2024-06-29 05:03:09

Journalist

Posted on: June 28, 2024

- The Ethereum worth lastly turned bullish within the final 24 hours.

- Promoting strain on Ethereum elevated final week.

Whale shares have a big impact on cryptocurrency costs, together with the costs of main cash comparable to Ethereum [ETH]. The newest evaluation rightly pointed to one in every of these fascinating developments. Furthermore, an necessary ETH metric means that traders might quickly witness a worth enhance.

The connection between Ethereum and Bitmex

CryptoQuant analyst and creator BlitzzTrading lately revealed a evaluation spotlight a novel development. In response to the evaluation, following a pointy enhance in Ethereum reserves, noticeable decreases within the worth of ETH are noticed.

For instance, on September 28, there was a large drop in Bitmex’s foreign money reserves, adopted by a rise within the worth of ETH.

This correlation between ETH and Bitmex meant that when Bitmex’s Ethereum whales purchase by means of Bitmex, we see a lower in reserves.

Quite the opposite, once they promote, we see a rise in Bitmex reserves. At press time, Bitmex’s ETH reserves remained comparatively low.

Supply: CryptoQuant

Ethereum on the backside of the market

In the meantime, the Ethereum worth lastly managed to show bullish following a number of days of corrections. In accordance Market worth of coin The ETH worth elevated by nearly 2% within the final 24 hours.

On the time of writing, ETH was buying and selling at $3,428.69 with a market capitalization of over $412 billion. AMBCrypto’s take a look at Glassnode knowledge additionally pointed to a bullish metric.

