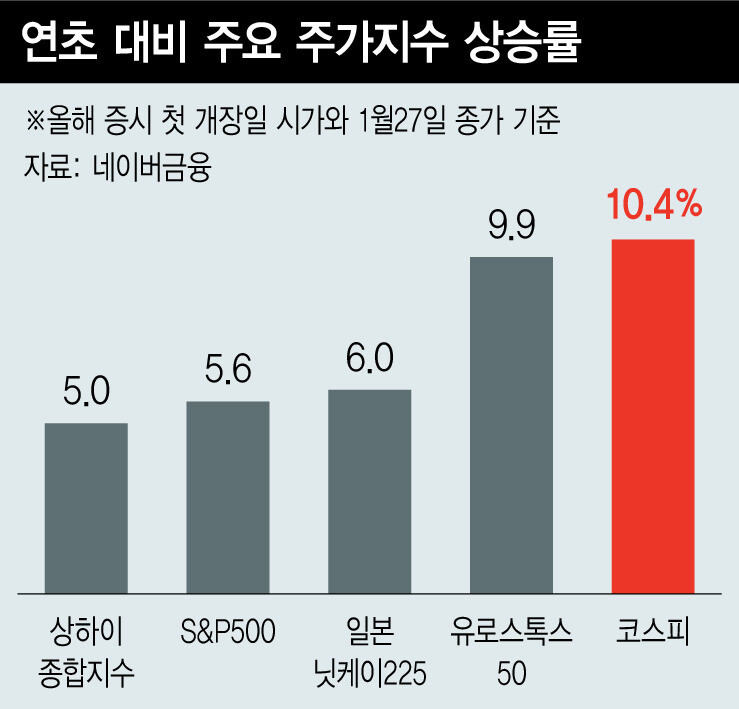

The world stock market in the new year is unexpectedly hot. There are several reasons for the recent rise in stock prices. Until the end of last year, the economic outlook for this year was so bleak that investors reduced their stock positions in advance, but as bond yields were also significantly lowered, the attractiveness of stocks increased once more. The 10-year US Treasury yield, which rose to 4.3 percent in October last year, fell to 3.4 percent at the beginning of the year. Next, relief that the tightening of central banks around the world was coming to an end helped investor sentiment. Since the beginning of the year, most economic indicators such as consumption, production, and housing, excluding employment, have been cooling down. As the consumer price inflation rate also fell to 6.5 percent in December last year, the end of austerity is gaining more momentum. Lastly, as the economic outlook for this year turns slightly positive, expectations are rising, especially in the stock markets of emerging countries. In the US and European stock markets, the possibility of a mild economic recession is expected rather than a major economic downturn this year. The prospect that China, which is the last to pass the Corona 19 collective immunity process, will regain economic vitality in earnest from this spring, is also adding to the global stock market. However, there are still some challenges that need to be addressed in the stock market this year. First, as stock prices continued to rise at the beginning of the year, the valuation appeal of stock markets around the world has weakened. This is all the more so considering the slowdown in corporate profits this year. Second, the US Federal Reserve System (Fed) is likely to raise its policy rate a little more during the first quarter and maintain it until the end of the year, but the 5.0% policy rate is still burdensome for this year’s recessionary interest rate. What’s more, if employment is as strong as it is now and stocks are bullish, the Fed may raise interest rates further, and it will be difficult to cut interest rates at least within the year. Third, even if the economy this year is not as gloomy as last year, a slump will not be avoided. The United States is also expected to grow at a low 0.5% this year from last year’s 2.1% growth, and Korea is also expected to grow at a low level of 1%. If so, the slowdown in corporate profits following the economic downturn will be the biggest stumbling block to the stock market this year.

Behind the rise in stock prices this month, supply and demand factors and economic fundamentals coexist. Some of these factors are reasonable, but others reflect expectations too far in advance. Of course, it is good news for the stock market this year that uncertainties in the economy, which is the main framework of the stock market, are decreasing. If Europe overcomes the energy crisis well thanks to warm weather and China, which has the world’s largest growth momentum, shakes off Corona 19 and stretches, this year’s stock market will not be as weak as last year. This year, it is necessary to approach stocks from a buying perspective rather than a selling perspective, and if there is a risk, it is necessary to actively use it as an opportunity. However, what I want to emphasize once more is that policy rates in each country are still high this year and corporate performance is weak. There are still barriers that must be passed in order for the stock price to go to a stronger bull market. The main barriers to this are slowing corporate earnings, inflationary pressure from China’s economic recovery, and delays in policy rate cuts. As time goes on, all of these tasks will be solved, but the problem is that considerable stock price volatility and twists and turns are expected in the process. Although this year is not a bear market like last year, we must face the fact that not all problems have been resolved to the extent that stock prices continue to rise without a break. For long-term investors, there are several opportunities to buy good stocks at good prices this year. The Economist