The popularity of villas (multi-family and row houses) is reviving while the real estate market is frozen due to a steep interest rate hike. The absolute level of apartment prices is still high and various regulatory barriers are relatively low.

In addition, as the government, which is promoting the rapid expansion of housing supply, has given strength to vitalization of maintenance projects, demand for investment purposes is also increasing. However, real estate experts agree that villas are less liquid than apartments and that they can be more directly affected by the housing economic slowdown. It is an explanation that caution should be exercised in purchasing a ‘don’t ask’ purchase that expects a profit from the maintenance project rather than the actual residence.

The proportion of villa sales and transactions beyond apartments

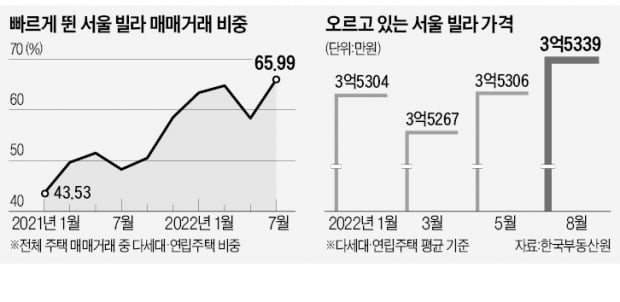

According to the Korea Real Estate Agency on the 25th, a total of 3,206 villa sales transactions in Seoul this July were counted. It accounted for 65.99% of all home sales transactions, the highest since related statistics were compiled. During the same period, apartment sales transactions amounted to 1,028, accounting for only one-third of villas. In the case of apartments, the proportion of the total housing sales transaction also decreased significantly to 21.16%.

Until last year, villas accounted for only 30-40% of the total housing sales transaction. A year ago, in July of last year, villas accounted for 48.27% of the total housing sales transaction.

This year, however, the situation has changed as the US central bank (Fed) accelerated rate hikes and domestic consumer prices rose rapidly. This is because the Bank of Korea has decided to raise interest rates one following another, which has greatly increased the loan interest burden. Apartment prices in Seoul have risen sharply over the past two to three years, and as interest rates rise and the possibility of lowering house prices increases, the demand to purchase apartments with excessive debt has decreased significantly.

A representative of a real estate agency in Yeongdeungpo-dong, Seoul said, “When the housing market is unstable, people have a higher preference for apartments with small price fluctuations compared to villas. “Although house prices are on the decline nationwide, including Seoul, the average apartment price in Seoul is still reaching 1.14 billion won,” he said. added.

Despite the drought, the demand for villas continues to rise, so the price is on the rise. As of August, the average price of a villa in Seoul was 353.9 million won, slightly higher than at the end of last year (352.83 million won). This is in contrast to apartment prices that have turned downward this year. An official from a real estate agency in Jamsil-dong, Seoul said, “In the past, apartments in major areas in Seoul were in a windless zone where prices were strong even when bad economic conditions overlapped.

“You should pay attention to villas in the station area that are more than 10 years old”

The government’s move to strengthen the maintenance business is also encouraging this trend of preference for villas. The government plans to actively utilize the maintenance project to achieve the target of supplying 2.7 million households within the term of office. In Seoul, there is an organization dedicated to reconstruction and redevelopment in each district. As there are more opportunities for reconstruction and redevelopment related to old residential areas than in the past, there are also consumers who view villas as investment targets.

Lee Eun-hyeong, a research fellow at the Korea Construction Policy Research Institute, said, “Even while housing buying sentiment is weakening, there is steady demand for villas in areas with high expectations for maintenance projects such as rapid integrated planning or Moa Town. There is also the view that it has value as a product,” he said.

Experts predicted that the popularity of villas will continue for the time being. However, he advised that when deciding to purchase for investment purposes rather than for real residence, it is necessary to carefully consider various conditions. He said that if you want to invest with the expectation of a maintenance project, you should choose a villa in a potential redevelopment site. This means that you need to know in advance the requirements such as the age and density of households. It is also necessary to check the reference date for calculating the rights set in order to block speculative forces such as splitting shares. Experts explain that the villa in the station area with a subway station nearby, which has been built for more than 10 years, should be the first investment target.

Yeo Kyung-hee, a senior researcher at Real Estate R114, said, “Villas have a characteristic of being easy to invest in due to their high jeonse rate and low prices compared to apartments. should be put in,” he said.

By Kim Eun-jung, staff reporter [email protected]

.tmb-1200v.jpg?sfvrsn=b60dd396_1)