2023-05-10 13:59:17

According to the latest events, the Ethereum network has noticed a sharp increase in staking rewards as they have achieved an annual return of almost 8.6%. This new record has paved the way for a sharp increase in on-chain gas fees, driven by the current memecoin trend in the market.

It has been reported that Ethereum validators have experienced a considerable increase in their total earningssince they have managed to win a whopping 46 million dollars in the first week of May. The current figure represents a 40% increase from the $33 million generated in the last week of April. Furthermore, these gains almost translate to approximately 25,000 ETH pocketed by investors in just one week.

It is believed that Widespread excitement around new meme coin PEPE is the main reason for increased rewards for Ethereum validators. In the past week, the average transaction fees on the Ethereum network have crossed the 100 gwei mark, which is something that not seen since may 2022.

As gas rates continue to rise, end users are required to pay more than $30 per exchangewhich inevitably results in increased fee income for validators for processing both transactions and regular rewards.

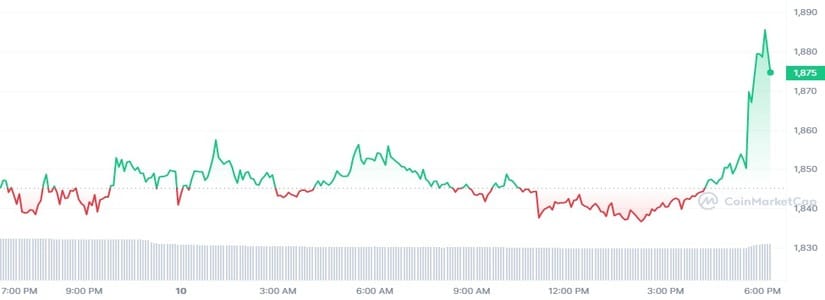

As the market continues to trade in the red, Ethereum (ETH) has kept its composure. At the moment, the token is up 1.43% in the last 24 hours, pushing the trading price to $1,873. Likewise, the total market capitalization of ETH is 225,000 million dollars.

ETHEREUM KEEPS ADVANCING

The current staking rate is responsible for providing an estimate of the annualized return that validators can anticipate. To participate in the Ethereum consensus process, validators must hold a minimum of 32 ETH, which is currently $59,000.

Other than that, the rewards for Ethereum validators can be categorized into two types, consensus rewards and transaction fee rewards. Consensus rewards are for proposing and witnessing a series of blocks, while transaction fee rewards are for processing transactions on the network.

Over time, Ethereum staking has acquired a considerable percentage of relevance for institutional investors following the transition of the network to a proof-of-stake consensus mechanism. At the same time, the Shapella’s recent update has also increased its relevance by allowing validator removals for the first time. So far, a total of 560,000 validators have staked 19 million ETH, worth $34 billion.

1683767436

#Ethereum #ETH #Validators #Earned #46M #Increasing #STAKING #Rate #Rewards