Original title: Haiqi Group plans to reorganize and cut into the duty-free market. Wang Yawei, the “first brother of public offering”, is betting on the next “Wangfujing” that will rise by more than 600%?

The shares of Haiqi Group (603069.SH) are boiling!

Yinshi Finance reporter learned that yesterday (May 16) evening, the announcement stated that the company intends to issue shares and pay cash to purchase Hainan Travel Investment Tax-free held by Hainan Investment Development Co., Ltd. (referred to as “Hainan Travel Investment”). (hereinfollowing referred to as “Hailv Duty Free”), and issue shares to certain qualified investors to raise matching funds.

According to the announcement, the counterparty of this transaction, Hainan Travel Investment, holds 90% of the equity of the company’s controlling shareholder, Hainan Haiqi Investment Holding Co., Ltd., which is the indirect controlling shareholder of the company. This transaction constitutes a connected transaction and will not lead to the change of the actual controller of the company. The company’s shares have been suspended since the market opened on May 16, and the suspension is expected to last no more than 10 trading days. Relevant plans are yet to be further discussed and confirmed.

According to public information,Haiqi Group is mainly engaged in automobile passenger transportation, commercial development and operation of automobile depots, and comprehensive automobile services. Two years ago, Haiqi Group was hyped by the market because its parent company Hainan Travel Investment was approved to operate duty-free goods in outlying islands. The company’s stock price has risen by more than 430% in two months.

However, Haiqi Group has repeatedly stated that it has no plans to inject tax-free business. But yesterday (May 16), the company announced that it plans to acquire Hailv Duty Free. As soon as this announcement came out, the shares of Haiqi Group also boiled. Some investors said: “This is the next one, at least 10 daily limit.”

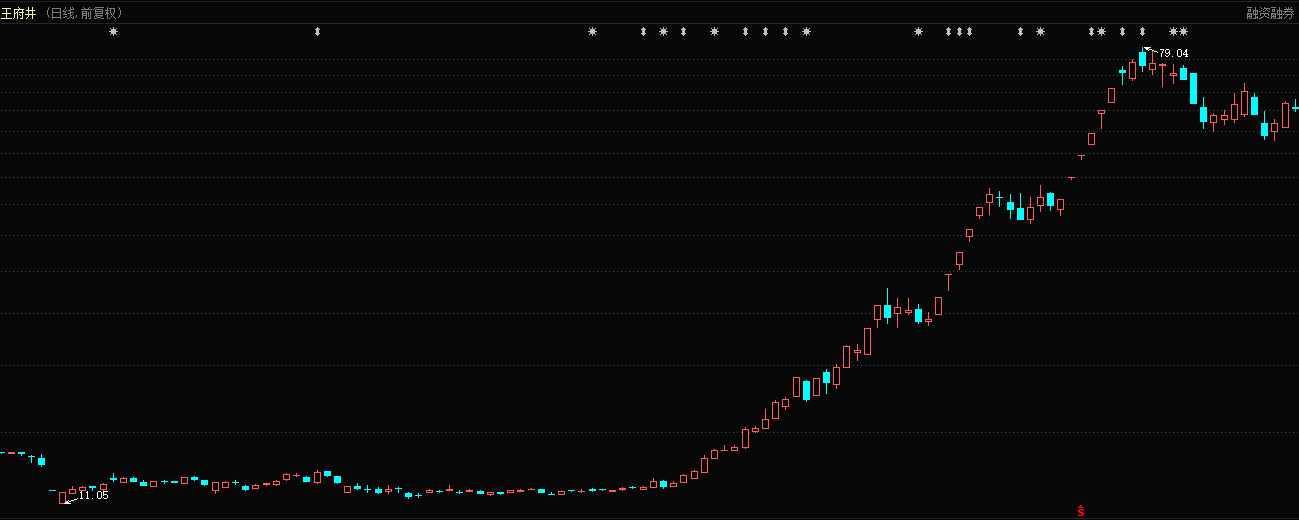

In the past two years, the tax-free market has been attractive, and the concept of tax-free has repeatedly caused market speculation. Previously, following winning the tax-free license, Wangfujing’s fierce trend has left an indelible impression on the minds of many investors. From a low of 11.05 yuan to a high of 79.04 yuan, Wangfujing rose as much as 615%.

Haiqi Group intends to reorganize, not only shareholders are boiling, I am afraid Wang Yawei is also “ecstatic”!

