European Stocks Decline Amid Political Uncertainty and Anticipated Economic Data

Table of Contents

- 1. European Stocks Decline Amid Political Uncertainty and Anticipated Economic Data

- 2. European Stocks Lag Behind U.S. Peers, Widening Discount

- 3. European Stocks Dip Amid Political Uncertainty

- 4. Unlock Exclusive Articles

- 5. European Equities: Trading Opportunities Emerge Amidst Challenges

- 6. Grim Outlook, But Potential for Upward Movement

- 7. Recent Market Rally Shows Signs of Hope

- 8. Political Instability in Germany and France Adds Uncertainty

- 9. Introducing the Simple Publish & Rewrite API Plugin for WordPress

- 10. Streamlined Workflow for Bloggers and Developers

- 11. Simplified Content Creation for the Modern Web

Table of Contents

- 1. European Stocks Decline Amid Political Uncertainty and Anticipated Economic Data

- 2. European Stocks Lag Behind U.S. Peers, Widening Discount

- 3. European Stocks Dip Amid Political Uncertainty

- 4. Unlock Exclusive Articles

- 5. European Equities: Trading Opportunities Emerge Amidst Challenges

- 6. Grim Outlook, But Potential for Upward Movement

- 7. Recent Market Rally Shows Signs of Hope

- 8. Political Instability in Germany and France Adds Uncertainty

- 9. Introducing the Simple Publish & Rewrite API Plugin for WordPress

- 10. Streamlined Workflow for Bloggers and Developers

- 11. Simplified Content Creation for the Modern Web

European stock markets experienced a downturn on Tuesday, December 17, 2024, as political instability in France and Germany cast a shadow over investor sentiment. Traders were also cautiously awaiting the release of crucial eurozone inflation data and a highly anticipated US interest rate decision scheduled for the following day.

The political landscape in Europe was marked by uncertainty, with both France and Germany grappling with internal challenges. these developments contributed to a cautious atmosphere in the markets.

