The value of the 3D printers that will be sold worldwide this year will increase more than the number. The turnover forecast for 2023 shows a plus of 19%; the increase in the number of systems sold is expected to grow by 9%. The reason for this move: inflation and the shift towards more efficient and productive systems. And that applies to the full breadth of the AM market.

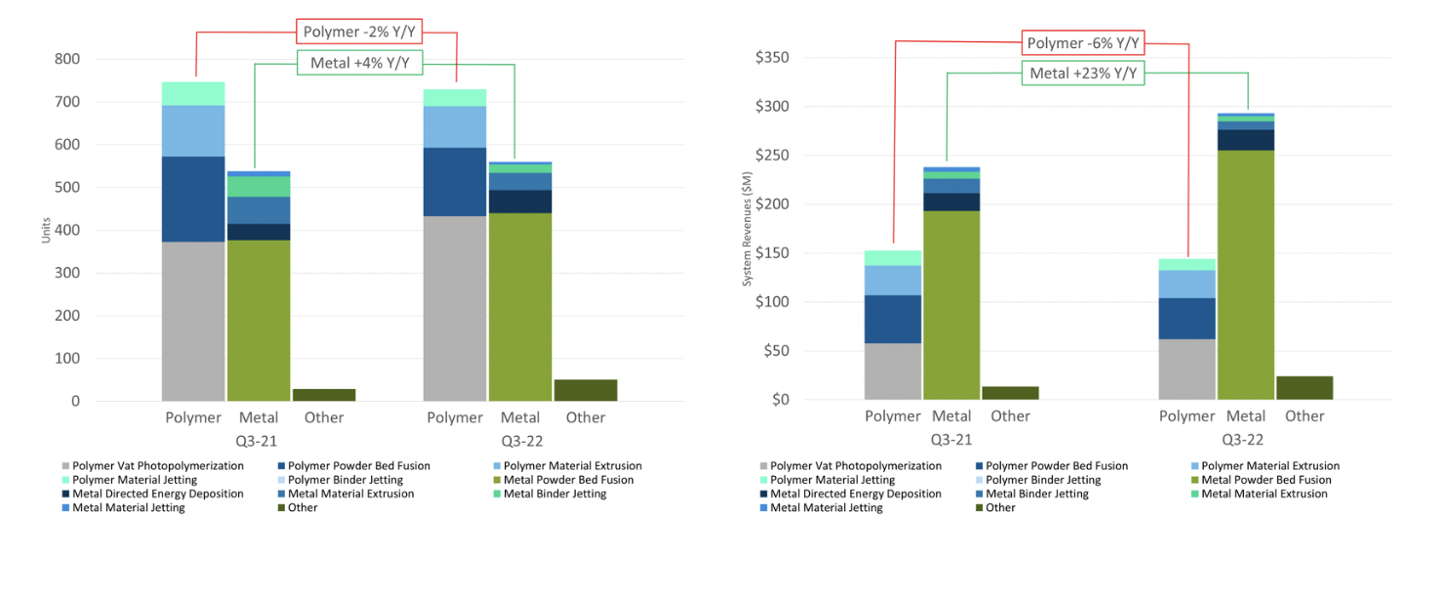

The conclusions are drawn by Chris Connery, market analyst at Context, which tracks sales in the AM industry every quarter. The numbers on the 3e quarter of 2022 already give a taste of what we can expect for the whole of 2023. In Q3, sales in terms of numbers decreased by 4%, the turnover that manufacturers achieved with it increased by 14%.

Will binder jetting make metal printing mainstream?

Prospects for metal printer sales markets remain good

The outlook for 2023 is cautious, on the one hand due to the expected recession, and on the other due to the release of the Covid-19 measures in China. However, the prospects for metal printer markets remain good, according to Chris Connery. He expects that with HP entering the market for binder jet systems with the MetalJet and GE Additive with the Series 3, 3D metal printing will become a more mainstream technology in the coming years. “As seen in 2022, growth is expected to be much higher in system revenue than in numbers, with revenue now expected to grow +19% across all technologies for the year once morest a unit volume growth forecast of just +9% ”, says Chris Connery regarding the expectations for this year.

