Russia retaliates once morest Dutch gas supply cessation

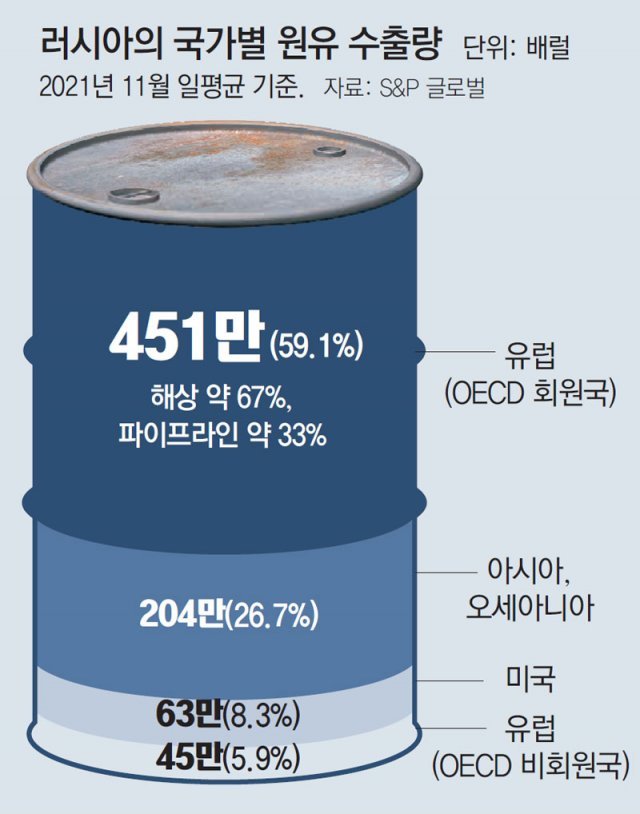

The European Union (EU) agreed to an immediate ban on imports of Russian crude oil by sea as part of sanctions once morest Russia that invaded Ukraine on the 30th of last month (local time). The amount is equivalent to regarding 67% of Russian crude oil imported by the EU. The EU has also announced that it will reduce its crude oil imports from Russia by 90% by the end of this year by phasing out land imports through pipelines, which account for 33%. As a result, on the 31st, the international oil price surpassed $120 per barrel for the first time in two months.

The Korean government, set out to catch inflation, is paying attention to the possibility that domestic gasoline and diesel prices will rise due to the rise in international oil prices, which will further fuel inflation.

After the EU summit held in Brussels, European Commission President Ursula von der Leyen, head of administration, announced that “the import of crude oil from sea through tankers is prohibited.” Hungary, which has a high dependence on Russian oil, opposes the complete embargo, so land imports are allowed for now.

As Russia stopped supplying natural gas to the Netherlands on the 31st, it is spreading into an energy war between Europe and Russia.

The price of Brent crude, traded on the London ICE Futures Exchange, once approached $124 on the 31st. On this day, gasoline and diesel prices in Korea continued to rise at 2012.33 won and 2008 per liter, respectively.

EU, Russia’s oil embargo, energy war… International oil price exceeds $120

Sea imports, which account for 67% of the total, will be blocked immediately… It might cost Russia $10 billion a year

Overland imports remain in opposition to opposition from Hungary, “maximum destructive power” and “limitations exposed” are mixed

Rising oil prices intensify global inflationary pressures

“Russia, which invaded Ukraine, is now able to put restrictions on the huge money it buys for weapons. This is an important step forward.”

This is the one thing that Charles Michel, the standing chairman of the European Union (EU) summit, posted on Twitter on the 30th of last month following the EU decided to immediately ban sea imports, which account for regarding 67% of Russian crude oil imports.

According to Bloomberg News, the EU embargo might cost Russia regarding $10 billion a year. However, the EU, which faced opposition from member countries that relied heavily on Russian crude oil, such as Hungary, allowed land imports through oil pipelines, which account for 33% of the total. This is a foreshadowing of conflicts between EU member states over whether to implement a complete embargo in the future.

Russia countered by halting natural gas supply to the Netherlands on the 31st. International oil prices rose above $120 per barrel during the day due to the European-Russian energy war. Global inflation is expected to intensify as natural gas prices in Asia soar due to a surge in demand for alternative energy in Europe. In the euro zone, which uses the euro, announced on the same day, the consumer price inflation rate in May was 8.1% compared to the same month last year, the highest ever.

○ Complete embargo is withheld due to differences in EU member states

EU Commission President Ursula von der Leyen said at a press conference on the same day, “If Germany and Poland reduce oil pipeline imports by the end of this year, the amount of land imports not included in sanctions will be regarding 10 to 11 percent of those imported by Hungary and Slovakia.” said. By the end of the year, imports will be reduced by regarding 90%.

According to Eurostat, the EU statistical agency, Russia accounted for 24.7% of EU crude oil imports last year. The EU is the largest buyer of Russian crude oil. CNN evaluated, “Even if this measure is not a 100% import ban, it is the most destructive of the Russian sanctions imposed by the EU.”

However, it was decided to maintain the overland revenue using the Druzeba pipeline, which also revealed its limitations. This is because Hungary, which is highly dependent on Russian oil, opposed it. The Druzhva oil pipeline is the world’s longest oil pipeline with a length of 4000 km that runs from Russia to Germany via Poland and the like.

Hungary, the Czech Republic, and Slovakia, whose dependence on Russian crude oil accounts for 65, 87, and 96 percent, respectively, will suffer a great economic blow if they immediately stop importing Russian crude oil. Hungarian Prime Minister Orban Viktor said: “The embargo is a nuclear bomb for us. It takes more than five years to prepare,” he said, opposing the embargo.

On the other hand, Western Europe, such as Germany, which lowered its dependence on Russian oil from 35% before the Ukraine war to 12%, and Italy, which has adopted a strategy of replacing oil imports from the Middle East, is relatively less affected. The BBC pointed out that the EU’s plan to cut crude oil imports by 90% by the end of the year might be disrupted. Ukrainian President Volodymyr Zelensky also criticized Russian President Vladimir Putin as a sign of weakening sanctions.

○ Korean gasoline and diesel prices are on the rise

Nevertheless, the embargo has raised the possibility of a surge in global energy prices. “Across Europe, already high gasoline prices will increase further,” said Michelle.

Russia, which previously stopped supplying natural gas to Poland, Bulgaria and Finland, is expanding its cessation of natural gas supply in response to EU sanctions.

At the ICE Futures Exchange in London on the 31st, Brent oil once approached $124 a barrel. It is the first time in two months since the end of March that it crossed the $120 mark. The domestic gasoline price, which showed a steep rise by breaking through the 2,000 won per liter range, recorded 2012.33 won on the same day, surpassing the diesel price (2008 won). Last month, diesel prices rose above gasoline prices due to disruptions in the supply and demand of diesel, but then reversed once more due to a sharp rise in gasoline prices. As Europe seeks alternative energy ahead of the crude oil embargo, the spot price of natural gas in Asia (as of the 27th of last month) also soared to $22 per million BTU (caloric unit), up 114% from the previous year.

Paris = Correspondent Yunjong Kim zozo@donga.com

Reporter Im Bo-mi bom@donga.com