Domestic and world gold recorded a simultaneous increase in the first session of the week following news of political tensions in the Middle East.

Gold price today January 30: World gold continues to increase as Middle East tensions escalate

World gold prices rose once more on Monday as tensions increased in the Middle East, boosting demand for gold as a safe-haven asset. Risk aversion deepened when an Iran-backed Houthi drone attack on US troops in Jordan killed three US soldiers. Washington is considering its response to the first deadly attack on its forces in the Middle East since the Gaza war. President Biden said the US will respond. Meanwhile, markets are still awaiting the Federal Reserve’s policy decision later this week for more clues regarding the timing of this year’s first US interest rate announcement.

Evolution of world gold prices. Source: Tradingeconomics

In other news, a Hong Kong court issued an order to liquidate China’s Evergrande Group following the real estate developer failed to reach an agreement with creditors. The liquidation will be closely watched by the market. Bloomberg reported that most of Evergrande’s assets are located in mainland China to test the legal access of Hong Kong courts.

The US economic data headline for the week is the Federal Reserve’s Open Market Committee meeting which began on Tuesday morning and ended on Wednesday followingnoon with a statement and press conference from Fed Chairman Jerome Powell . The FOMC is not expected to change US monetary policy at this meeting but may provide new guidance on future policy plans.

Key external markets today saw the USD index stabilize a bit. Nymex crude oil prices are almost stable and trading around 78.00 USD per barrel. Meanwhile, the 10-year US Treasury bond interest rate is currently at 4.107%.

World gold price is currently trading at 2,030 USD/ounce at the time of the survey at 6:45 a.m. (Vietnam time).

Technically, gold futures bullishness has the slight overall near-term technical advantage but has faded. The three-month-old uptrend on the daily bar chart has been negated and the price is now in a seven-week-old downtrend on the daily bar chart. The Bulls’ next upside price objective is to produce a close for March futures above solid resistance at $2,050.00. The Bears’ next near-term downside price objective is pushing futures prices below the $2,000.00 technical support level. The first level of resistance seen at $2,033.20 was broken last night, the target would then be at last week’s high of $2,039.30. First support is seen at last night’s low of $2,018.80 and then at the January low of $2,004.00.

Gold price today January 30: Domestic gold increased simultaneously

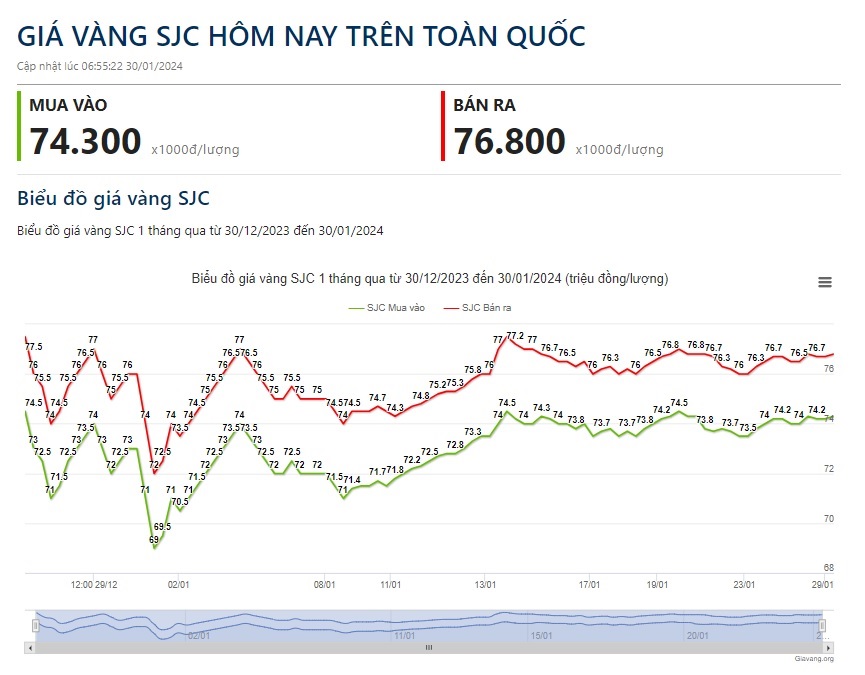

Domestic SJC gold today recorded an increase of regarding 100,000 VND/tael in both buying and selling compared to the same survey time yesterday. Specifically:

In Ho Chi Minh City, SJC listed the gold purchase price at 74.30 million VND/tael; The selling price is 76.80 million VND/tael, an increase of 100,000 VND/tael in both buying and selling directions compared to the opening session on the same day. The difference in buying – selling price of SJC gold remains at 2.5 million VND/tael.

The buying and selling price of gold bars at SJC Hanoi and Da Nang was at 74.30 – 76.82 million VND/tael, an increase of 100,000 VND/tael in the buying and selling sides compared to the previous session.

SJC gold price at Bao Tin Minh Chau is listed at: 74.45 – 76.85 million VND/tael, an increase of 300,000 VND/tael on the buying side and 250,000 VND/tael on the selling side compared to the previous session.

PNJ gold price in Hanoi and Ho Chi Minh City is buying at 74.40 million VND/tael and selling at 76.80 million VND/tael, keeping the price unchanged compared to the previous session.

At the same time, the gold price at DOJI Group is listed at the buying – selling price at 74.15 – 76.75 million VND/tael, an increase of 250,000 VND/tael on the buying side and an increase of 100,000 VND/tael on the buying side. selling followingnoon compared to the opening session on January 29. The difference between the buying price and selling price of DOJI gold narrowed to 2.6 million VND/tael.

The price of gold rings of Bao Tin Minh Chau brand (Hanoi) alone increased to 65 million VND/tael due to a sudden increase in purchasing power. Meanwhile, the gold ring price of other businesses remained unchanged at 64 million VND/tael.

Domestic SJC gold price developments. Source: giavang.org

Unit: x1000 VND/tael

| Area | System | Buy into | Sold out |

|---|---|---|---|

| City. Ho Chi Minh | SJC | 74.300 | 76.800 |

| PNJ | 74.400 | 76.800 | |

| Mi Hong | 75.000 | 75.900 | |

| Hanoi | SJC | 74.300 | 76.820 |

| PNJ | 72.500 | 75.200 | |

| Bao Tin Minh Chau | 74.400 | 76.700 | |

| wealth | 74.050 | 76.500 | |

| Danang | SJC | 74.300 | 76.820 |

| PNJ | 72.500 | 75.200 | |

| Nha Trang | SJC | 74.300 | 76.820 |

| Ca Mau | SJC | 74.300 | 76.820 |

| Hue | SJC | 74.270 | 76.820 |

| Bien Hoa | SJC | 74.300 | 76.800 |

| West | SJC | 74.300 | 76.800 |

| Quang Ngai | SJC | 74.300 | 76.800 |

| Bac Lieu | SJC | 74.300 | 76.820 |

| Ha Long | SJC | 74.280 | 76.820 |

| West | PNJ | 72.100 | 75.100 |

| Ben tre | Mi Hong | 75.000 | 75.900 |

| Tien Giang | Mi Hong | 75.000 | 75.900 |

| Updated at 06:50:21 January 30, 2024 | |||