China the largest growth market

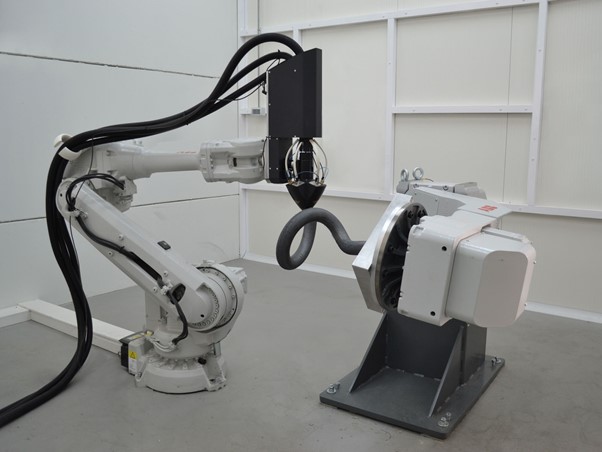

The picture, broken down by segment of the AM market, fluctuates very strongly. The big trend in the Industrial segment (above $100k) is growing demand for metal printers and DLP / SLA printers. The sales numbers here increased by 2%. Context particularly mentions the strong growth towards DED systems, partly because players such as Meltio have been added at the bottom of the market. In addition, the market analysts see a continued increase in demand for metal Powderbed Fusion systems, especially in China. The growth in the number of DLP printers sold can be attributed to the recovery at UnionTech, the Chinese manufacturer. After a sharp drop in sales during the Corona lockdowns, the manufacturer saw sales increase by 62% in the 3rd quarter. As far as Industrial printers are concerned, China has now passed the US and Europe. Growth in the third quarter was 34%, the Chinese market is now 35% of the world market.

Top 10 players in the AM market

EOS is the market leader in this segment, according to Context. According to the researchers, the turnover of the German group has increased by 35% on an annual basis; the number of systems sold by only 1%. Other names in the top 10 include UnionTech, HBD, SLM Solutions, Velo3D and Desktop Metal. Growth might have been higher, according to Connery, but quite a few players laid off people at the beginning of 2022 and experienced problems in their supply chains. Others saw demand stagnate. The outlook for the AM market in 2023 has been dampened for this market segment. “Amid fears of an impending recession, some end markets are cutting capital spending as a precautionary measure until global macroeconomic conditions stabilize.”

Formlabs Fuse and Origin P3 lead growth in Design class

In terms of numbers, the music apparently plays in the Design class (the systems between $20K and $100k). 29% more printers were sold here; on an annual basis 22%. According to Context, this is entirely due to the newcomers, such as the Origin P3 from Stratasys, the Fiber from Desktop Metal and the Formlabs Fuse , among others the new 1+30W version. This SLS printer model is already one of the three best-selling printers in this price range. The Fuse and the Origin P3 together account for 9% of all sales in this class.

UltiMaker is losing market share

In the price range below, the Professional ($2.5k – $20k), the number of printers sold is down 7%. The FDM printers in this segment stabilize on an annual basis; the cheap SLA printers lost quite a bit: – 19%. The merger group UltiMaker (following the merger of Ultimaker with Makerbot) is still the market leader with 36%, but has lost a lot, according to the analysts. They sold 14% fewer printers in Q3. Together with Formlabs, the new UltiMaker brings in 51% of all sales in the Professional class worldwide. Newcomer in this segment is Nexa3D. Context sees the market contracting in the very lowest price segment. A positive exception is newcomer Bambu Lab, which received 5,513 pre-orders following a successful Kickstarter campaign ($7.1 million). Previously, only Anker and Snapmaker managed to raise such amounts with their Kickstarter campaign.