One year since the launch of the China Business Innovation Team under the direct control of Vice Chairman Han Jong-hee

Samsung’s smartphone market share in China is still near 0%

Sales of Samsung’s Chinese sales subsidiary ‘half a tenth’ in 7 years

is struggling in the Chinese smartphone market. Its sales, which reached 25 trillion won in 2013, shrank to one-tenth in seven years, and its market share, which had exceeded 20%, sank to 0%. After repeated struggles in the world’s largest market, they tried to change the game by establishing a new ‘China Business Innovation Team’ under the direct control of Samsung Electronics Vice Chairman Han Jong-hee last year, but no significant changes have been detected for the first year. Samsung Electronics’ China Sales Corporation (SCIC) turned into a loss following 7 years without any breakthrough.

Samsung’s Chinese sales subsidiary cuts 1/10th of its sales in 7 years

According to the Financial Supervisory Service’s electronic disclosure on the 16th, SCIC recorded cumulative sales of 2.66 trillion won and cumulative net loss of 31 million won in the third quarter of this year. It posted a net loss of 63.6 billion won in the third quarter alone. If the loss is not recovered in the remaining fourth quarter, it will turn into a deficit for the first time in seven years since 2015.

SCIC is in charge of selling set products such as smartphones and TVs in China. Samsung Electronics ranked first in the Chinese smartphone market with a market share of more than 20% in 2013, but its sales and market share have plummeted since then. Sales, which exceeded 25 trillion won at the time, plummeted to 16 trillion won the following year (2014), and to 8 trillion won in 2016. Eventually, in 2020, it fell to 2 trillion won, and sales decreased to 1/10 in 7 years.

This is the result of being pushed back by Chinese native companies that put price competitiveness at the forefront, such as Xiaomi, Huawei, Oppo, and Vivo. The year 2016, when there was a boycott among Chinese consumers due to the THAAD (High Altitude Area Defense) sanctions and the Galaxy Note 7 ignition accident, was a particularly painful time.

Its market share, which fell to 0.8% in 2018, is still around 0%. Samsung Electronics’ sluggishness is all the more noticeable compared to Apple’s recent rise to No. 1 in the Chinese market with a 25% market share, overtaking Chinese companies. Analysts say that the sales gap in the Chinese market had a big impact on the prospect that Samsung Electronics will give up the No. 1 spot in the global smartphone market to Apple in the fourth quarter of this year.

Last year, the China Business Innovation Team was newly established… The wind of change is ‘still’

To overcome this crisis, Samsung Electronics established the ‘China Business Innovation Team’ at the end of last year. In addition to the smartphone business, which has been struggling for several years, it had to raise its share of the TV market, which was only around 4%. In terms of supply chain management, market innovation was desperately needed.

Vice Chairman Han came to the fore as the head of the innovation team. As he served as the head of the DX (Device Experience) division, which oversees the home appliance, TV, mobile, and network businesses, expectations for innovation in the overall business in China were high. However, even following a year has passed since the team was established, no significant change has been seen.

Executing a large-scale advertisement or operating an experience center related to the Beijing Winter Olympics at the beginning of the year was no different from any other Olympic marketing. After the release of the Galaxy Z Fold 4 and Z Flip 4 in August, a separate unpacked (public) event in China was held and publicity was conducted in collaboration with influencers. The ‘W series’, which has been applied in gold to premium smartphones targeting the Chinese market, is also a unique marketing that has been continued since 2016.

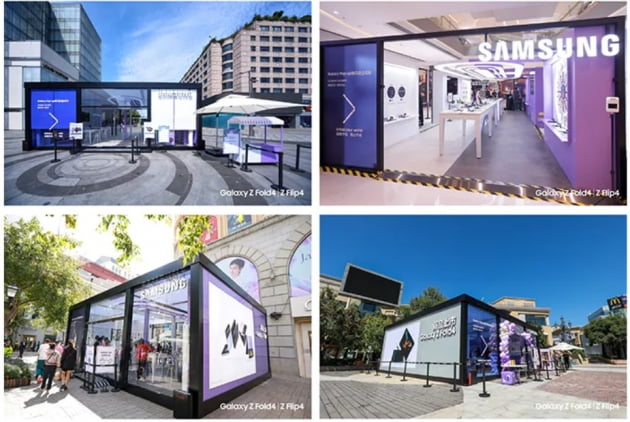

After the launch of the Galaxy Z series, it opened 40 pop-up stores in 30 Chinese cities, including Shanghai, Hangzhou, Shenyang and Harbin, in succession to increase contact with Chinese consumers. However, Apple and Chinese companies, which are rivals, are also strengthening customer experience marketing, so it is difficult to see that increasing pop-up stores is differentiated marketing unique to Samsung Electronics.

Apple dominates the premium segment, while Chinese companies dominate the mid-range segment

The industry expects that Samsung Electronics will continue to struggle in China. This is because the premium market is dominated by Apple, and the mid- to low-end market is dominated by Chinese companies. This means that Samsung Electronics has no room to intervene. The Chinese business innovation team is also in a difficult environment to achieve results.

An official from the business world said, “Samsung Electronics’ position in the Chinese market is ambiguous.” He added, “It is necessary to renew the brand image, but it is a more difficult part than technology development. Recovery of market share will not be easy.”

At the end of this year, Samsung Electronics promoted Yang Gul, vice president of the China Strategic Cooperation Office, to president during regular personnel appointments at the end of this year. Yang Gul, the new president, led Samsung Electronics’ semiconductor business in China. The Shanghai subsidiary (SSS), which is in charge of selling semiconductors and displays, is also showing a recent decline in performance, and the industry says that Samsung Electronics made this personnel decision to strengthen its semiconductor business.

Vice President Wang Tong, who is in charge of smartphone sales at SCIC, is the second foreigner to become vice president at Samsung Electronics. He has held the position ever since his promotion to vice president in late 2013.

Regarding this reshuffling, a Samsung Electronics official said, “Placing the necessary personnel in the right place at the right time is the key to personnel management. Among the personnel working in the region, only vice president Yang Gul was promoted.” It doesn’t mean you’re excluded,” he said.

Kim Eun-ji, Hankyung.com reporter eunin11@hankyung.com