2023-05-31 11:25:34

Key Highlights

- Exports in April contracted 7.6%.YoY is negative for the 7th consecutive month. from exports of industrial products and agro-industry which contracted Amid concerns regarding the global economic slowdown While agricultural products continued to expand. Imports continued to contract by -7.3% and the trade balance returned to a deficit of $1,471.7 million.

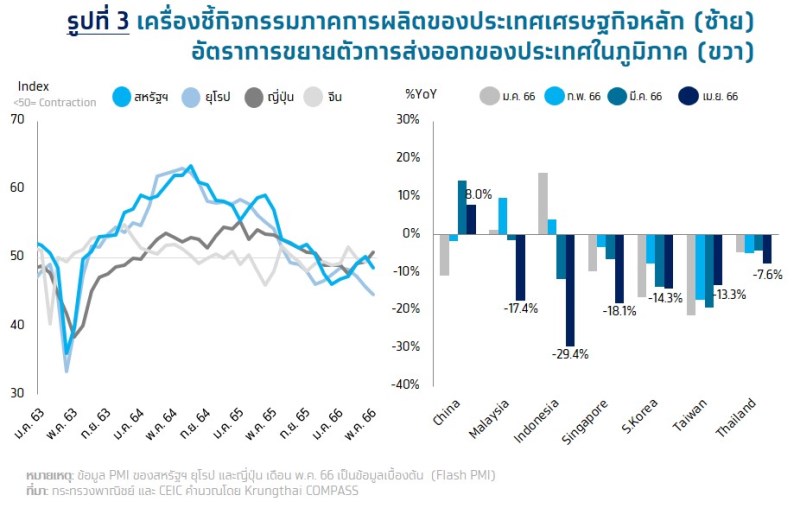

- Krungthai COMPASS estimates that although overall exports will gradually recover But exporters may face risks from weak demand. due to inflation and high interest rates As a result, the cost of the business sector increases. Amidst the demand for products that have shifted to the continuous service sector The business sector therefore stocks enough products for sales only. This is reflected by the decline in new orders in the US and Europe, which will put pressure on the fragile export sector, in line with exports in most of Asia, which have continued to contract.

Chonnithis Chaisingthong Krungthai COMPASS

Export Value April 20136 shrink 7.6%

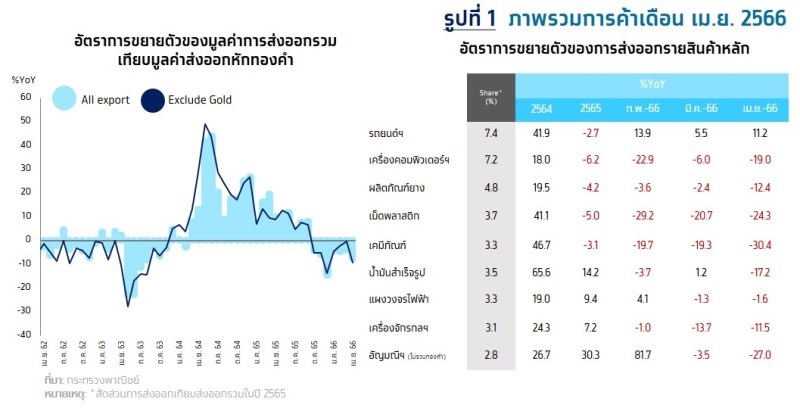

The value of exports in April was 21,723.2 million dollars, a contraction of 7.6%YoY, a negative growth rate for the seventh consecutive month. This was a larger contraction than the market expected at -2.0% from the continued contraction of the industry sector. and the contraction of the agricultural sector. due to concerns regarding the global economic slowdown However, agricultural products continued to expand. As for gold exports, this month returned to grow 79.2%, when deducting gold. The value of exports this month was negative 9.3%YoY, but exports in the first 4 months contracted 5.2%.

Exportlist of productsMost of them continued to decline.

