According to many experts, some special factors might make gold sales during this year’s Lunar New Year holiday surprising. Gold prices today, February 9, will be boosted when China enters the Lunar New Year holiday.

Gold price today February 9: Will be boosted when China enters the Lunar New Year holiday

The gold market continues to face difficulties due to strong selling pressure due to news regarding the US labor market being relatively stable compared to last week. Thursday, the U.S. Department of Labor announced weekly unemployment claims fell 9,000 to 218,000 last week, down from the previous week’s 224,000 claims.

The gold market has seen strong selling pressure ahead of the North American session and was unchanged ahead of the latest labor market data. The world gold price is currently last traded at 2,034 USD/ounce.

Evolution of world gold prices. Source: Tradingeconomics

The four-week moving average for new claims — generally considered a more reliable gauge of the labor market — rose to 212,250, up from last week’s average of 208,500.

Continuing unemployment claims, which represent the number of people already receiving benefits, fell to 1.871 million in the week ended Jan. 27, down 23,000 from the previous week’s revised level of 1.894 million.

Gold traders and investors are closely watching consumer purchases in China as the world’s largest precious metals market prepares for Lunar New Year celebrations. According to many experts, there are some special factors that might make gold sales during this year’s Lunar New Year holiday surprising.

China’s gold purchases surged last year even as prices of the precious metal hit new all-time highs in the domestic market. The first day of the New Year Giap Thin will fall on Saturday, February 10.

According to China-based consultants at Metals Focus, an independent precious metals company, this new year is a complicated year to calculate gold sales because there are some unusual factors at play: Dragons will often boost jewelry demand because this is a very auspicious time.” “Furthermore, demand for gold jewelry at the consumer level in China is generally quite good.”

Metals Focus consultants are also seeing “major headwinds” to consumer gold purchases in the country, including China’s “challenging economic conditions” and “historically high” gold prices. ” and the appeal of jewelry faces competition from travel, experiences, dining. According to these experts, in terms of value, the country’s gold sales will still be quite impressive.

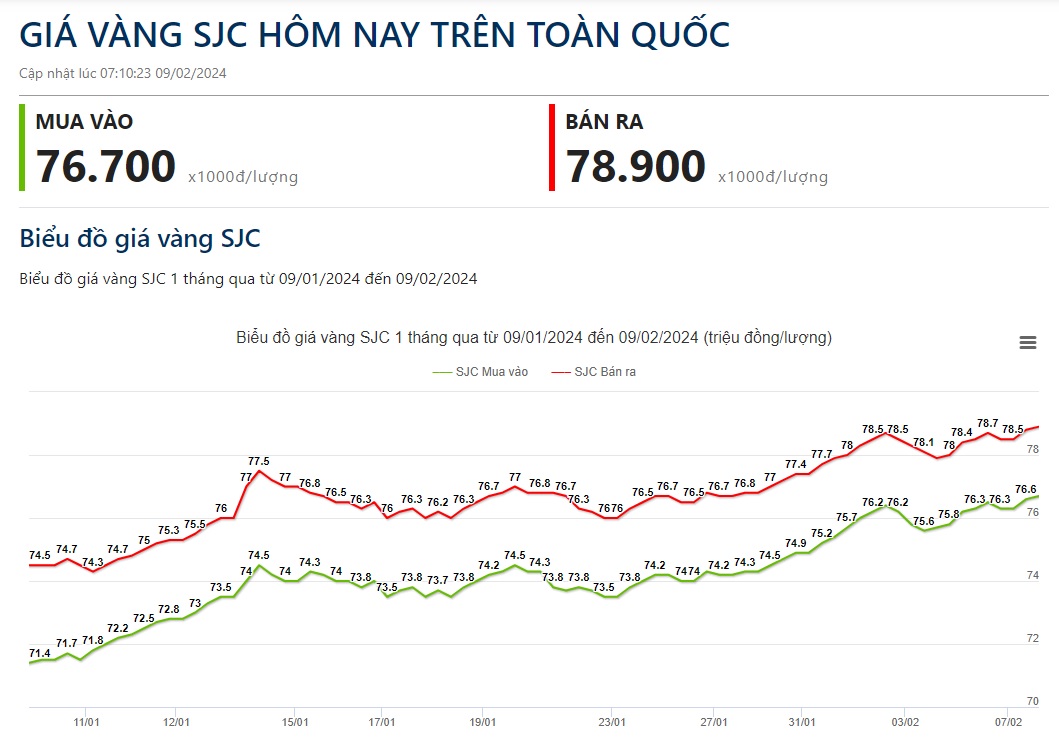

Gold price today February 9: Domestic gold is stable

Gold prices stabilized as the country began the Lunar New Year holiday week. Currently, gold bar prices for brands are listed specifically as follows:

SJC gold price in Hanoi and Da Nang area is listed at 76.7 million VND/tael purchased and 78.92 million VND/tael sold. In Ho Chi Minh City, SJC gold is still buying at the same level as in Hanoi and Da Nang but selling is 20,000 VND lower.

Phu Quy listed SJC gold at 76.65 million VND/tael purchased and 78.9 million VND/tael sold.

Meanwhile, SJC brand gold bars are being purchased by PNJ at 76.7 million VND/tael and sold at 78.9 million VND/tael.

DOJI in the Hanoi area listed the price of SJC gold bars at 76.55 million VND/tael purchased and 78.85 million VND/tael sold.

Meanwhile, the buying price and selling price of Bao Tin Minh Chau brand gold are 76.75 million VND/tael and 78.85 million VND/tael, respectively.

Domestic SJC gold price developments. Source: giavang.org

Unit: x1000 VND/tael

| Area | System | Buy into | Sold out |

|---|---|---|---|

| City. Ho Chi Minh | SJC | 76.700 | 78.900 |

| PNJ | 72.500 | 75.200 | |

| Mi Hong | 77.500 | 78.500 | |

| Hanoi | SJC | 76.700 | 78.920 |

| PNJ | 72.500 | 75.200 | |

| Bao Tin Minh Chau | 76.550 | 78.650 | |

| wealth | 74.050 | 76.500 | |

| Danang | SJC | 76.700 | 78.920 |

| PNJ | 72.500 | 75.200 | |

| Nha Trang | SJC | 76.700 | 78.920 |

| Ca Mau | SJC | 76.700 | 78.920 |

| Hue | SJC | 76.670 | 78.920 |

| Bien Hoa | SJC | 76.700 | 78.900 |

| West | SJC | 76.700 | 78.900 |

| Quang Ngai | SJC | 76.700 | 78.900 |

| Bac Lieu | SJC | 76.700 | 78.920 |

| Ha Long | SJC | 76.680 | 78.920 |

| West | PNJ | 72.100 | 75.100 |

| Ben tre | Mi Hong | 77.500 | 78.500 |

| Tien Giang | Mi Hong | 77.500 | 78.500 |

| Updated at 07:10:23 February 9, 2024 | |||