The main thing

Russian stock market started the week with the continuation of the neutral dynamics of the last days. The Moscow Exchange Index is consolidating around 2430-2450 points, without showing a pronounced trend. Trading turnover on Monday fell below 30 billion rubles, which reflects a slight decline in the activity of participants due to the flat trend.

Only the information technology sector looked significantly better than the market (+1.1%) once morest the background of the growth of VK, HeadHunter, Yandex and Ozon – in the near future it may continue to trade slightly better than the Moscow Exchange index.

Sale in OFZ. After the weekend, many investors rethought Friday’s signals from the Central Bank of the Russian Federation regarding the completion of the monetary policy easing cycle, which led to a significant decrease in the price of government bonds.

Traditionally, the longest OFZs with a constant coupon fell the most. The Government Bond Index (RGBI) sank 1.2%, the biggest daily drawdown in five months. Holders of long securities do not see room for a positive revaluation in the medium term. On the contrary, pro-inflationary risks will prevail on the horizon of the coming months.

The decline in OFZ will probably be short-lived, limited to 2-3 sessions. After all, the overall situation on the debt market is still neutral. If inflationary pressures remain subdued until the next meeting on October 28, and there are no strong fiscal stimuli, a key rate cut by another 25 bp to 7.25% is acceptable.

What bonds are protected? While bonds with maturities of one year are actively declining, there are debt securities that do not respond to changes in the policy of the Central Bank. These are issues with variable coupons linked to the RUONIA market rate (OFZ-PK). For them, interest risks are smoothed out and practically do not depend on the maturity. For example, among OFZs, these are series issues with numbers from 29006 to 29019.

The value of RUONIA, on which coupons depend, usually fluctuates around the level of the key rate of the Central Bank with a small premium or discount. That is, if suddenly the Bank of Russia raises the key tomorrow, then the size of the future coupon on these OFZs will also increase.

Relatively stable in the current situation are inflationary linkers — bonds, the face value of which varies depending on the consumer price index. Among the bonds of the Ministry of Finance there are 4 such issues: series from 52001 to 52004. They are called OFZ-IN.

The presence of OFZ-PK and OFZ-IN in portfolios mitigate the risks of changes in market interest rates. At the same time, there are also corporate bonds, the coupons of which are tied to different rates. The final yield on them is higher than on OFZs with a variable coupon. If this topic is interesting, then write in the comments to the article and we will prepare a separate selection of such securities with increased yield.