- Exports of industrial goods contracted for the seventh consecutive month. -11.2%YoY contracted more compared to the contraction of -5.9%YoY in the previous month. from the contraction of important products, including products related to oil

(-23.5%) contracted for the ninth consecutive month, computers, equipment and parts (-19%), machinery and parts (-11.5%), gems and jewelry (-27%) and steel and products (-27.1%), etc. However, continued growth in exports of key products included automobiles, equipment and parts (+3.4%), fax machines, telephones, equipment and parts (+55.0%), semiconductors, transistors and diodes (+107.8%) and travel appliances ( 2%) etc. - Exports of agricultural products and agro-industry expanded at +8.2%YoY. Growth for the third consecutive month, accelerating from the previous month at 2%. from agricultural products that increased by 23..8%, while agricultural products returned to a contraction of -12.0%, with the main products expanding such as fruits (+142.8%), which made the highest revenue in history, and rice ( +3.5%), beverages (+2.4%), and fresh/chilled/frozen chicken (+38.9%), etc. Major products that contracted were cassava products (-44.1%), rubber.

(-40.2%) Canned and processed seafood (-17.1%) Pet food (-33.6%) and vegetable and animal fats and oils (-34.3%), etc.

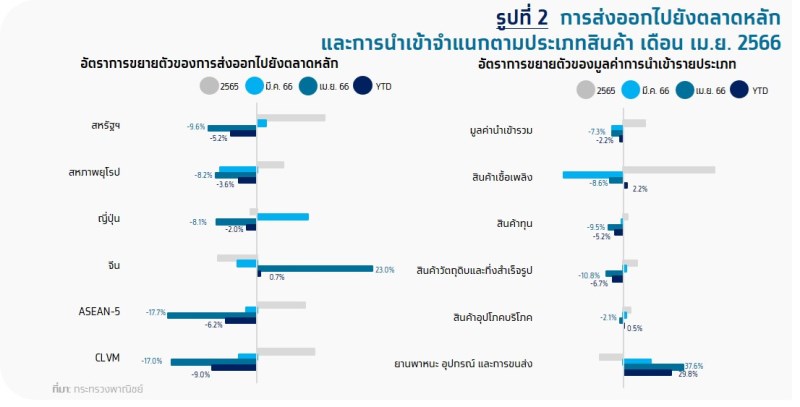

Exportby marketMost of them returned to contraction.

- United States : returned to a contraction of -9.6%YoY, with significant contraction in computers equipment and parts, rubber and iron products, steel and products, etc. For expanded products such as fax machines, telephones, equipment and parts semiconductors, transistors and diodes, and radio, television receivers and components, etc. (export in the first 4 months contracted 5.2%)

- China : returned to expand in 11 months at 23.0%YoY, with the expansion of products such as fresh/chilled/frozen/dried fruits. Fresh/chilled/frozen shrimp and electronic circuit boards, etc. Major products that contracted were cassava products, chemicals, and plastic tablets, etc. (Exports in the first 4 months grew by 0.7%).

- Japan : returned to a contraction of -8.1%YoY, with the major contraction being copper and copper-made articles. and plastic pellets, etc. for expanding products such as refined oil motorcycles and components and electrical appliances and components, etc. (export in the first 4 months contracted 0%)

- EU27: contracted for the second consecutive month at -8.2%YoY, with contracted products such as rubber, rubber products, and iron, steel and products, etc. The main products that expanded were air conditioners and parts. and transformers and components, etc. (exports for the first 4 months contracted 6%)

- ASEAN5 : Contracted for the third consecutive month at -17.7%YoY, with contracted products such as refined oil, plastic pellets and rubber, etc., while expanding products included gems and jewelry, automobiles, equipment and parts. and sugar, etc. (export in the first 4 months contracted 2%)

Implication:

- Krungthai COMPASS views that exporters may face risks from weak demand for their products. Although the overall export direction tends to gradually recover and is expected to return to expand in the second half of the year. The supporting factor was exports to China that returned to expand in the past 11 months from domestic demand in line with China’s retail sales index of consumer goods that continued to expand in April 4. %YoY, but the impact of high inflation and rising interest rates in many countries from continued tight monetary policy As a result, the cost of the business sector increased amid the shift in demand for products to the downstream service sector. The business sector tends to stock only enough for sales. This was reflected by the latest Flash Manufacturing PMI indicators in the US and Europe that contracted partly from the decline in new orders. As a result, the manufacturing sector has not clearly recovered. This will put pressure on merchandise exports that are still fragile, in line with exports in most of Asia that continue to contract. from such factors Krungthai COMPASS therefore maintains its outlook on exports this year with a negative trend of 1.6%.

1685537734

#Exports #April #fell #Krungthai #COMPASS #assesses #global #demand #goods #weak