Last week, the demands for an emergency interest rate cut in the US intensified as turmoil erupted in financial markets globally. Growing concerns about a recession in the US and the collapse of the carry trade led market participants to increase their bets on the Federal Reserve cutting interest rates before the September meeting. However, such an action is unlikely to be taken quickly. A single disappointing labor market report will not sway the Fed’s decision. Recently, Federal Reserve Chairman Powell hinted that an interest rate cut might be on the horizon in September but emphasized that they would await new data on inflation and the economy, which are the primary focus for the upcoming week.

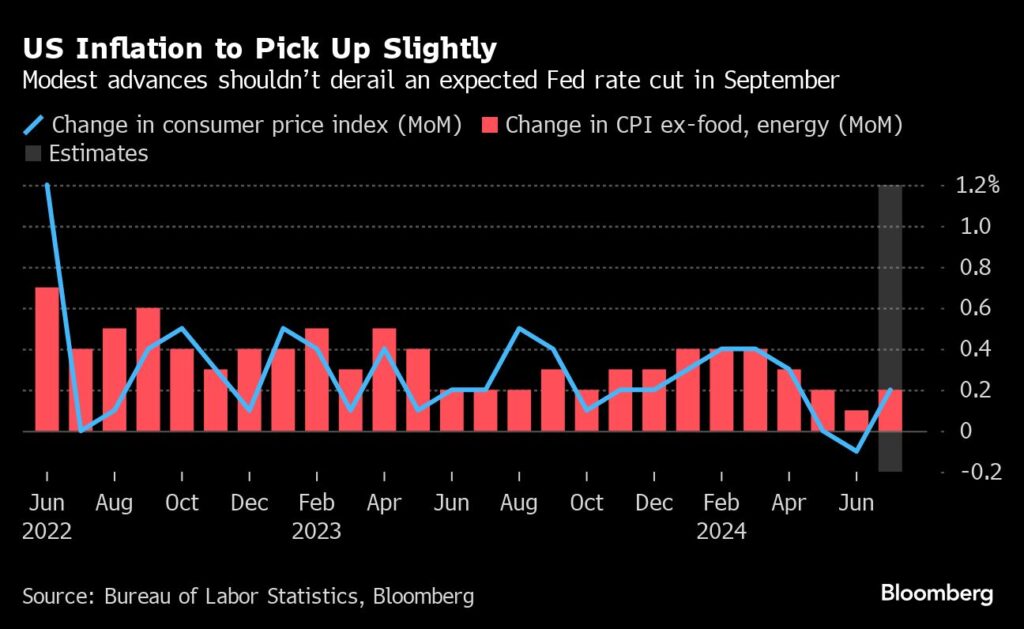

The timing and magnitude of the Fed’s interest rate cuts are also influenced by the pace of inflation decline. With a rate cut in September appearing nearly certain, a slight uptick in US inflation is unlikely to deter the Fed from relaxing borrowing costs. While markets contemplate a significant rate increase of 50 basis points, most economists remain more cautious.

Fed cuts despite rising inflation

The upcoming US consumer price report on Wednesday could reveal a slight increase in inflation for July, but not enough to prevent the Federal Reserve from proceeding with the widely anticipated interest rate cut next month.

According to Bloomberg, economists predict that the consumer price index will have risen 0.2% in July compared to June, both in headline inflation and in the core rate, which excludes volatile elements such as food and energy. While this would signify an acceleration from June, annual measures are expected to continue rising at their slowest rate since early 2021, meaning that modest improvements should not derail the Fed’s anticipated rate cut in September.

Slight increase in US inflation in July

Slight increase in US inflation in July

The recent easing of price pressures has bolstered the confidence of Fed policymakers, allowing them to begin cutting interest rates while refocusing on the labor market, which is increasingly exhibiting signs of slowing. Recent data indicating an economic slowdown in the US, coupled with the emergence of liquidity pressures within the financial system, raises concerns about the cessation of balance sheet reduction becoming a nearer reality.

However, in a speech on Saturday, Fed Governor Michelle Bowman urged caution, noting that she still perceives upside risks to inflation and continued strength in the labor market, suggesting she may not support a rate cut at the Fed’s next meeting in September.

and Jay Barry, Co-Head of US Rates Strategy at JPMorgan, on the other hand, expect the Fed to adopt an aggressive easing approach. They contend that the US economy has reached a juncture that necessitates interest rate cuts by the Fed.

Cracks in the US labor market

The July employment report revealed that US employers significantly slowed hiring, and the unemployment rate increased for the fourth consecutive month, which is an important recession indicator contributing to a global sell-off in equity markets. The subsequent recovery at the end of the week is now facing a real test.

If the Consumer Price Index (CPI) readings align with expectations, it would suggest that inflation continues to trend downward. However, economists forecast a slight increase following June’s unexpectedly low figures, attributing this shift mainly to the so-called core services excluding housing—a critical category monitored by Fed members. Some forecasters also identify potential upward risks in commodity prices due to rising transportation costs.

Nonetheless, the long-anticipated reduction in accommodation expenses that commenced in June is expected to persist. This category constitutes approximately one-third of the total CPI and plays a pivotal role in determining the overall inflation trajectory.

