The summons to an extraordinary meeting of shareholders of Sura, the imminent publication of the notices and booklets of the Public Offer of Acquisition (OPA) for shares of Grupo Argos and the high prices observed in the stock market for the species of Sura and Bancolombia attract the looks of the market and analysts at the beginning of this week.

On Saturday, through press releases and through the Financial Superintendence, Grupo Sura, responding to a request from JGDB Holding, called its partners to a meeting on June 13, with the aim of electing a new board of directors, despite the fact that in March In an ordinary assembly, the governing body had been elected for the period April 2022-March 2024 (see Parentheses).

The request was made known following the banker Jaime Gilinski stated during the previous week that he owns 38% of Sura, following carrying out three takeover bids and buying more shares of that company on the Colombian Stock Exchange (BVC).

With this shareholding, Gilinski consolidates himself as the main individual partner of Sura, for which he considers that he has the right to greater representation on the board of directors of the company. holding Paisa financial institution, to which his son Gabriel Gilinski Kardonski already belongs, as an equity member; and José Luis Suárez Parra, an independent member nominated by Gilinski.

Following in Sura’s shareholding composition are the Argos and Nutresa groups, which hold 27.86% and 13.07%, respectively. In this context, the participation of the so-called Grupo Empresarial Antioqueño (GEA) in Sura is greater if the portions held by Cementos Argos (6.08%) and Fundación Grupo Argos (2.29%) are added, reaching 49, 3%.

High and low shares

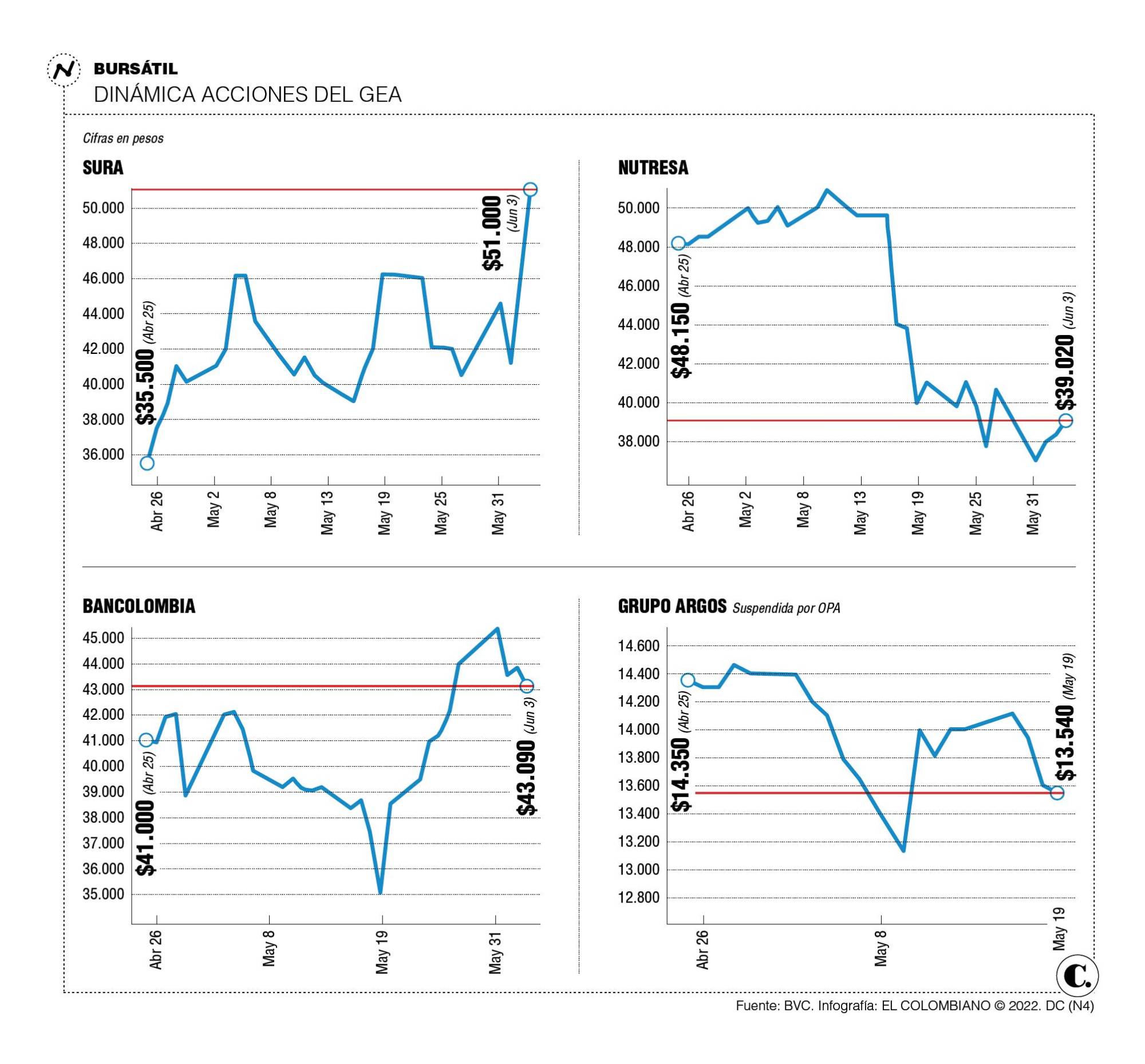

Since last April 25, when Gilinski’s third takeover bid for Sura ended, the share price of this company has accumulated a valuation of 43.66%, since it closed at $35,500 on that date and ended the previous week at the record price of $51,000, that is to say that in six weeks he earned $15,500 (see graph).

In the understanding that Gilinski’s 38% stake in Sura represents 177.35 million shares, at current value these cost US$2,398.17 million, a figure higher than the US$1,373.43 million it paid in the three takeover bids it carried out since the end of of 2021, although it must be taken into account that the additional investment it made to rise from the 34.5% that those offers gave it to the 38% that it claims to have is not known.

In any case, in the second and third takeover bids, Gilinski paid US$9.88 for each Sura share, and at the current exchange rate of $3,771.63, each title has a value equivalent to US$13.52. In addition, 38% of Sura’s shares represent Gilinski US$36.8 million in dividends.

In the midst of these moves, the behavior of the Bancolombia share is also striking, an entity in which Sura has 45.77% of the shares, which has reached prices of $45,320, approaching the record of $45,500 it had in December 2019 .

For its part, the Nutresa stock, which until May 16 was the subject of a third takeover bid by Gilinski, trading above $50,000, has contracted and its value starts at $39,020.

For 30.8% of the holding of food (141.03 million shares) the Nugil de Gilinski company paid US$1,126.9 million, and at the current price of the species that share package would be worth US$1,459.09 million. In the first offer, with which he obtained the largest portion (27.7%), he paid US$7.71 per share, with the current exchange rate today the stock is worth US$10.34.

US$4,28

Gilinski will pay per share in the takeover bid that he intends to launch for Grupo Argos.