<!–

Кристина Холупова

–>

20 Apr 2022 16:54

|

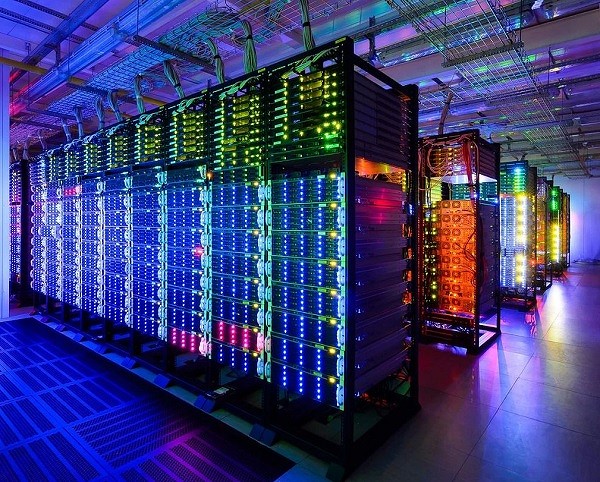

Data center market participants told CNews that many foreign manufacturers of engineering equipment for data processing centers have stopped supplying it to Russia. We are talking regarding power supply, cooling and ventilation systems, as well as security systems that are used in the centers. The prices for such equipment have also risen. Market players have already found alternative ways to solve these problems – Russian vendors, parallel imports, as well as work with suppliers who have not suspended deliveries.

Rate settings

As it became known to CNews, foreign vendors stopped supplying engineering equipment used in Russian data processing centers (DPCs). Among such companies, for example, German Siemens and French Schneider Electric. Engineering equipment includes power supply, cooling and ventilation systems, security systems, including fire alarms and fire extinguishing systems, etc.

“Direct deliveries have been suspended by many Western and some Asian manufacturers,” the CEO of the 3data data center network told CNews.

Ilya Hala. “The established supply chains and payment methods stopped working.” The complicated situation with deliveries was also noted by Selectel.

Cloud MTS agreed with this. “Partly yes, they stopped,” CNews told Dmitry Milov, Director of the Cloud Infrastructure Department at MTS. — However, in the segment of engineering equipment the situation is somewhat better than, say, in the field of software. We have more alternative suppliers, including those whose production of components is localized in Russia.”

The prices have also risen

Of course, purchase prices are rising, Hala notes. In 3data, the prices for services are not increased yet. But they reduced the number of discounts provided.

Foreign vendors of engineering equipment for data centers have suspended deliveries

MTS noted the exchange rate adjustment of prices for engineering equipment. Including, the players switched to prepaid. “This allows them to level the risks, we treat them with understanding,” Milov notes.

Additional risks of vendors were also noted in Selectel. “We discuss these risks with partners and together we try to take them into account in contracts,” the company emphasizes.

There are solutions

Despite the complicated situation and the suspension of supplies, for the most part, alternative solutions to the current situation have already been found. “A number of available foreign vendors remain, the demand for Russian solutions is increasing, parallel imports are developing through friendly countries,” Ilya Khala told CNews.

“In general, the situation on the market is not easy, but a balanced approach to planning and investment allows us to maintain the planned pace of development,” says Milov. MTS also reported that their goal is “not to increase the number of racks, but to develop the network steadily and make efficient use of available capacities.”

10 simple steps: how to import-substitute a communication platform

Digitization

“As far as server hardware is concerned, we currently have a sufficient number of servers ready for operation and a stock of components in stock for several months ahead,” said Selectel’s director of infrastructure. Alexey Eremenko. “For subsequent purchases, we are building new ways of interacting with suppliers and distributors.”

Plans have not changed

“At the current stage, we have not adjusted plans for the introduction of new racks and are building the number that we planned,” said Eremenko. In 2022, Selectel plans to bring 570 racks into commercial operation. He also noted a sharp increase in demand for the transfer or reservation of infrastructure from abroad (the demand for DRaaS solutions has grown tenfold compared to the traditional level).

3data puts into operation from two to four data centers per year with 200-600 racks. And in 2022, their plans have not changed. “The sharply increased demand for the services of Russian data centers and cloud services requires a rapid increase in capacity, so we are increasing the pace of construction,” says Hala.

MTS purchased equipment in advance and received orders on time. “Therefore, we have a certain margin of safety that allows us not to narrow the horizons of planning and development,” says Milov.

Cloud prices are on the rise

In March 2022, it became known

that once morest the backdrop of sanctions and the withdrawal of foreign players from the market, Russian cloud infrastructure providers began to raise prices for their services.

Vladislav Kamensky, Unidata: We will compete with foreign companies on their territory!

Digitization

So, Yandex.Cloud raised prices by 60-80% on average. Increased the cost of services in Selectel and DataFort companies. Experts noted that tariffs for cloud services will only grow. And this, in turn, can lead to a slowdown or freezing of projects for the digitalization of the state secretary and business.

Kristina Holupova