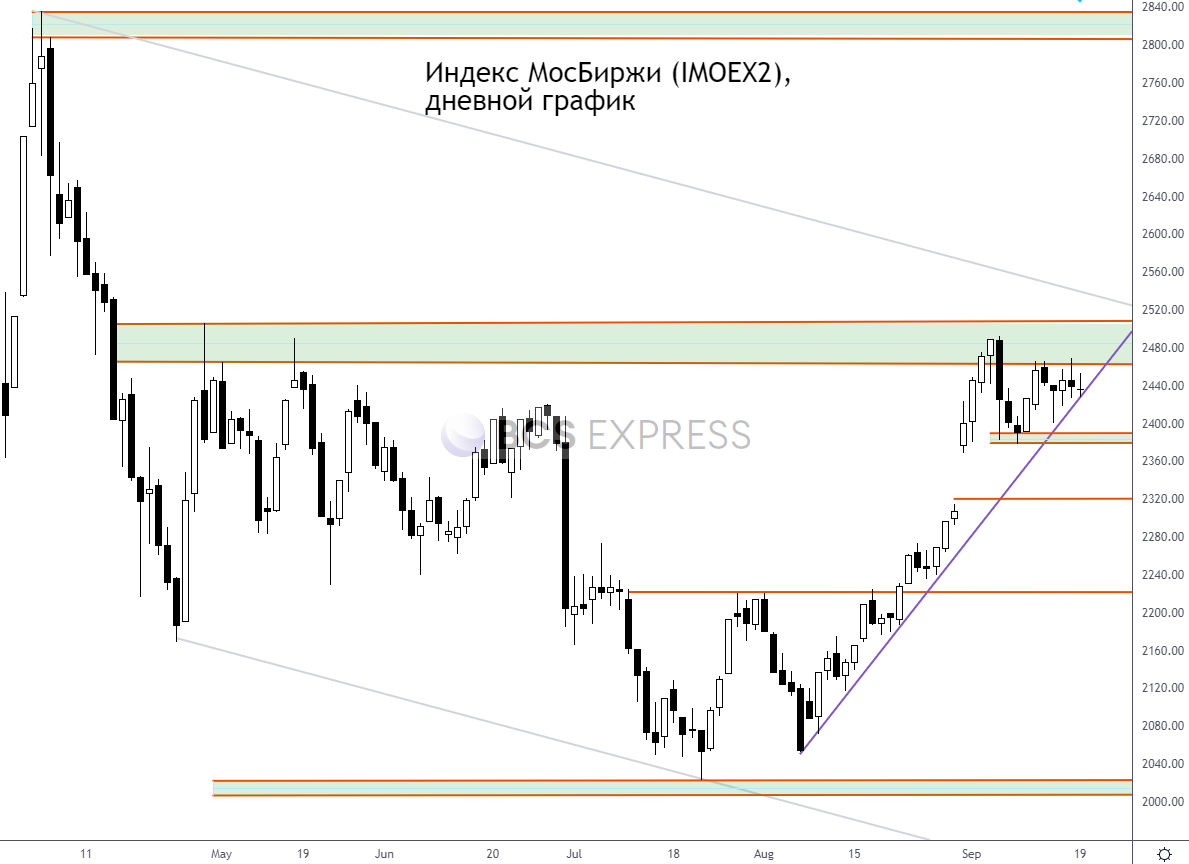

Picture on the Moscow Exchange index until it changes. Right now, many participants are just on standby. It is necessary to wait for the breakdown of the boundaries of the side corridor, which will indicate the further direction and goals. In particular, from above the range we follow the area of 2480–2500 p. It separates the market from the rearrangement of targets towards 2800 p. From below, the support zone is the area of 2370–2380 p.

On the US stock market meanwhile, there was a slight rebound ahead of tomorrow’s Fed meeting. It often happens that if the market approaches a meeting in a state of technical oversold, then a rebound follows before the decision of the Central Bank. Many participants take speculative short positions, remembering the popular “Don’t fight the Fed” rule. The S&P 500 added 0.7% on Monday. However, medium-term downside risks still exist. For a detailed analysis of the current situation, see separate material.

papers in focus

• VK (+7,9%). Shares once more became the leaders of growth among liquid shares, continuing to update highs. For three months, the growth was 110%. High demand is supported by several long-term factors, as well as positive corporate events. First of all, this is the departure of foreign IT companies. Against this background, activity in the social network VK is actively growing. The state provides support to the entire IT sector. In addition, investors see business opportunities in expansion and acquisitions, including an asset swap with Yandex. Interest is also fueled by reports on the development of various new products, for example, its own marketplace for video games VK Play, an analogue of Steam. Now the company is negotiating with developers regarding filling the store with games.

At the moment, the VK papers look overheated. Region 560–595 rubles. can act as a zone of technical resistance. At the same time, the long-term benchmark for shares is 640 rubles.

• Fix Price (+1,6%). published a good financial report for the first half of 2022. Information on revenue (+24% yoy) was known in advance from operating results, but net profit for the period decreased by 47.9%, to 5.1 billion rubles. The decline was due to foreign exchange losses and higher tax expenses. At the same time, gross profit increased by 31.2% YoY to RUB 43.5 billion.

Fix Price has suspended its dividend policy but plans to resume payouts as the lockdown stabilizes. The wording is standard for all companies registered outside of Russia. The timing of the refund is unknown. The appearance of any prerequisites for the return of dividends is a powerful driver for growth.

