Fed boss Jerome Powell is facing a mission impossible with his speech at the central banker meeting in Jackson Hole! He wants to curb inflation by means of monetary policy steps, combined with a soft landing of the US economy, i.e. avoiding an economic recession. All of this, if possible, without too severe a slump in the stock market, which is so important for the USA. The US Federal Reserve, which must have watched with horror as the markets ignored the Fed’s monetary turnaround, sees itself in this predicament and had meanwhile opted for a turnaround à la 2018. How do you fight inflation? To make matters worse, many leading indicators are pointing to an imminent recession. What will Jerome Powell say regarding his strategy at the Wyoming (Jackson Hole) meeting two days from now?

Jerome Powell in Jackson Hole: Cut demand – but no collapse in consumption, please!

From this headline alone you can already see the tightrope walk that the Fed has to walk in order to achieve a real inflation-reducing effect with its monetary policy. Because the trillions of dollars that were printed by the central bank and distributed to companies and consumers via rescue packages and helicopter money created a quantity of money that had to lead to inflation when the supply situation was disrupted (delivery bottlenecks).

All of this happened under the top premise of not allowing consumption in the USA to collapse, following all it accounts for 70 percent of the entire national product. And it is precisely this demand that the central bank must now reduce without triggering a full-blown recession.

The news from the economy might not be more confusing: On the one hand, a totally overstretched labor market, with millions of vacancies, rising wages. A real estate market that is already showing signs of a bear market. And on the other hand, there are millions of Americans who are saddled with debt, have maxed out their credit cards, and are living paycheck to paycheck.

Tightening financial conditions but down oil and gas prices

The next dilemma arises from the different behavior and intentions of market participants, the central bank and the government. In October 2021, it finally became clear to the US Federal Reserve: “Inflation is not transitory”. At least not for the acceptable duration, the Corona variant Omikron had exacerbated the supply chain problem once more.

President Biden then made fighting inflation a top priority. This is linked to the appointment of Jerome Powell, because he had to expect a major electoral defeat given the inflation rates, especially given the rising petrol prices.

In October 2021, the inflation rate had risen from a good 5 percent to 6.2 percent following five months of sideways movement, and the monthly change for energy from 0.6 percent to 2.9 percent. The US President was horrified to see the rising fuel prices, a great political danger for every incumbent in the country of the big gas guzzlers.

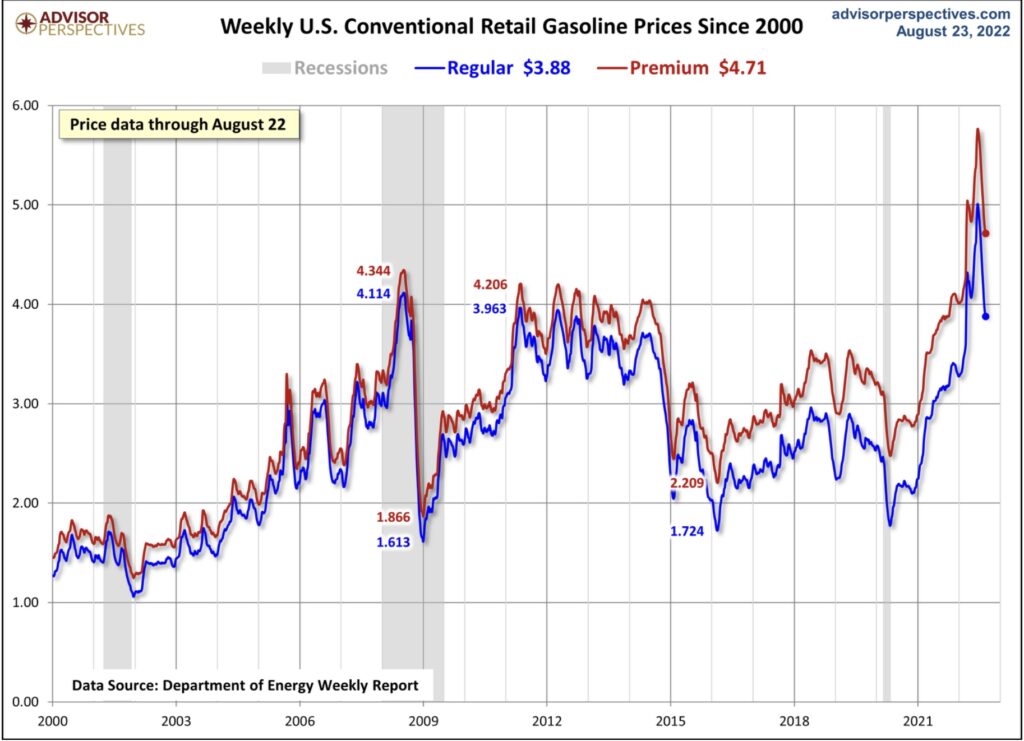

Fed Chairman Jerome Powell carefully prepared the markets for the turnaround in interest rates, because the first interest rate hike only came in March 2022. Interest rates gradually increased 10 year olds up to 3.50 percent, just like the gas prices. But in mid-June, something strange began. The return on the 10-year US Treasury fell below 2.60 percent, oil and especially fuel prices began a sharp slide – up to now 68 days in a row.

Here are the charts with the energy prices. In week ten, fuel prices went down once more by six cents. Harbinger of a recession – or consequence of emergency government measures (keyword release of strategic oil reserves)?

Oil also fell last week. The current data sets the next inflation data (13th September issue): will housing costs hold back a further decline?

The inconsistency of the current situation can be broken down into a simple formula:

Cheap black gold (oil and gas) for US consumers who are also the (hoped-for) Democratic Party voters versus tightening financing conditions (cost of borrowing) for consumers to end demand-side fueling of inflation.

Actually squaring the circle. Because both the fall in interest rates for the 10-year US government bond, which is the benchmark for almost all consumer loans, and the enormous financial relief for the drivers of the well over 100 million cars in the USA, counteract the Fed’s intention to to dampen demand.

US President Biden wants both until the elections: low oil and gasoline prices as a success once morest inflation that everyone can see. But at the same time thorough and effective measures for a permanently falling inflation rate. So a tightening of theFinancial Conditions“.

Both may be difficult to achieve at the same time, Mr. President.

Conclusion

Federal Reserve Chairman Jerome Powell’s job is hard to envy, as he’s caught in the middle in a way. This applies in particular to the forthcoming conference in Jackson Hole, at which the Federal Reserve Bank’s future monetary policy will no doubt be discussed. But once once more he is being driven by economic factors: “Data Dependancy”, as the US central bankers call it.

Just a week ago one might have said with certainty that Jerome Powell would be very “hawkish” in order to show the boisterous capital markets with the undesirably lax “financial conditions” the danger of their actions. But following the rapid slump on the stock markets in the last few days – with a simultaneous significant increase in interest rates – his hands are probably tied once more. Will he exercise caution once more, repeat the last statement, keep options open?

Aside from a recession induced by key interest rates, a stock market crash would probably be the last thing that both the US Federal Reserve and the incumbent president would wish for a few weeks before the midterm elections.

The uncertainty is palpable, the agile hedge funds have already positioned themselves short once more. Should they be mistaken once more in their assessment of the situation? But at some point every series breaks – even the negative ones.