sending time2022-04-08 08:00

22 months in a row… Reduced goods account surplus by US$1.59 billion due to surge in imports

Shipping surplus of US$1.9 billion due to freight rate rise

[연합뉴스 자료사진]

(Seoul = Yonhap News) Reporter Shin Kyung-kyung = The current account surplus continued for 22 months until last month, but the surplus fell by more than $1.6 billion compared to a year ago as import prices of oil and raw materials soared.

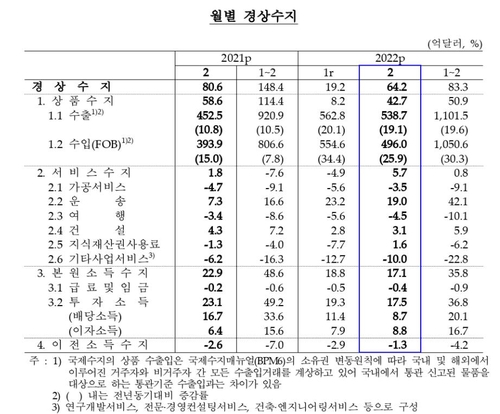

According to the interim balance of payments statistics released by the Bank of Korea on the 8th, the current account balance in February was recorded as a surplus of US$6.42 billion (regarding 7.835 trillion won).

It was a surplus for 22 consecutive months since May 2020, but the surplus decreased by $1.64 billion from the same month of the previous year ($8.06 billion).

By item, the goods account surplus was only $4.27 billion, $1.59 billion less than a year ago.

[한국은행 제공.재판매 및 DB 금지]

Exports (US$53.87 billion) increased 19.1% (US$8.62 billion) thanks to brisk petroleum products and semiconductors, but imports (US$49.6 billion) increased by 25.9% (US$10.21 billion) am.

In particular, as of February, imports of raw materials surged 36.7% from the same month of the previous year. Among raw materials, import growth rates of coal, petroleum products, and crude oil reached 171.7%, 67.1%, and 63.3%, respectively.

The service balance was recorded as a surplus of $570 million. The surplus increased by $390 million compared to February last year ($180 million).

Among the service balances, the transportation surplus in particular jumped from $730 million to $1.9 billion in one year.

This is because export freight rates remained high, with the ship container freight rate index (SCFI) rising 73.0% from a year ago in February, while transportation income also surged to $4.35 billion.

However, as overseas travel gradually increased, the travel account deficit ($450 million) was larger than in February last year ($340 million).

The primary income balance recorded a surplus of 1.71 billion dollars, but the surplus decreased by 580 million dollars in one year. The biggest impact was the decrease in the dividend income surplus of US$800 million from US$1.67 billion to US$870 million due to increased dividend payments by foreign-invested companies.

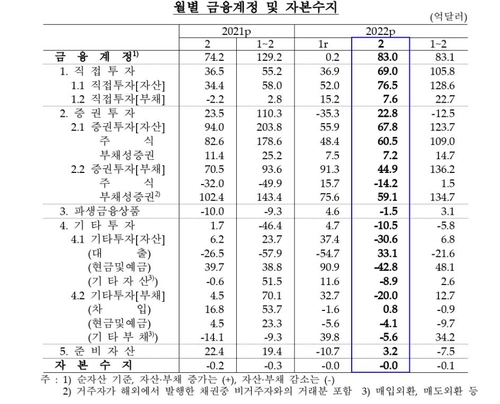

Financial account net assets (assets-liabilities) increased by $8.3 billion in February.

In the case of direct investment, foreign investment by Koreans increased by $7.65 billion, and domestic investment by foreigners also increased by $760 million.

In the case of securities investment, foreign investment by Koreans rose $6.78 billion, and foreign investment in domestic securities also rose $4.49 billion.

[한국은행 제공.재판매 및 DB 금지]

Report on Kakao Talk okjebo

<저작권자(c) 연합뉴스,

Unauthorized reproduction-redistribution prohibited>

2022/04/08 08:00 Send