2023-08-30 12:13:46

Sargent, on screen, talking to Bullrich regarding successfully fighting inflation, from Lenin to Thatcher

With the economy, and in particular inflation, at the center of the political and pre-electoral scene in Argentina, Patricia Bullrich today will accentuate her determination to combat the scourge of inflation by meeting with Thomas Sargent, a scholar of the phenomenon and -along with economists such as Robert Lucas- one of the greatest exponents of the theory of “rational expectations”.

It may interest you: Jorge Ávila, the Argentine “dollarizing hawk”, raised at what value the peso can be abolished and expressed differences with Milei

Sargent won the Nobel Prize in Economics in 2011 together with Christopher Sims, for their research on cause-effect relationships in the functioning of the economy and Bullrich already had contact with him in April 2022, on a tour he carried out in the US at the who spoke with Sargent via Zoom accompanied by two of his advisers: Juan Pablo Arenaza and Alberto Föhrig, coordinators of his technical teams.

Patricia Bullrich’s tweet, in April 2022, following talking with Sargent and meeting other prestigious economists in New York

“Thomas Sargent is an inflation specialist, James Heckman is a human resources expert, and Michael Kremer understands all things social policy. Raghuram Rajan had the responsibility of stabilizing the economy of India ”, Bullrich tweeted then following the interviews he had in his New York days.

It may interest you: What is the bi-monetary economy scheme that Melconian proposes as an alternative to dollarization?

That time, the current presidential candidate later recounted, Sargent spoke to her regarding two extreme cases of success in the fight once morest inflation: Margareth Thatcher in the United Kingdom in the 1980s and Vladimir Illich Ulyanov, better known as Lenin, in the monetary stabilization of the post-October Revolution Soviet Union, as if to underline that the fight once morest inflation is not a matter of left or right and transcends ideological questions.

Thatcher stabilized the British economy, which had come from a deep crisis in the 70s, when she even had to resort to two packages from the IMF –an affront to English pride- basically privatizing companies and violently reducing public spending. Lenin did it by imposing an almost martial discipline in the functioning of the State, which served at least in the first years of the socialist experiment; Although he fought capitalism, he was convinced that currency might not be played with and in fact the phrase that to destroy a country the best thing to do is destroy its currency is attributed to him. A damage that Argentina in recent decades has inflicted on itself.

It may interest you: IMF: the measures it calls for to “get the program back on track” and the message to the 3 presidential candidates

Sargent is in Buenos Aires as the star Alex Reed of a workshop on international economics and finance that began yesterday and will close tomorrow with a debate between Luciano Laspina, who was Bullrich’s main economic adviser during the campaign, and Gabriel Rubinstein, the deputy minister of Sergio Massa.

The 2011 Nobel Prize winner is famous for his contributions to the so-called rational expectations theory, which basically says that economic agents (entrepreneurs, workers, consumers, savers, investors) cannot be deceived for a long time by the economic authorities. If they lied to you – for example, they told you they would reduce inflation, but they continue to run fiscal deficits and issue money – they stop believing them.

Hence the importance that rationalists assign to the “reputation” and “credibility” of governments and officials and political leadership. To combat inflation, it is key to be credible, to generate the conviction that things are serious, so that the population adapts their behavior to the new situation.

Sargent and Sims, when they won the 2011 Nobel Prize in Economics

Sargent, born in July 1943 in Pasadena, California, studied at Berkeley, in his native California, where he was distinguished as the best of the class in 1964, did his postgraduate studies at Harvard and was later a professor at several of the most prestigious universities in the United States. : Pennsylvania, Minnesota, Chicago, Stanford, Princeton, and New York, where he currently teaches and resides.

Among his papers, two stand out, from the year 1981. One of his sole authorship, on “Four great inflations”, in which he studied and revealed the hyperinflations of Germany, Hungary, Austria and Poland at the beginning of the 20th century. There he explained not only the cause of these phenomena, but also how they managed to overcome them: basically, freeing the Central Bank from the obligation to finance the State deficit, abruptly cutting off the issuance of currency, and forcing the government to finance itself with its own revenue by placing valued debt. (and bought or rejected) freely by the market.

This relationship between the monetary and fiscal authorities of a country was the one that he modeled with his colleague Neil Wallace, another rational expectations theorist, in a famous paper among academic economists: “Some Nasty Monetarist Arithmetic”, a work loaded with formulas and equations, difficult to read even for seasoned professionals of the “dark science”.

Beyond the formulation, one of the corollaries of the paper is that if the “fiscal authorities” dominate the “monetary authorities”, the latter lose control over monetary policy and management and, ultimately, over inflation. For this reason, just as Milton Friedman, the father of monetarism, said that inflation is “always and everywhere a monetary phenomenon”, Sargent went one step further in the causal chain and affirmed that “high and persistent inflation is always and everywhere a fiscal phenomenon”.

Hence the importance of “an independent Central Bank” from government impositions, capable of saying no to the Treasury (in Argentina, the Ministry of Economy) and forcing it to come face to face with its own accounts and, in the event of deficit, with the discipline of the bond market.

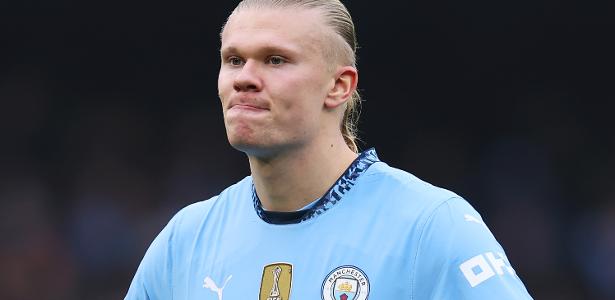

Bullrich, Sargent, Melconian.

In Argentina, Bullrich promises to achieve that discipline. This is also one of the components of the economic plan that Carlos Melconian prepared in the last 20 months with the assistance of more than 70 economists from the Ieral of the Mediterranean Foundation: it includes a reform to the Organic Charter of the BCRA. The candidate will formalize tomorrow in Córdoba, in a meeting of the “Federal Voices” cycle, the election of Melconian as media sword in the campaign and minister in an eventual presidency of hers.

Bullrich will arrive there with his hawkish credentials, not only in terms of security, but also in anti-inflation, thanks to his relationship with Thomas Sargent, an economist so critical of Keynes that it is even strange that Javier Milei, who called “Bob” one of his dogs, named following Robert Lucas, a Sargent associate, has not named any of the others “Tom.”

Keep reading:

The companies accelerate their electoral coverage and the dollar counted with liquidation exceeded 800 pesosAmong the uncertainty and discomfort, the businessmen analyzed the impact of the measures while they wait for the fine printPlan Melconian: the 12 keys to the program of the chosen one of Patricia Bullrich for Economy

1693401024

#Thomas #Sargent #Nobel #Prize #winner #listens #Bullrich