On Tuesday, a day before the closely watched consumer price index, producer prices will also come into focus. Analysts predict an increase of 0.2% in July compared to the prior month (also 0.2% last month).

Bloomberg Economics’ assessment:

“The consumer price index for July is likely to exhibit slight weakness, while the year-on-year change in core inflation is also trending downward. Markets may respond positively to this news; however, we expect the impact on the Fed’s preferred price indicator—the PCE core deflator—to be more mixed when consumer prices are evaluated alongside producer prices.” – Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou, and Chris G. Collins, economists.

Analysts anticipate that an economic report next week will indicate an increase in total retail sales for July, but excluding certain components used in gross domestic product calculations, sales are likely to show a noticeable slowdown.

This week’s data includes the latest figures on inflation expectations, small business sentiment, industrial production, and new home construction. Regional Fed Presidents Raphael Bostic, Alberto Musalem, Patrick Harker, and Austan Goolsbee are scheduled to speak.

FMW/Bloomberg

Last week, calls for an emergency interest rate cut in the US became louder after turmoil broke out on financial markets around the world. Emerging fears of a recession in the US and the collapse of the carry trade prompted market participants to increase bets that the US Federal Reserve will cut interest rates before the September meeting. However, experts are skeptical about such a rapid move. A single weak US labor market report is unlikely to sway the Fed into immediate action. Federal Reserve Chairman Powell recently suggested that while an interest rate cut could appear on the horizon in September, they would await further data regarding inflation and the economy, the latter of which will be in the spotlight this new week.

Understanding the Fed’s Dilemma: Inflation vs. Economic Growth

Whether and how quickly the Fed cuts interest rates hinges significantly on the trajectory of inflation. With a September rate cut appearing almost certain despite a slight uptick in US inflation, experts believe that the Federal Reserve will prioritize economic conditions over inflation in its decision-making process. While markets speculate about a substantial rate hike of 50 basis points, most economists remain cautious.

Fed Cuts Amid Rising Inflation

New consumer price data anticipated on Wednesday could show a minor uptick in inflation for July. However, this shift is not expected to deter the Fed from carrying out a widely anticipated interest rate cut next month. According to Bloomberg, economists predict the Consumer Price Index (CPI) to have increased by 0.2% from June in both overall and core inflation metrics, which exclude volatile food and energy prices. Even with this uptick, annual inflation rates are forecasted to rise at the slowest pace observed since early 2021, suggesting that modest progress shouldn’t obstruct the expected rate cut.

Slight Increase in July Inflation

The recent softening of price pressures has boosted the Federal Reserve’s confidence, paving the way for a potential interest rate cut as they redirect focus towards a labor market exhibiting signs of deceleration. Evidence of economic slowdown in the US, coupled with emerging liquidity pressures within the financial system, raises further alarms about the end of balance sheet reduction being closer than previously thought.

In contrast, Fed Governor Michelle Bowman voiced caution, recognizing persistent inflation risks alongside a resilient labor market. Her insights indicate possible hesitance within the Fed regarding a rate cut in the upcoming September meeting.

Expert Predictions on the Fed’s Future Actions

Analysts, including TCW Group Co-Head of Global Rates Jamie Patton and Jay Barry from JPMorgan, forecast aggressive easing from the Fed, contending that current economic conditions necessitate such actions.

Labor Market Concerns: A Potential Harbinger of Recession

The July employment report revealed a notable decrease in hiring while the unemployment rate rose for the fourth consecutive month, signaling potential recessionary indicators that contributed to a broad sell-off in equity markets. As recovery efforts emerge towards the end of the week, market resilience now faces a crucial test.

If the upcoming Consumer Price Index (CPI) readings align with expectations, they would suggest sustained downward trends in inflation. However, economists anticipate a slight rise following June’s unexpectedly low metrics, largely influenced by shifts in core services excluding housing—this category remains a focal point for Fed assessments. Some experts expect an increase in commodity prices due to escalating transportation costs.

Analyzing the Outlook for Accommodation Costs

Though the anticipated slowdown in accommodation expenses that began in June is expected to persist, this category holds significant weight in the CPI calculation, accounting for nearly one-third of the total. Its trajectory will be crucial in determining the overarching inflation trend.

Monitoring Economic Indicators: What Comes Next?

Before the much-anticipated consumer price index release, producer prices will be closely monitored. Analysts project a monthly increase of 0.2% in July, mirroring June’s figures.

Bloomberg Economics’ Assessment:

“The consumer price index for July is likely to reveal slight weakness, while the year-on-year change in core inflation is also on a downward trend. Markets may react positively, but we foresee a mixed impact on the Fed’s preferred price measure—the PCE core deflator—when considering consumer prices alongside producer prices.” – Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou, and Chris G. Collins, economists.

Market analysts expect an upcoming economic report to indicate a boost in total retail sales for July. However, exclusions of certain components tied to GDP calculation may yield a stark slowdown. The week ahead also features fresh insights on inflation expectations, small business sentiment, industrial production, and new home construction. In addition, discussions from Regional Fed Presidents Raphael Bostic, Alberto Musalem, Patrick Harker, and Austan Goolsbee are scheduled.

FMW/Bloomberg