenditure (PCE) price index fell 0.1% in June compared to June, some were expecting the Fed to slow the pace of rate hikes.

However, Chairman Powell said, “The data is far below expectations to judge that inflation has been captured.” “Inflation is too high and the job market is too tight to stop raising interest rates,” he added.

“Historically, it is dangerous to turn to easing policy too soon,” he said.

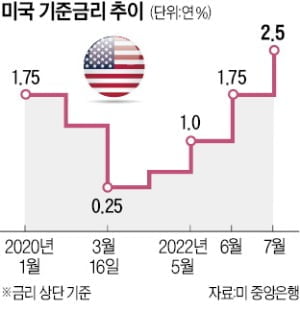

Stocks and bonds fell on the same day as Chairman Powell made hawkish remarks. This is because of concerns that the Fed is likely to take a giant step in raising the benchmark interest rate from 2.25% to 2.5% by 0.75 percentage points at the same time at the Federal Open Market Committee (FOMC), which will be held on the 20th and 21st of next month. As of 00:00 (Korean time) on the 27th, the S&P 500 index fell 1.61% to 4131.46. The tech-focused Nasdaq index plunged 2.03% to 12,382.12. The 10-year U.S. Treasury yield rose 0.021 percentage points to 3.045% a year.

Powell, the hawkish color, says it costs money and pain to keep prices down.

The reason why Federal Reserve (Fed) Chairman Jerome Powell did not bend his strong will to tighten monetary policy on the 26th is analyzed to be because he judged that inflation, which soared to the highest level in more than 40 years, is still serious. The recent decline in gasoline prices in the US has raised the idea of a peak in inflation, but it is necessary to watch the trend downward. As Chairman Powell continued his hawkish remarks (preferring monetary tightening), there is an observation that the possibility of a ‘giant step’ (0.75 percentage point increase) for the third consecutive month at the Federal Open Market Committee (FOMC) next month has increased.

○Powell showed the hawk’s true color

Chairman Powell stood at the podium for the Economic Policy Symposium held in Jackson Hole, Wyoming, in the northwestern United States on the same day, with investors around the world watching. “Until we are confident that inflation is caught, we must keep raising rates and keep them higher,” Powell said. He pointed out the side effects of the rate hike, such as a slump in the labor market, but made it clear that he would continue to raise interest rates. “If price stability is not restored, it will cause much greater suffering,” he said.

Until just before Chairman Powell’s speech, some predicted that Chairman Powell would make dovish (preferring monetary easing) remarks. This is because there are signs that inflation is slowing in the US, with energy prices calming down. The rate of increase in personal consumption expenditure (PCE) in the US in July, announced regarding an hour before Chairman Powell’s speech, also strengthened the probability of a big step (0.5 percentage point increase). The U.S. Department of Commerce announced on Monday that the PCE price index fell 0.1% in May from the previous month. The PCE price index fell for the first time since April 2020. Compared to July last year, the increase was 6.3%, slower than the increase in June (6.8%). As the rise of the PCE, a price index that the Fed values, has eased, expectations for the rate adjustment theory have grown.

However, Powell said on the same day that the lower July inflation figures are welcome, but the improvement in a month before we are convinced that inflation is falling is far short of what we should see. “We will continue to push (raise interest rates) until we do,” he said.

Chairman Powell, who mistakenly judged that “inflation in the United States is temporary” a year ago, was harsh on that day. According to CNBC, “the rate of inflation may have peaked, but the remarks were made while there was no clear sign of a decline.”

○The probability of a giant step will increase next month

The market, who was expecting ‘Dove Powell’, was shocked. The three major indices on the New York Stock Exchange, which started mixedly, turned downward on the same day.

Chairman Powell did not reveal the extent of the rate hike at the FOMC meeting on the 20th and 21st of next month. However, the market was inclined to predict the possibility of a giant step high. According to the Chicago Mercantile Exchange’s FedWatch, the forecast for Giant Step as of 10 am on the 26th was 56.5%, more than half.

Now, the market’s attention is expected to focus on various economic indicators to be announced before the FOMC next month. The August CPI, which will be released on the 13th of next month, is also expected to be a clue to predict the extent of interest rate hikes.

“The decision at the September meeting will depend on the data and the prospects that change accordingly,” Powell said.

Jackson Hole = Washington Correspondent Jeong In-seol / Reporter Huh Se-min [email protected]