2023-05-06 15:43:00

Actions since April 19, 2023 suggest that a break may be imminent, as gold prices seem poised for a reversal. Gold futures failed to break above the previous high of $2,078, following it was tested on March 8, 2022, and then witnessed a sharp decline in the next six trading sessions, eventually reaching $1,896..

On the daily chart, gold futures may repeat these movements if they cannot hold the immediate support level at 2,006 by the end of this week..

However, a rally in short positions might occur as gold bulls become increasingly hesitant in the wake of the results of the recent Federal Reserve meetings. If gold futures cannot hold above the immediate resistance at $2,064 on May 5, 2023, exhaustion will become apparent..

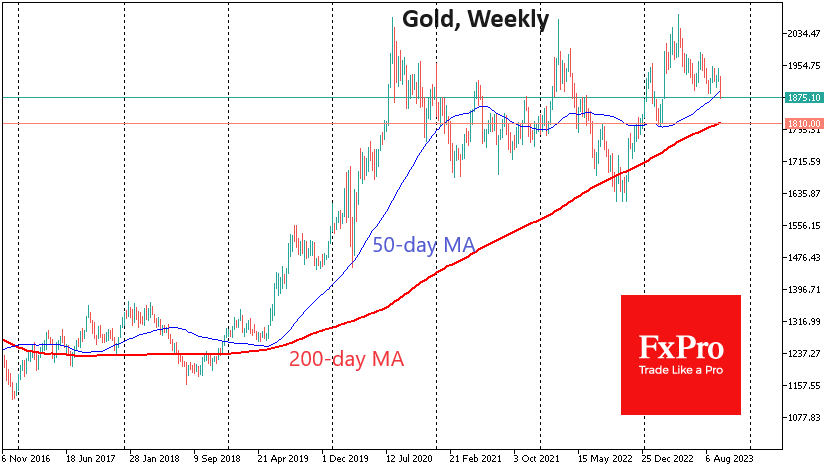

On the weekly chart, gold futures formed a double top that is likely to attract large speculators looking to short any rally in gold futures..

Gold futures are currently above a bullish cross formation on the weekly chart, but might see selling if it fails to hold above the 9 daily moving average. DMA at $1,981.

A reversal is expected from the daily moving average level 18 DMA On the weekly chart, it is at $1,928, and a breakdown below this important support might be in favor of the bears..

On the monthly chart, gold futures contracts formed A bullish monthly candle, which casts doubt on the sustainability of the monthly candle, which was formed during only four trading sessions of this month..

The Fed’s latest final decision, announced on May 3, 2023, raised concerns that such exaggerated movement by gold futures during the first three sessions might lead to a sell-off this month..

This week’s close and next week’s open are crucial for gold futures, as uncertainty has risen since Mr. Powell himself said the Fed funds rate at 5% as well as the quantitative tightening policy. QT The current is undoubtedly a restrictive policy tool.

Combined with banking pressures and tighter credit conditions, this might create outright turmoil.

Evacuation responsibilatyThe author of this analysis may or may not have open positions in gold futures contracts. Readers may open buy or sell positions at their own risk.

1683413255

#Gold #pause #Fed #signal