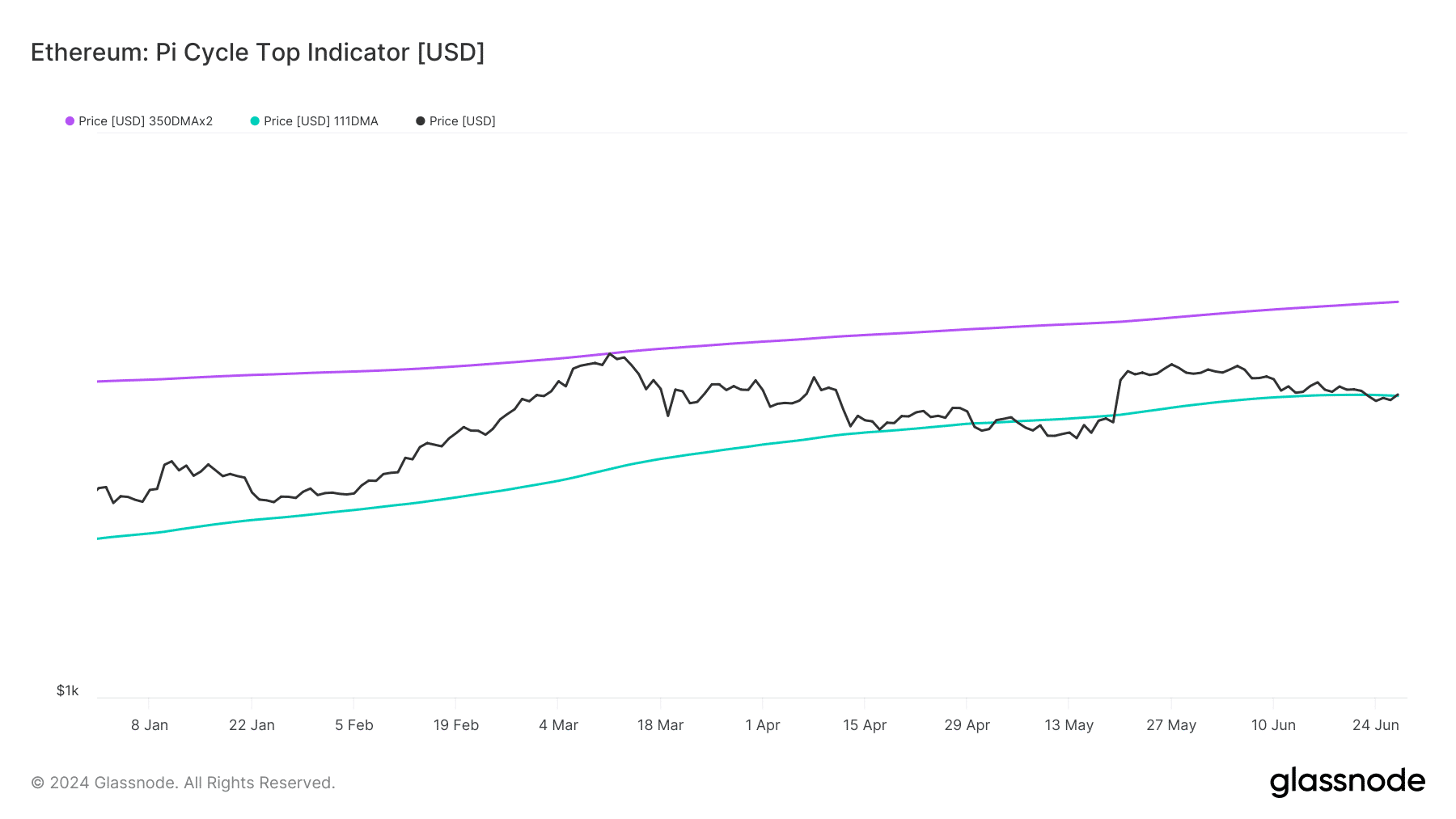

The Pi Cycle Prime indicator revealed that the ETH worth had bottomed, indicating a bullish rally. If this seems to be true this time, ETH may quickly attain $5000.

Fuente: Glassnode

Other than this, Ethereum worry and greed index At press time, the share worth was 32%, which implies the market was in a “worry” section. When the calculation reaches this degree, it signifies that the probabilities of a worth enhance are excessive.

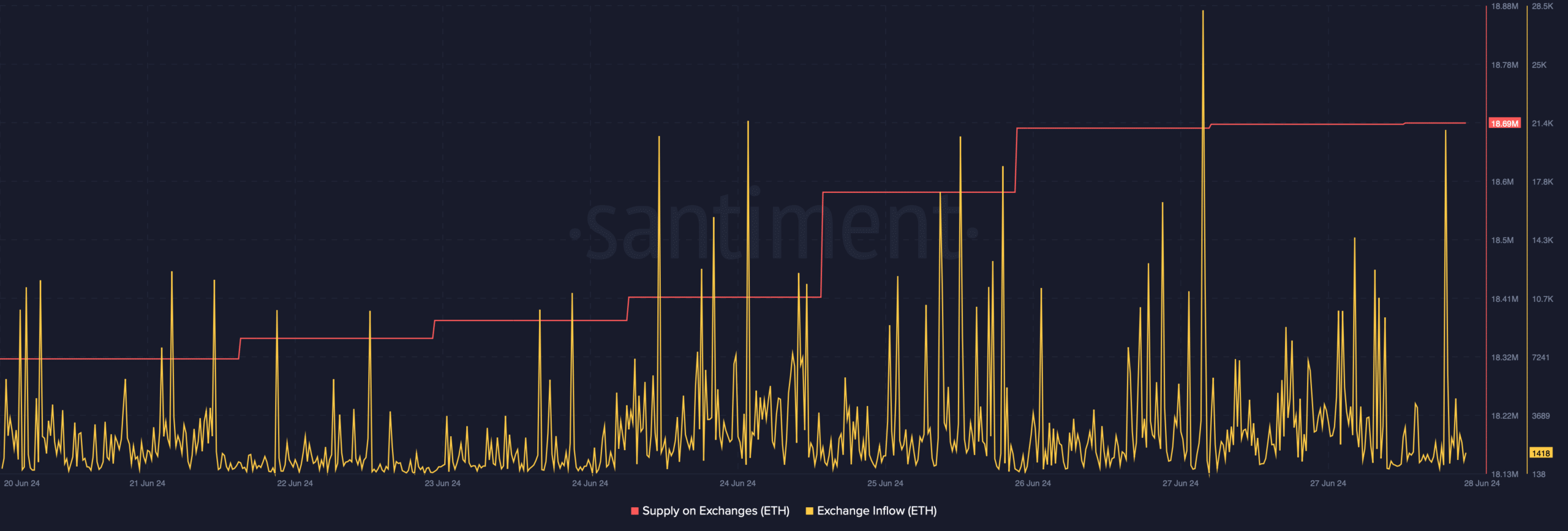

Nonetheless, knowledge from Santiment revealed that promoting strain on the token was excessive. This seemed to be the case as the provision of ETH on exchanges elevated.

Moreover, foreign money inflows additionally skyrocketed, indicating a rise in promoting strain, which may restrict the rise within the ETH worth.

