Last Friday, Federal Reserve Chairman Jerome Powell confirmed what the markets had been anticipating for some time: the onset of monetary easing. Through his dovish remarks at Jackson Hole, Powell hinted at a potential interest rate cut in September. This led to increases in various assets, including stocks, gold, and cryptocurrencies. However, the shift in interest rates could also have adverse effects. A report by Bloomberg suggests that due to the anticipated interest rate reductions in the U.S., Chinese companies may be forced to liquidate dollar-denominated assets worth $1 trillion. This perspective comes from economist Stephen Jen, who is recognized for his “dollar smile theory.” Given this situation, he forecasts that the Yuan could strengthen by as much as 10%, putting pressure on the already flourishing Yuan carry trade.

Dollar-Yuan: Exchange Rate as a Risk

The head of Eurizon SLJ Capital currently views exchange rates as the largest risk that markets have not adequately priced in. He believes the Yuan could play a significant role in this context.

“Imagine an avalanche,” Jen remarked in a Bloomberg interview regarding the impact of repatriation flows. The Yuan “will appreciate, likely within a range of five to ten percent, which would be moderate and acceptable for China.”

Jen estimates that since the pandemic, Chinese companies have amassed over $2 trillion in offshore investments, held in assets that provide higher yields compared to those denominated in Yuan.

If the Federal Reserve reduces interest rates, the appeal of dollar assets will decline, Jen explained. This may lead to a conservative estimate of $1 trillion in repatriated funds, as the interest rate differential between China and the U.S. contracts as the Fed adopts a more accommodative monetary stance.

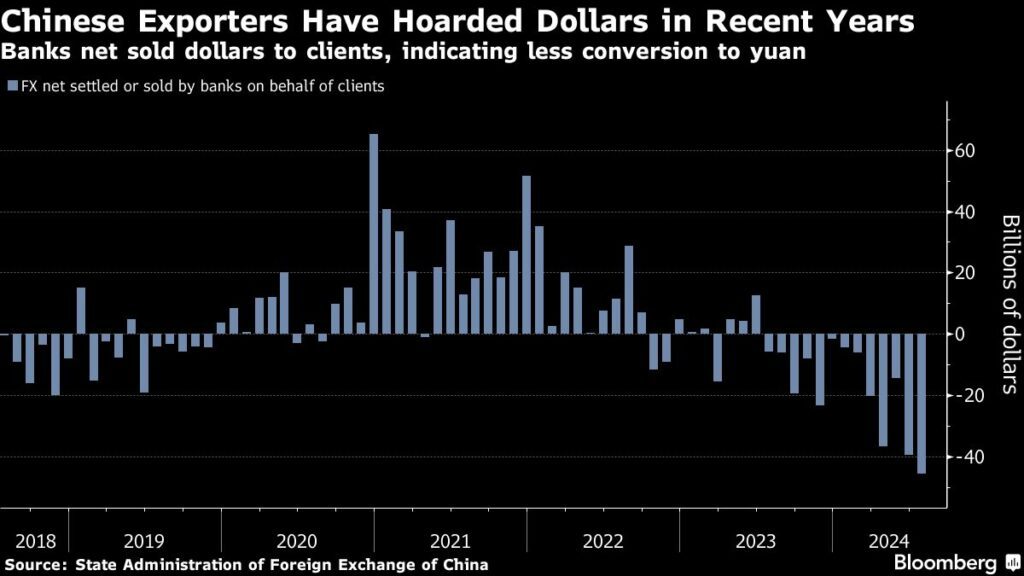

Chinese exporters have accumulated dollars in recent years | Banks are selling net dollars to customers

Chinese exporters have accumulated dollars in recent years | Banks are selling net dollars to customers

Aggressive Fed Interest Rate Cuts

Jen anticipates that the Fed will implement interest rate cuts more aggressively than the markets expect, especially as U.S. inflation suggests a depreciation of the dollar due to the overvaluation of the greenback, the twin deficits in the U.S., and the likelihood of a soft landing for the economy.

