Tesla(284.82 -1.14%) Let’s slow down, as an opportunity to buy at a low price

As the semiconductor industry slows down… Betting on the likelihood of a decline

Stocks with the top 1% of return on investment were on the 29th (local time) Teslaand a bet on a decline in the semiconductor industry. The market is also looking for investment opportunities despite the recent remarks by the Federal Reserve (Fed) Chairman Jerome Powell that he would keep interest rates at a high level.

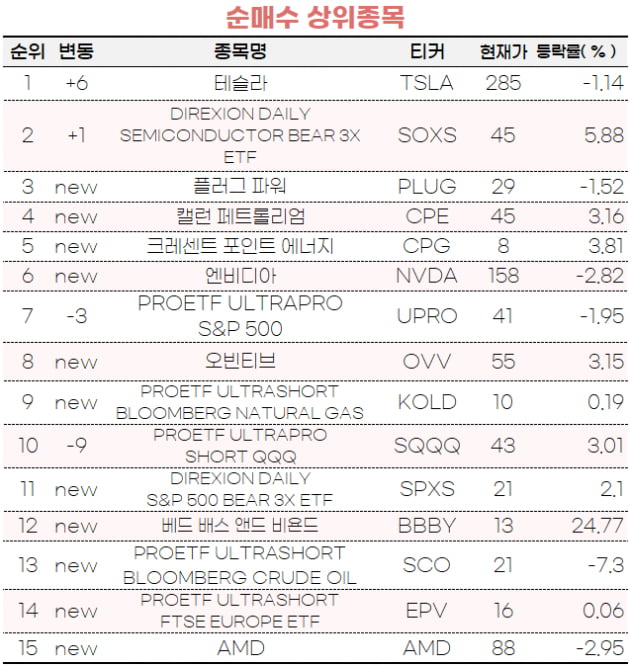

According to Mirae Asset M Club, the top 1% in yields who trade stocks with their Mirae Asset Securities account were in the US stock market last night. Tesla(TSLA) and ‘Direction Daily Semiconductor Bear 3X ETF’ (SOXS), a 3x leveraged product that invests in the possibility of a decline in the US Philadelphia Semiconductor index, were the most net buyers.

The Fed’s strong hawkish will Tesla Growth stocks are booming. Chairman Powell said in his Jackson Hole speech that interest rates would remain high until inflation drops to 2%.

As a result, the top 1% investors Tesla We see this as an opportunity to buy low-priced growth stocks. Teslafell more than 2% in the last five trading days. Furthermore TeslaIt is also interpreted that the price per share was adjusted to ‘three hundred sla’, which is close to $300 per share, through the stock split, which also had a positive effect on investment.

Teslastarted trading on the 25th at one-third of the previous day’s closing price ($297). Stock split refers to splitting already issued stocks and distributing them according to the share ratio, and the price per share becomes cheaper than before, resulting in easier trading.

SOXS also has a buying trend. This is because the possibility of a slowdown in the semiconductor industry is raised. On the 23rd, the World Semiconductor Market Statistical Organization (WSTS) downgraded its growth forecast for the global semiconductor market this year to 13.9% from the previous 16.3%. This is half of the growth rate of last year (26.2%).

Hydrogen fuel cell companies ranked 3rd and 4th in net buyingplug power(28.50 -1.52%)‘(PLUG) and a resource exploration company’Callen Petroleum(45.07 +3.16%)‘ (CPE) took over. plug powerRecently, it was reported that the company has signed a large-scale hydrogen fuel supply contract with Amazon.

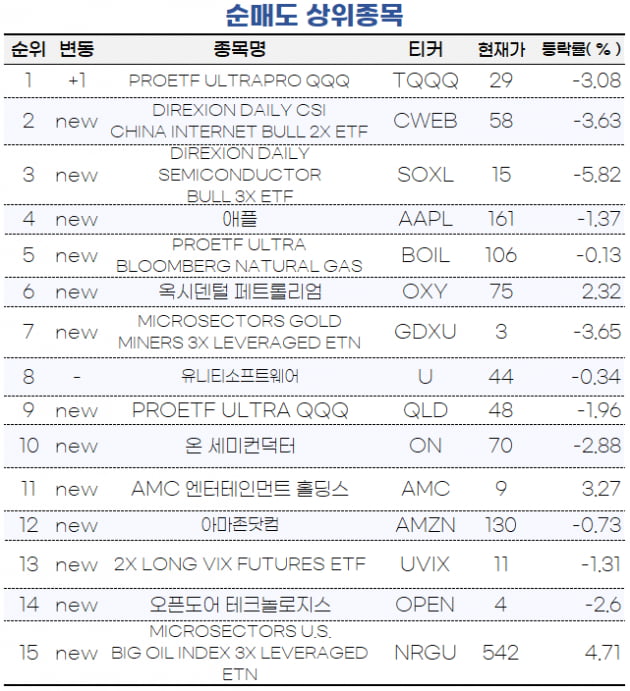

On the other hand, the stocks sold the most on the U.S. stock market by top players are the ‘ProShares Ultra Pro QQQ’ (TQQQ) and ‘Direction Daily SCI China Internet Double ETF’ (CWEB), which are designed to follow three times the daily fluctuations of the Nasdaq 100 Index. etc. were ranked.

CWEB is an ETF that tracks the stock prices of IT stocks representing China, such as Alibaba and Tencent. in addition Apple(161.38 -1.37%)‘Direction Daily Semiconductor Bull 3X’ (SOXL), which tracks three times the daily fluctuation of the Philadelphia semiconductor index in the US, Apple The proportions were also reduced at the same time.

Ryu Eun-hyuk, staff reporter at Hankyung.com [email protected]

※If you want to receive the news of Hankyung Market PRO as soon as possible telegramYou can subscribe to