The current estimate of the Fix Price by multiples is still overstated relative to the consumer sector. This is partly due to high business growth rates, but the premium still looks excessive. Ceteris paribus, there are no expectations of outperforming dynamics of the company’s receipts relative to the sector.

• Group Positive (-0.2%). The company announced an SPO for 4% of capital. However, this is not an ordinary additional issue, but the sale of a block of existing major shareholders. So there is no negative impact on the paper from the blurring of shares. On the contrary, liquidity and free-float on the exchange are increasing.

Moreover, the Group proposed a scheme, unique for our market, when the placement participants will have the right to purchase 1 additional share in addition to the 4 shares purchased at SPO at the same price within 12 months (placement range 1200-1320 rubles). It turns out the form of an option, when an investor can, under favorable conditions for him (if the price rises), buy more shares at a better price. If the market quotes are suddenly lower, then the option may not be exercised.

At the “Dialogue with the Issuer” meeting on the BCS Live channel, the company’s management confirmed plans for further strong business growth, and also spoke in detail regarding the goals and reasons for the SPO. Edition can be viewed here.

• MMC Norilsk Nickel (-1.3%). Stocks were among the underperformers among blue chips, reacting negatively to Potanin’s interview. We have not seen any local growth drivers yet. The weakening of the ruble might provide support, but the USD/RUB rate is still stable around 60.

• At+ (-4.4%). Again, the investors’ negative reaction might be related to Potanin’s comment that so far there has been no progress in negotiations with RUSAL regarding a possible merger. Accordingly, the topic of disclosing the value of the parent company has so far receded into the background. There are not very many short-term strong drivers for growth yet, but in general, En+ papers are more of a long-term story.

• Globaltrans (-5,6%). Company published expected strong financial results. At the moment, the receipts were even actively growing, but by the end of the session, a wave of fixation passed. A 5% drop does not look excessive given last Friday’s 10% rise. In addition, management indicated that, due to the current restrictions, a solution has not yet been found on the dividend payment scheme that satisfies the interests of all shareholders. Dividends remain a priority for the company, but there are no guidelines on the timing of the return to the payment practice. At the same time, Globaltrans is holding the buyback program on pause for the time being, and will redeem the previously redeemed shares.

• PIK (-4.5%), Samolet (-4.1%), LSR (-2.7%). Shares remain under temporary pressure following the CBR signaled the end of the rate cut cycle. But yesterday there was also an additional negative factor. From December 1, 2022, the regulator has established a premium on the risk ratio for mortgage loans provided for financing under DDU agreements with an initial payment of no more than 10%. The Central Bank notes that in recent months, in the primary market, construction companies have begun to actively advertise mortgage programs without a down payment, including in installments. At the same time, historical data from banks show that borrowers applying for a loan with a low down payment are characterized by an increased level of credit risk.

• Ice steam Rus (-21%). One of the most popular third-tier securities among speculators showed the worst result on the market. On Monday, a sharp decline was provided by news of the imminent removal of shares from trading. Previously, since the end of August, quotes have grown 4 times, but now a gradual decline is likely in the absence of any ideas.

• On September 19, the Moscow Exchange resumed evening trading in some mutual funds (13 in total). The trading platform plans to further expand the list of funds available during the evening session.

External background

Asian markets are trading in positive territory today. Futures for the S&P 500 index are down 0.15%, Brent oil is up 0.2% and is near the $92.2 level.

Quotes

Stock Indices

Ind. Moscow Exchange (IMOEX2) 2436.04 (+0.04%)

RTS 1272.66 (-0.19%)

S&P 500 3899,89 (+0,69%)

Currency

USD/RUB 60,16 (-0,19%)

EUR/RUB 60,16 (+0,59%)

CNY/RUB 8,5559 (+0,15%)

Find out more

• They fall even on the general growth

• S&P 500 index. How much more to fall?

• Which bonds to choose following the meeting of the Central Bank

BCS World of Investments