Supply: Sentiment

Is your pockets inexperienced? Overview ETH revenue calculator

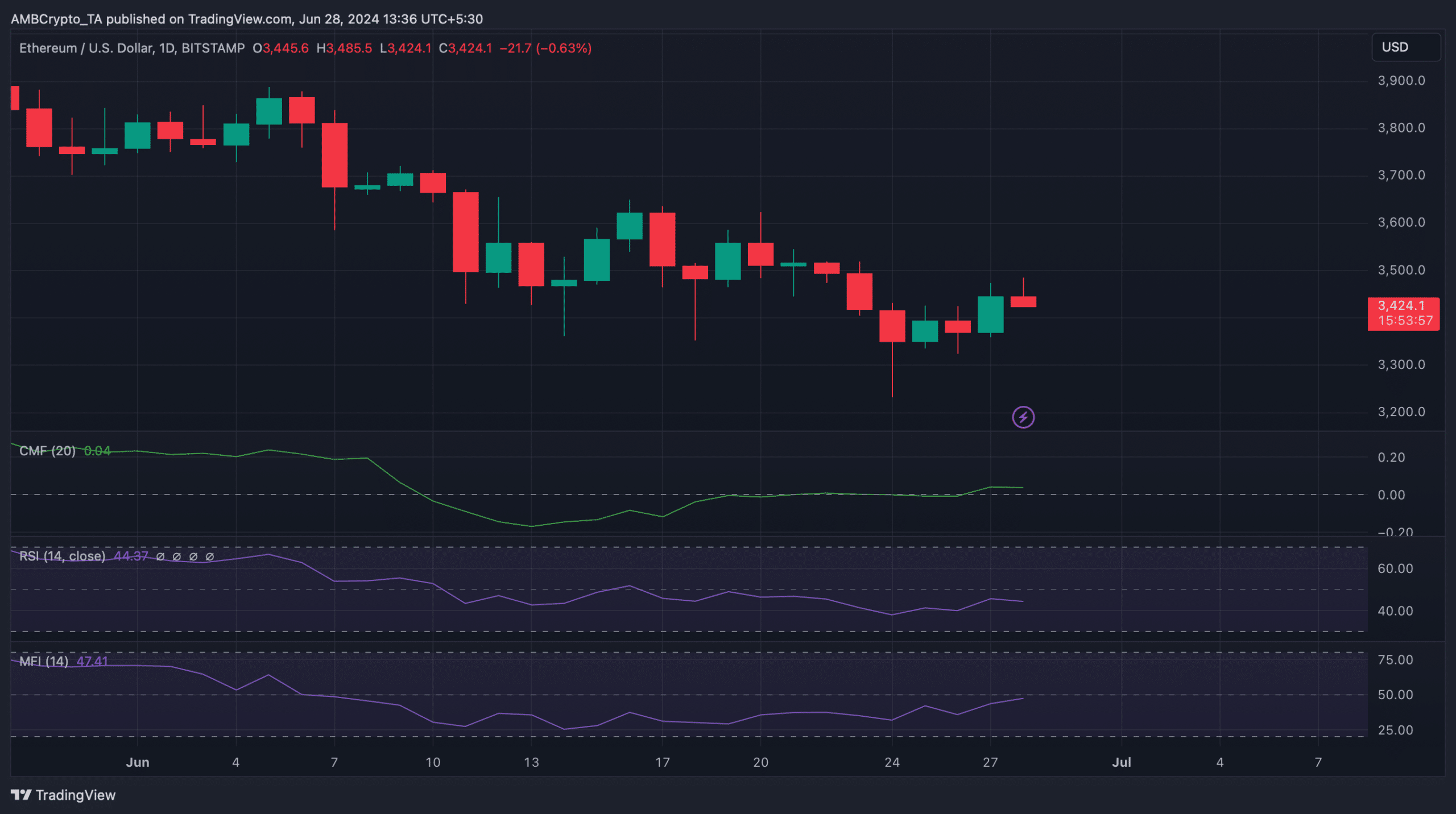

Much like the aforementioned metrics, a number of the market indicators additionally remained bearish for the token. For instance, each Ethereum’s Relative Power Index (RSI) and Chaikin Cash Circulation (CMF) moved sideways in the direction of their respective impartial marks.

Nonetheless, the Cash Circulation Index (MFI) appeared bullish because it moved north, indicating continued worth progress.

Supply: TradingView

That is an computerized translation of our English model.

1719650730

#Ethereum #market #bottomed #Worth #indicators #level #goal