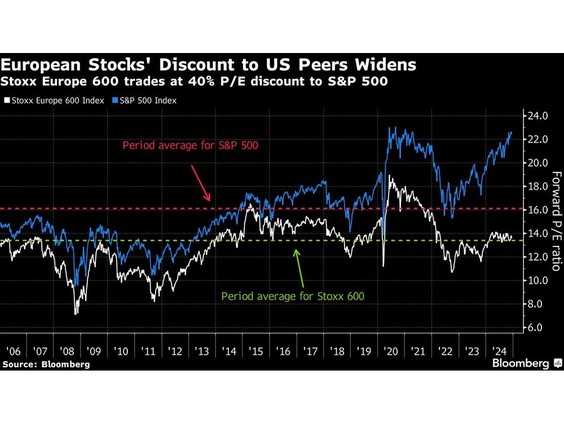

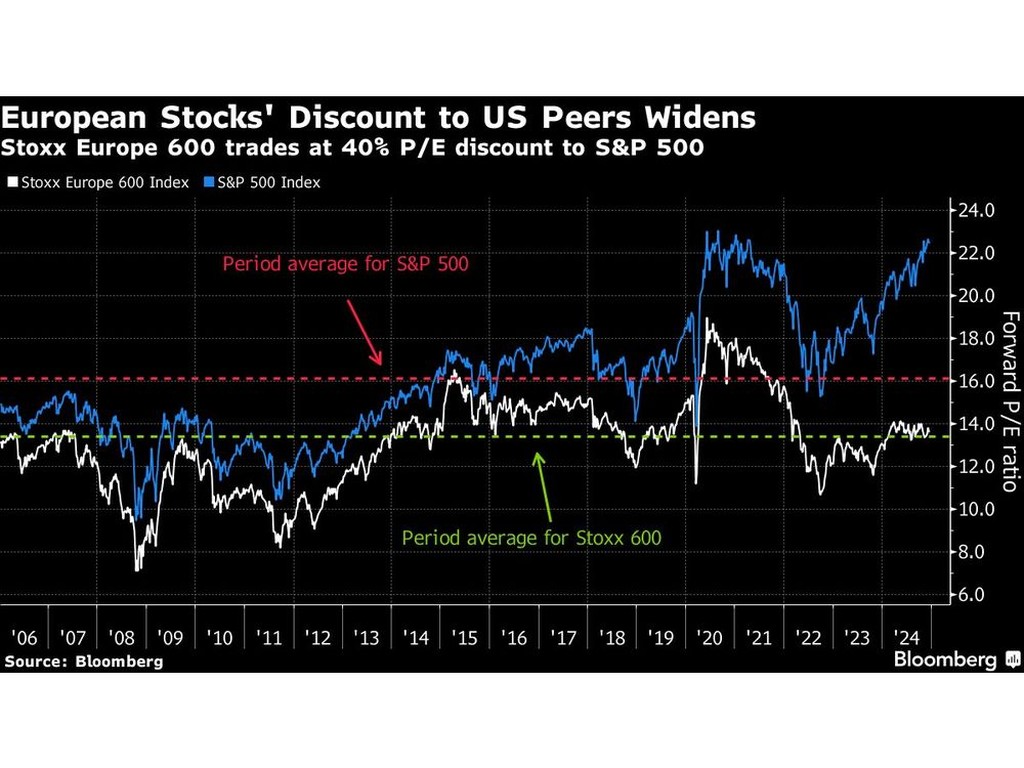

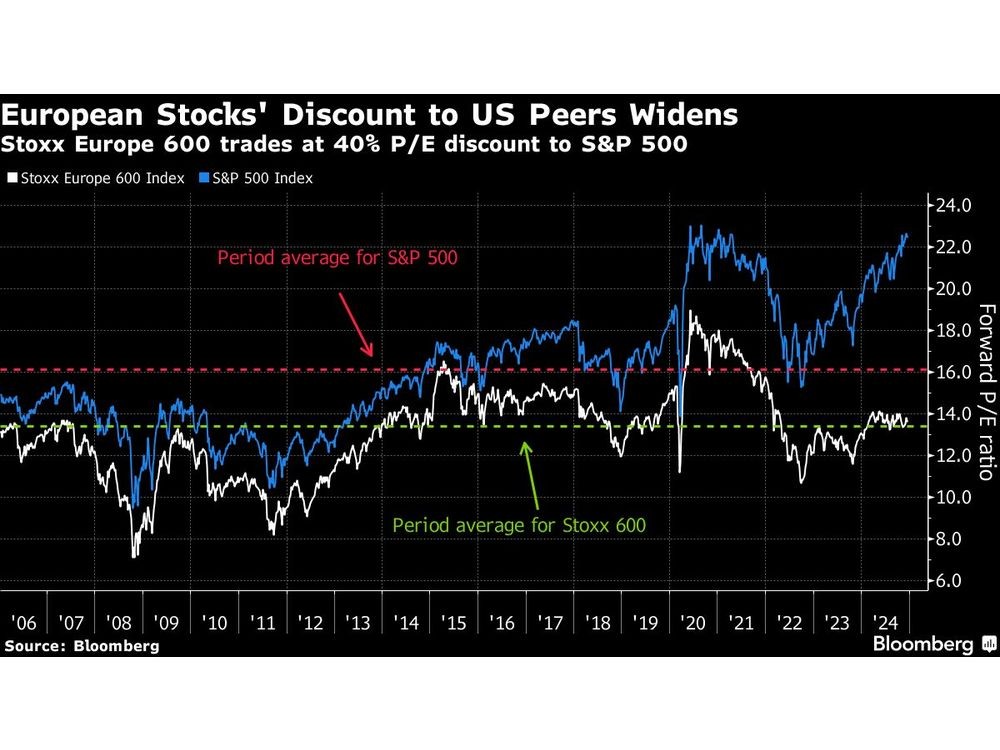

European Stocks Lag Behind U.S. Peers, Widening Discount

The gap between valuations of European and U.S. stocks has continued to grow, with European equities trading at a significant discount. This trend highlights the ongoing concerns surrounding the Eurozone’s economic outlook,despite recent optimism.  As of December 2024, the stoxx Europe 600 Index trades at a 20% discount to the S&P 500 Index. This disparity reflects investor concerns about Europe’s economic prospects, including slower growth, persistent inflation, and the ongoing energy crisis.

“The reasons for this widening discount are multifaceted,” explains one analyst. “Concerns about Europe’s economic outlook, coupled with the relative strength of the U.S. economy, have weighed on investor sentiment.”

While European stocks have shown some resilience in recent months, the widening discount suggests that investors remain cautious about the region’s ability to overcome its economic challenges. Market observers believe a sustainable recovery in European equities will require a combination of factors, including stronger economic growth, receding inflationary pressures, and a resolution to the ongoing energy crisis.

Whether this discount presents a buying opportunity for investors remains a subject of debate. some argue that the current valuations represent an attractive entry point for long-term investors, while others remain skeptical about Europe’s ability to bridge the gap with its U.S. peers in the near future.

