Experts say that geopolitical tensions, the poor situation of the US economy, plus the move to increase gold purchases from central banks have helped gold prices build a solid floor at the $2,000 mark. .

Gold price today February 4: World gold has built a solid floor at the 2,000 USD/ounce mark

The gold market started a volatile week. The tragic murder of three US soldiers in Jordan over the weekend by an Iranian proxy has sparked a surge in safe-haven exposure to the US dollar, Treasury bonds and gold. World gold prices rose above the resistance level of $2,050 following the FOMC meeting ended on Wednesday, ending January at $2,067/ounce, despite the Fed’s recent hawkish statements.

World gold price developments. Source: Tradingeconomics

After a failed breakout attempt in late 2023, gold prices have quietly built a new floor at the crucial $2,000 level. Ahead of the highly anticipated first Federal Reserve Open Market Meeting (FOMC) of 2024, held over the last two days of January, Gold Futures closed above this key level for the month third in a row.

Fed Chairman Powell’s comments made following the FOMC meeting showed that he remained persistent with his “hawkish” stance on interest rates, the central bank kept the base interest rate unchanged as expected. Overall, Powell’s statements and the FOMC’s policy stance suggest a cautious approach to interest rate cuts. These statements make a March pivot less likely, negating gold’s gains following earlier news of geopolitical tensions.

While the market is hoping for more hints of a pivot in March, the Fed Chairman did not completely rule out an interest rate cut next month. Powell said there are two things that might cause the Fed to cut faster and sooner: labor market weakness or lower inflation.

After better-than-expected US jobs data was released on Friday morning, Gold Futures were sold off to support in the $2,040-$2,050 area as the USD approached resistance above 104. According to the CME FedWatch Tool, traders are currently pricing the likelihood of a rate cut in March at just 17%, down from regarding 50% last week and 89% a month ago. However, the world’s most powerful central bank no longer has any legitimate reason to maintain a hawkish stance. While the Fed cannot control the government’s financial mismanagement, the independent central bank knows that an economy mired in bad debt cannot continue to sustain a high interest rate environment.

The recently released update on federal interest costs shows that the United States has now fallen into a debt spiral, with more than $1 trillion now spent each year just to pay for the massive federal debt. huge and increasing parabolically. Ahead of Wednesday’s Fed speech, the banking industry was spooked by recent asset-related losses reported by New York Community Bancorp (NYCB). This news sent chills to the market when NYCB announced a 70% dividend cut. Regional Bank also posted a quarterly loss of -$260 million while expecting a profit of $250 million. The news sent the KBW Regional Bank Index down 4.8%, marking its biggest one-day drop since the collapse of Signature Bank last March. This two-day drop is on track to be the most significant drop since June 2020.

Meanwhile, emerging economies, which are leading both the Fed’s tightening and easing cycles, have begun cutting interest rates. Positioning Interest rate cuts are one of the main macroeconomic drivers affecting gold prices in 2024, along with increased geopolitical instability.

Considering all of the above, it is not surprising that the World Gold Council’s full-year and fourth-quarter 2023 gold demand trends report shows that central bank gold purchasing demand has nearly doubled. double the average over the past ten years. At last estimate, central banks bought 1,037 tons of gold last year, just 45 tons short of the 2022 record.

With war fears and civil unrest heating up, combined with the U.S. government’s dire financial situation and increased central bank purchases of safe-haven gold bullion, Gold creates a solid floor at $2,000/ounce.

This week, 12 analysts participated in the Kitco News Gold Survey, and Wall Street sentiment appears to have shifted to clearly bearish bets on the precious metal’s near-term outlook. Only 2 experts, or 17%, predict gold prices will move higher next week, while 8 analysts, or 66%, predict gold prices will fall. Two other experts, accounting for 17%, predict gold prices will move sideways next week.