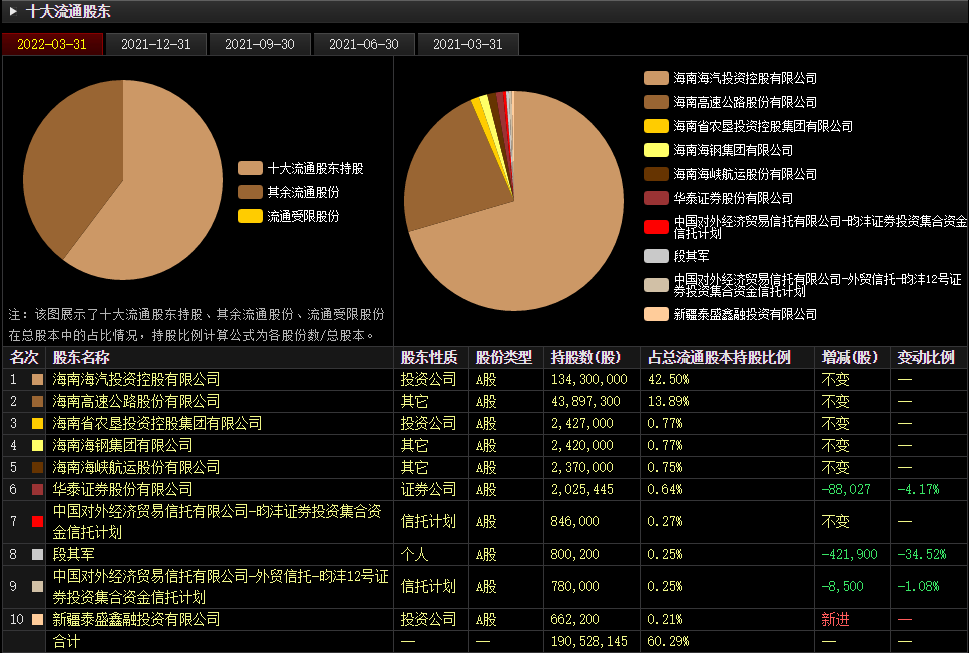

The reporter noticed that in the fourth quarter of last year, two products of Wang Yawei’s Qianhe Capital, the Yunfeng Securities Investment Collective Fund Trust Plan and the Yunfeng No. 12 Trust Plan, entered the top ten tradable shareholders of Haiqi Group, holding 846,000 shares respectively. and 788,500 shares. In the first quarter of this year, among these two products, the shares held by Yunfeng Securities Investment Collective Fund Trust Plan remained unchanged, and the shares held by Yunfeng No. 12 Trust Plan did not change much, holding 780,000 shares. From April 1st to May 13th, if Wang Yawei does not sell, it is highly likely that he has bet on the restructuring of the Haiqi Group.

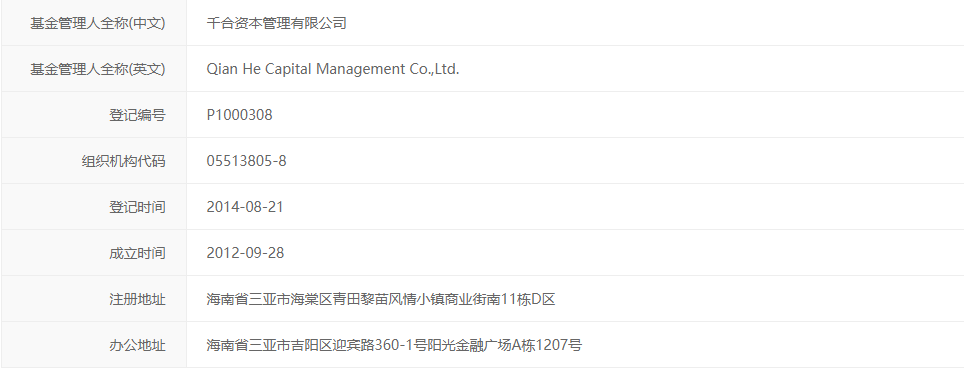

In addition, the reporter also noticed that Wang Yawei even moved the company’s registered address and office address to Hainan because of his “natural relationship” with Hainan. According to the information of the China Fund Industry Association, the registered address and office address of Qianhe Capital are both in Sanya, Hainan.

When it comes to Wang Yawei, almost everyone with a little more investment experience has heard of his name.

As a former public fundraiser, Wang Yawei has won two championships and one runner-up in the Huaxia market he managed during the six complete calendar years from December 31, 2005 to May 2012.

From the perspective of investment style, Wang Yawei is good at grasping restructuring stocks. And this kind of investment in gambling reorganization makes Wang Yawei’s success always accompanied by controversy.

Historically, Wang Yawei has successively bet on a number of reorganization concept stocks such as Zhongzhong, ST Guangsha, ST Changhe, Emeishan A, , Guangzhou Iron and Steel Co., Ltd. Typically, in the third quarter of 2006, the fund managed by Wang Yawei appeared on the list of shareholders of Yueyang Xingchang. In December of that year, Yueyang Xingchang announced the suspension of trading due to restructuring. In February 2007, the company announced an agreement with Hunan Gaoqiao Company. Restructuring intention, following resumption of trading, Yueyang Xingchang gained 10 daily limit.

“I pay attention to restructuring stocks because they are the product of a specific development stage of my country’s securities market, and there are many investment opportunities. It is irresponsible to turn a blind eye to this.” Wang Yawei said previously regarding investment and restructuring stocks.Return to Sohu, see more

Editor:

Disclaimer: The opinions of this article only represent the author himself, Sohu is an information publishing platform, and Sohu only provides information storage space services.