As of December 2024, the stoxx Europe 600 Index trades at a 20% discount to the S&P 500 Index. This disparity reflects investor concerns about Europe’s economic prospects, including slower growth, persistent inflation, and the ongoing energy crisis.

“The reasons for this widening discount are multifaceted,” explains one analyst. “Concerns about Europe’s economic outlook, coupled with the relative strength of the U.S. economy, have weighed on investor sentiment.”

While European stocks have shown some resilience in recent months, the widening discount suggests that investors remain cautious about the region’s ability to overcome its economic challenges. Market observers believe a sustainable recovery in European equities will require a combination of factors, including stronger economic growth, receding inflationary pressures, and a resolution to the ongoing energy crisis.

Whether this discount presents a buying opportunity for investors remains a subject of debate. some argue that the current valuations represent an attractive entry point for long-term investors, while others remain skeptical about Europe’s ability to bridge the gap with its U.S. peers in the near future.

European Stocks Dip Amid Political Uncertainty

European stock markets experienced a decline on Tuesday,marking a fourth consecutive day of losses. The Stoxx europe 600 index closed 0.4% lower, weighed down by political uncertainty in both France and Germany. Investors are also cautiously anticipating the release of euro-zone inflation data and a crucial US interest rate decision scheduled for the following day. Among the hardest-hit sectors were banks, energy stocks, and telecom companies.

Financial Post requires a subscription for access to its content.

Among the hardest-hit sectors were banks, energy stocks, and telecom companies.

Financial Post requires a subscription for access to its content.

Unlock Exclusive Articles

To read this article and others like it,subscribe to Financial Post and enjoy a range of benefits,including:- Exclusive articles from renowned journalists like Barbara Shecter,Joe O’Connor,and Gabriel Friedman.

- Daily content from the esteemed Financial Times.

- Unlimited online access to articles from Financial Post, National Post, and 15 other news sites across Canada.

- access to the national Post ePaper, a digital replica of the print edition.

- daily puzzles, including the New York Times Crossword.

European Equities: Trading Opportunities Emerge Amidst Challenges

Despite facing macroeconomic and geopolitical headwinds, experts predict potential trading opportunities in European equities in the coming months. While the Stoxx 600 index has underperformed the US market in 2024, with a gain of 7.2% compared to the S&P 500 Index’s 27%, analysts see promise in undervalued companies positioned for global growth.Grim Outlook, But Potential for Upward Movement

Frederique Carrier, Head of Investment Strategy for RBC Wealth Management in the British Isles and asia, acknowledges the challenges. “While Europe’s macroeconomic and geopolitical challenges warrant an underweight equity position on a six to 12-month view, there could be opportunities ahead,” she says. “Because of the current extreme negative sentiment and very low valuations, we think a trading opportunity could arise in European equities over the coming months.” Carrier suggests focusing on “world-leading companies that happen to be listed in Europe and that benefit from and drive structural global trends” given the “current depressed valuations.”Recent Market Rally Shows Signs of Hope

Recent movements in the European market offer encouragement. The benchmark index saw a 1% rise in December, fueled by optimism surrounding potential chinese stimulus measures. Sectors heavily reliant on the Chinese economy, such as luxury goods and automobiles, have experienced a boost.Political Instability in Germany and France Adds Uncertainty

Though, political turmoil in europe’s two largest economies casts a shadow of uncertainty. In Germany, Chancellor Olaf Scholz lost a confidence motion, triggering a February 23rd election. Meanwhile, newly appointed French prime minister Francois Bayrou faces the urgent task of assembling a government and crafting a 2025 budget. Navigating these complexities will be crucial for investors seeking to capitalize on the potential rebound in European equities.- Being Short Luxury is Getting Less Obvious Now: Taking Stock

- M&A Watch Europe: Britvic Avoids Phase 2 Review, UMG, Vallourec

- Canal+’s Spin-Off From Vivendi Boosts London Market: ECM Watch

- US Stock Futures Little Changed; EVgo, Red Cat Fall

- First Home Frenzy: The London Rush

Introducing the Simple Publish & Rewrite API Plugin for WordPress

Tired of spending hours writing blog posts? The Simple Publish & Rewrite API plugin, available on WordPress.org, offers a revolutionary solution for hassle-free content creation. Leveraging the power of OpenAI’s GPT model, this plugin can rewrite existing content or even generate entirely new articles with minimal effort on your part. The process is simple. Just input your topic or existing content, and the plugin will do the rest. It can automatically generate engaging and informative articles, saving you valuable time and allowing you to focus on other aspects of your website.Streamlined Workflow for Bloggers and Developers

