2023-08-04 15:10:08

Global markets were up Thursday morning. (Photo: The Canadian Press)

MARKET REVIEW. European stock markets are moving in mixed order and Wall Street is heading for a slightly higher opening, investors awaiting the publication of employment data in the United States.

Stock indices at 8:45 a.m.

Global markets were up on Friday morning, the day following the Bank of England decided to raise its key rate and hours before the release of US jobs data.

London and Paris added 0.4% in early trading in Europe, while Frankfurt improved 0.2%.

In New York, before the markets open, the average Dow Jones of industrial stocks rose by 0.2% and the broader index S&P 500 of 0.4%.

In Asia, the Nikkei 225 added 0.1% in Tokyo. The Shanghai Stock Exchange advanced 0.2% and the Hang Seng 0.6% in Hong Kong. Sydney climbed 0.2% and Seoul lost 0.1%. The Indian Sensex improved by 0.4%.

On the New York Commodities Exchange, oil prices added 29 US cents to US$81.84 a barrel.

The context

In July, the unemployment rate fell slightly in the United States to 3.5%, a historic low, and only 187,000 jobs were created, according to the Labor Department, less than the 200,000 expected by the consensus. Market Watch analysts.

In addition, job creations for June were revised downwards, to 185,000 once morest 209,000 initially announced.

A slowdown in the labor market would, paradoxically, be a good thing for the American economy, because it would allow inflation to fall durably according to economists.

Data on American employment are therefore particularly watched by the American central bank (Fed), because they constitute an important variable in defining the orientation of the institution’s monetary policy, while the end of monetary tightening is emerging. .

For Rubeela Farooqi, chief economist for High Frequency Economics, these figures should not be enough to convince the Fed that a sustainable decline in inflation is on track, but investors were delighted by this publication.

After renewed nervousness on Thursday in the bond market, where the yield on ten-year Treasury bills had reached 4.18%, the highest since the beginning of November 2022, interest rates eased significantly on Friday around 7:45 p.m.

That of the 10-year US debt stood at 4.12% once morest 4.18% at the close of the previous day and the rate for the 2-year maturity, more sensitive to monetary policy expectations, fell to 4.81 % once morest 4.88% the day before.

In Europe, the yield on the 10-year German government bond, up at the start of the European session, fell to 2.58%, once morest 2.60% at the close of the previous day.

The dollar was also weighed down by expectations of the end of monetary tightening by the Fed, and fell sharply once morest most other currencies. Against the euro, the greenback lost 0.68% to 0.907 2 euros for one dollar and once morest the pound, it lost 0.52% to 0.782 8 pounds for one dollar, around 5:45 p.m.

Apple and Amazon go in opposite directions

Tech giants Apple and Amazon released earnings Thursday following US stock markets closed.

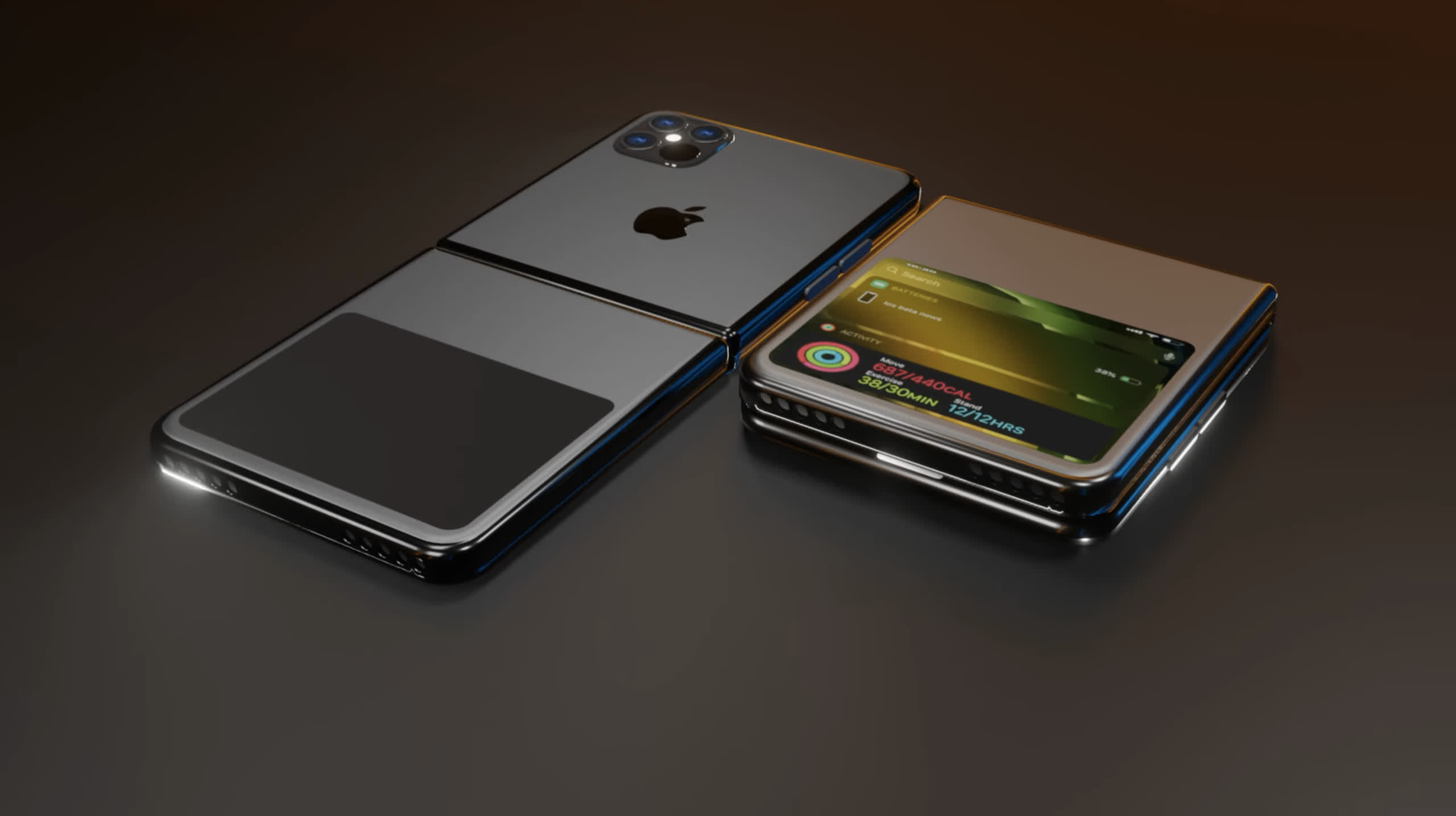

Apple dropped 2.97% on Wall Street, following having published for the third quarter of its fiscal year shifted a turnover once more in decline (-1.4%), for the third time in a row.

Conversely, Amazon far exceeded investor forecasts in the second quarter, with $134.4 billion in revenue and net profit of $6.7 billion. Its stock jumped 9.08%.

Capital penalized

The British group Capita, specializing in consulting, transformation programs and digital services, lost more than 16% in London following announcing a result that went into the red in the first half, penalized in particular by exceptional costs, following a cyberattack in March, which will amount to up to 25 million pounds.

Trend reversal for Maersk

Danish shipping giant Maersk announced an 83% drop in net profit in the second quarter, marked by the expected drop in volumes, particularly in North America and Europe, following an exceptional year 2022 due to the overheating of the sea freight. Its action fell 3.92% in Copenhagen.

On the currency side

Bitcoin fell 0.13% to $29,245.

1691165365

#Stock #market #moving #markets #opening #Friday