The “dollar smile” theory posits that the dollar tends to appreciate when the U.S. economy is either in a severe recession or in a robust recovery. In the former case, this is due to a flight to safety, while in the latter, it is driven by market greed. According to the theory, during periods of moderate growth, the dollar is less sought after and thus weaker.

On Monday, the Yuan was trading at 7.12 per USD. In July, the dollar was briefly valued at nearly 7.28 Yuan.

The Yuan has appreciated against the dollar as carry trades unwind

The Yuan has appreciated against the dollar as carry trades unwind

FMW/Bloomberg

Last Friday, Fed Chairman Jerome Powell confirmed what the markets have long been waiting for: the start of monetary easing. With his dovish statements in Jackson Hole, Powell signaled a cut in interest rates in September. Many assets such as shares, gold, and cryptocurrencies rose as a result. However, this interest rate turnaround poses potential risks, particularly for the Chinese economy. A report by Bloomberg suggests that companies in China may be prompted to liquidate dollar-denominated assets worth $1 trillion due to anticipated interest rate cuts in the USA, a situation described by economist Stephen Jen, famous for his “dollar smile theory.” In this context, he forecasts the Yuan to appreciate by as much as 10%, which may pressure the flourishing carry trade involving the Yuan.

Dollar-Yuan: Exchange Rate Dynamics

The head of Eurizon SLJ Capital has identified exchange rates as the most significant risk that the markets are currently overlooking. According to him, the Yuan could play an outsized role in this precarious situation.

“Imagine an avalanche,” Jen remarked in a Bloomberg interview, referring to the implications of repatriation flows. He theorizes that the Yuan will appreciate in value—five to ten percent would be a moderate and acceptable increase for China.

Since the pandemic, Jen estimates that Chinese companies have amasses over $2 trillion in offshore investments, primarily in assets with higher interest yields compared to those in Yuan.

If the US Federal Reserve proceeds with interest rate cuts, the allure of dollar assets is likely to wane, leading to a conservative estimate of $1 trillion in repatriated funds, as the interest rate differential between the US and China diminishes.

Aggressive Fed Interest Rate Cuts

Jen predicts the Federal Reserve may execute more aggressive interest rate cuts than the markets currently predict. Such actions could hint at a decline in the dollar’s value, given the greenback’s overvaluation, the twin deficit faced by the USA, and the potential for a soft landing in the economy.

The “dollar smile” theory suggests that the dollar typically appreciates during either extreme economic downturns or robust recoveries. In severe downturns, investors flock to safe-haven assets, while in recovery phases, market exuberance drives demand for investments. Conversely, during periods of moderate growth, the demand for the dollar diminishes, resulting in a weaker currency.

As of Monday, the Yuan was trading at 7.12 against the dollar. Notably, just last July, the dollar surged to almost 7.28 Yuan, illustrating the recent volatility in the currency exchange market.

Potential Economic Impact

The potential for a $1 trillion repatriation of assets could have significant implications for both the US and Chinese economies. Here’s how:

- Strengthening the Yuan: A repatriation of assets would likely lead to an appreciation of the Yuan, enhancing its status as a stable currency in global markets.

- Impact on Chinese Exports: An appreciating Yuan could potentially dampen Chinese exports, making them less competitive in international markets.

- Investment Shifts: Chinese firms may increasingly seek to diversify their investments within domestic markets, steering capital to sectors that would benefit from the repatriation wave.

Benefits of Understanding Currency Dynamics

Understanding these economic dynamics is crucial for several reasons:

- Investment Decisions: Investors can make more informed decisions by understanding how currency fluctuations will impact asset classes, particularly in international markets.

- Risk Management: Companies that engage in international trade can enhance their risk management strategies by anticipating currency risk and hedging accordingly.

- Policy Formulation: Policymakers can derive insights into how monetary policy decisions may influence currency dynamics, thus improving their economic strategies.

Conclusion

While there are no concluding sections for this article, it is evident that the anticipated interest rate cuts from the Fed, the dynamics of Dollar-Yuan exchanges, and the potential $1 trillion repatriation of assets create a complex landscape for both economies. Investors, policymakers, and companies must stay informed and alert as they navigate this evolving situation.

Read and write comments, click here