Brazil has been facing a new wave of taxation on products imported from popular Chinese stores, such as AliExpress, Shein and Shopee. Many consumers have been surprised by exorbitant fees for importing products.

Due to this situation, some Chinese stores that sell imported hardware have decided to suspend sales to Brazil as a precaution.

Will it be the end of product imports?

The Brazilian government intends to tax all imported products, regardless of the amount paid, with the aim of raising around 7 to 8 billion reais a year in taxes. According to Finance Minister Fernando Haddad, this initiative seeks to protect Brazilian companies that pay taxes and face unfair competition from foreign companies that sell products without paying taxes in Brazil.

The current law provides that imports made by individuals are taxed at 60% of the value of the shipment, with exemption from import tax for products worth up to US$ 50, provided that the sender and recipient are individuals. The inspection of the collection of these taxes is the responsibility of the Federal Revenue Service and is carried out by sampling.

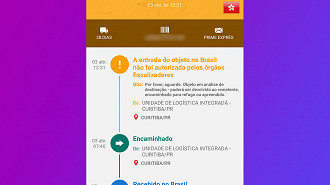

Deliveries will be delayed even more

With the new taxation, it is likely that there will be an increase in customs inspection and control, which may result in delays in the delivery of products. This change can generate queues at customs inspection never seen before, especially during dates such as Black Friday and Singles Day (11/11).

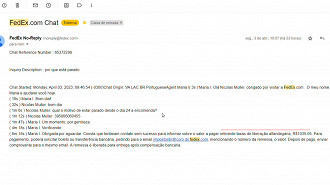

Some stores are already adapting to the new reality, looking for ways to avoid excessive taxation. However, there are still cases where consumers face very high rates, such as a Redmi Note 12 smartphone that we are receiving for testing, where the tax rate exceeded 100% of the amount charged.

Cases of products being barred from entering Brazil

Reader Edilson Cardoso reported that he bought a Xiaomi Poco X5 smartphone on Aliexpress, but had the product barred and prevented from entering Brazil. According to him, this was the first time that this has happened and he fears that it will become more and more common. This situation highlights the import problems in the country and how government policies can directly impact international trade.

Did you experience this problem? Send the report to [email protected]let’s complement the matter.

Opinion

There are two main reasons why the government decided to tax all imports. The first, as already mentioned, aims to increase fundraising for public coffers. The second reason is to protect national companies that pay due import taxes. However, this second point is open to debate. After all, domestic companies pay taxes when importing products they sell, and many of them, who complain regarding Chinese stores, resell products under their own brand or manufacture abroad and pay import taxes. In this way, they contribute to the generation of jobs and taxes, helping the country.

However, instead of companies looking for forms of tax exemption or reduction of the tax burden to promote healthier competition – considering that many consumers would not import products with similar prices, taking into account the waiting time and guarantee -, the option chosen went to tax everyone. This decision ends up directly affecting the final consumer, who will bear the additional costs. Furthermore, it is unlikely that the government would forego tax revenue.