The Simple Publish & Rewrite API plugin caters to both bloggers and developers.Bloggers can enjoy the convenience of automated content generation, while developers can leverage the API to seamlessly integrate the rewriting and publishing functionality into their own projects. For added convenience, any associated images (thumbnails) are automatically saved to the WordPress media library, ensuring all your content is organized and accessible.Simplified Content Creation for the Modern Web

In today’s fast-paced digital world, time is a precious commodity. The Simple Publish & Rewrite API plugin empowers website owners to create high-quality content efficiently, giving them a competitive edge in a crowded online landscape. [1](https://wordpress.org/plugins/simple-publish-rewrite-api/)This text provides an captivating snapshot of the European stock market from late 2024, highlighting key themes and concerns:

**Key Takeaways:**

* **Discount Widening:** European stocks (stoxx Europe 600) are trading at a significant 20% discount compared to the US (S&P 500), reflecting investor concerns about Europe’s economic outlook.

* **Reasons for the Discount:**

* Slower economic growth in Europe.

* Persistent inflation.

* Ongoing energy crisis.

* Political uncertainty in Germany and France.

* **Potential Opportunities:** While the outlook is cautious, analysts believe undervalued companies with global growth potential could offer attractive buying opportunities for investors willing to take on risk.

* **Focus on Valuations & Global Trends:** Experts suggest looking for well-established companies listed in Europe that are leaders in global trends, as their current valuations might be appealing for long-term investment.

**Additional Points:**

* **Market Volatility:** The text mentions a four-day losing streak for European markets, indicating volatility and susceptibility to global factors like anticipated US interest rate decisions and euro-zone inflation data.

* **Investor Sentiment:** Negative sentiment towards Europe appears widespread, creating the potential for “extreme” undervaluation and making some analysts optimistic about a possible rebound.

* **China’s Influence:** Potential Chinese stimulus measures are seen as a positive catalyst for sectors like luxury goods and automobiles, which have strong ties to the Chinese market.

**Investment Considerations:**

If you’re considering investing in European stocks, here are some factors to consider based on this information:

* **Risk Tolerance:** are you comfortable with the economic and political risks currently facing Europe?

* **Investment Horizon:** are you looking for short-term gains or long-term growth potential?

* **Diversification:** Do you have a diversified portfolio that can balance the risks associated with European investments?

* **Due Diligence:** Research specific companies and sectors thoroughly before making any investment decisions.

This appears to be a partial HTML article snippet from a WordPress website,likely the Financial Post. Here’s a breakdown of what we can glean from it:

**Content Summary**

* **European Equities Analysis:** The main focus is on the performance and prospects of European stocks, noting their underperformance compared to US markets but highlighting potential trading opportunities due to undervaluation.

* **Market challenges and Opportunities:** The article discusses challenges such as macroeconomic headwinds, geopolitical uncertainty (political instability in Germany and France), and potentially positive catalysts like Chinese stimulus measures and growth in sectors like luxury goods and automobiles.

* **Expert Opinions:** Quotes from financial experts like Frederique Carrier of RBC Wealth Management provide insights into the European market outlook.

* **WordPress Plugin Promotion:** The article unexpectedly ends with a promotional section for the “Simple Publish & Rewrite API plugin” for WordPress, highlighting its ability to generate and rewrite content using OpenAI’s GPT model.

**Technical Details**

* **HTML Structure:** The snippet uses standard HTML tags for headings, paragraphs, lists, and images.

* **WordPress Shortcodes:** The presence of `[wp:image]`, `[wp:paragraph]`, `[wp:heading]`, `[wp:list]`, and `[wp:ul]` suggests the content was likely created using the Gutenberg block editor in WordPress.

* **Image:** The `img` tag reveals a link to an image hosted on a Postmedia server, indicating that the original article may have been published on a website like the Financial Post, which uses Postmedia’s publishing platform.

* **Subscription Barrier:** The mention of needing a subscription to access the full article suggests this snippet is likely a teaser designed to encourage readers to subscribe.

**Potential Completion:**

To understand the full context, you would need the complete article, which likely includes:

* **More in-depth analysis:** Expanded discussion of factors influencing European equity markets, including economic indicators, industry trends, and specific company performance.

* **Investment Strategies:**

Recommendations on how investors can navigate the current market conditions,

such as which sectors or companies present attractive opportunities.

* **Further Expert commentary:** More insights from analysts,

portfolio managers,or economists.

* **Conclusion:** A summary of the key takeaways and a final viewpoint on the outlook for European equities.