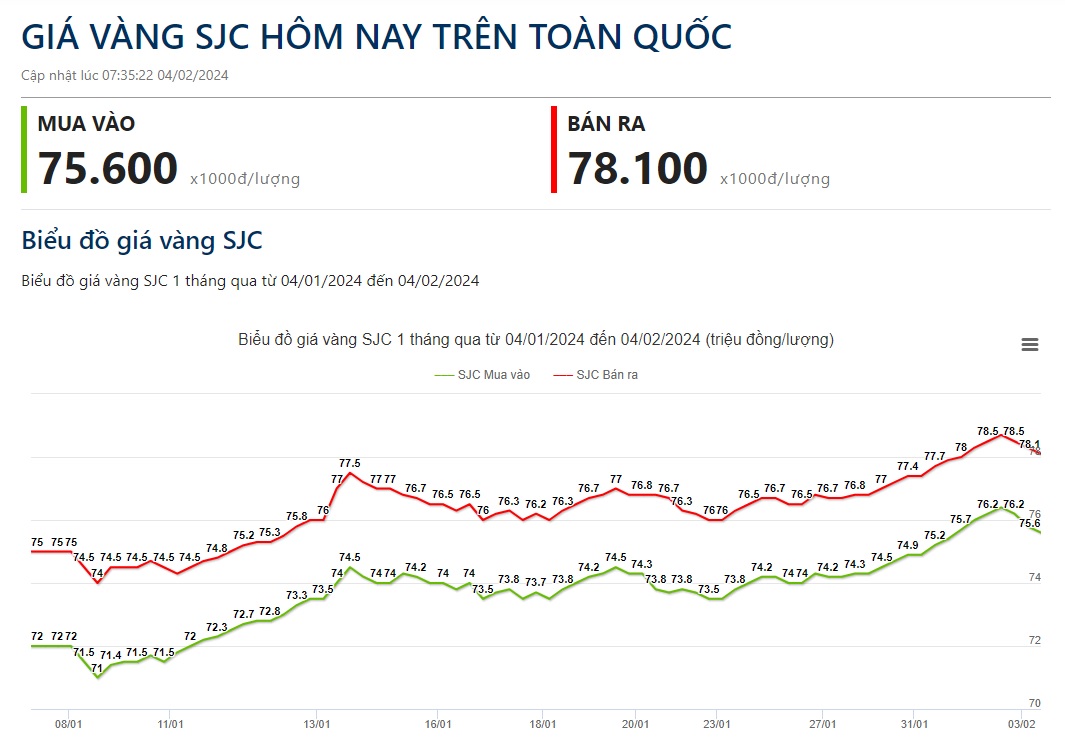

Gold price today February 4: SJC gold decreased by 400,000 VND/tael

This morning, the domestic SJC gold price was adjusted down with the highest reduction of 400,000 VND. Currently, the prices of gold bars for brands are listed specifically as follows:

SJC gold price in Hanoi and Da Nang area is listed at 75.6 million VND/tael purchased and 78.12 million VND/tael sold. In Ho Chi Minh City, SJC gold is still buying at the same level as in Hanoi and Da Nang but selling is 20,000 VND lower. Thus, compared to yesterday morning, the price of SJC gold bars has been adjusted down by 600,000 VND on the buying side and 400,000 VND on the selling side.

SJC gold bar price is being listed by Phu Quy at 75.7 million VND/tael purchased and 78.1 million VND/tael sold, down 500,000 VND on the buying side and 300,000 VND on the selling side.

At PNJ, SJC gold bars are buying at 75.9 million VND/tael and selling at 78.3 million VND/tael, down 500,000 VND on the buying side and 400,000 VND on the selling side compared to yesterday morning.

At DOJI, the price of SJC gold bars has been adjusted down by 100,000 VND on the buying side and 200,000 VND on the selling side to 75.95 million VND/tael and 78.25 million VND/tael sold, respectively.

Meanwhile, SJC gold prices at Bao Tin Minh Chau are 76 million VND/tael and 78.05 million VND/tael respectively, down 250,000 VND on the buying side and 300,000 VND on the selling side.

The difference between domestic and world gold prices is regarding 18 million VND/tael.

Domestic SJC gold price developments. Source: giavang.org

Unit: x1000 VND/tael