Ethereum Hints at Potential Reversal as Sell Pressure Eases,$1,800 level Holds

April 5,2025

After a grueling 14-month downturn,Ethereum (ETH) might potentially be signaling a light at the end of the tunnel. From a high of $4,000 in February 2024, ETH plummeted to nearly $1,800 by April 2025. However, recent market indicators suggest that the intense selling pressure that fueled this decline is beginning to wane.

Signs of a Potential Market Bottom

Recent analysis from CryptoQuant points to a bullish divergence forming beneath the surface of Ethereum’s price action. Despite hitting multi-month lows, key metrics indicate that sellers are losing steam. This is crucial information for U.S. investors who have been closely watching Ethereum’s performance, especially given its prominence in decentralized finance (DeFi) and the broader crypto market.

One of the most telling indicators is Ethereum’s Net Taker Volume (NTV). NTV reflects the difference between buying and selling pressure. Previously,it hit a low of negative $360 million,reflecting sustained sell pressure. Though, this pressure appears to be declining.

Instead, NTV has begun forming higher lows despite the relative decline in Ethereum’s price, hinting at a shift. This divergence may indicate that sellers are losing control, possibly leading to a trend reversal.

Recent CryptoQuant analysis highlights a meaningful bullish divergence emerging beneath the surface. Although Ethereum’s price has dropped to multi-month lows, several metrics indicate that sellers are losing momentum.

CryptoQuant analysis, April 2025

Analyzing Volume Breakdowns

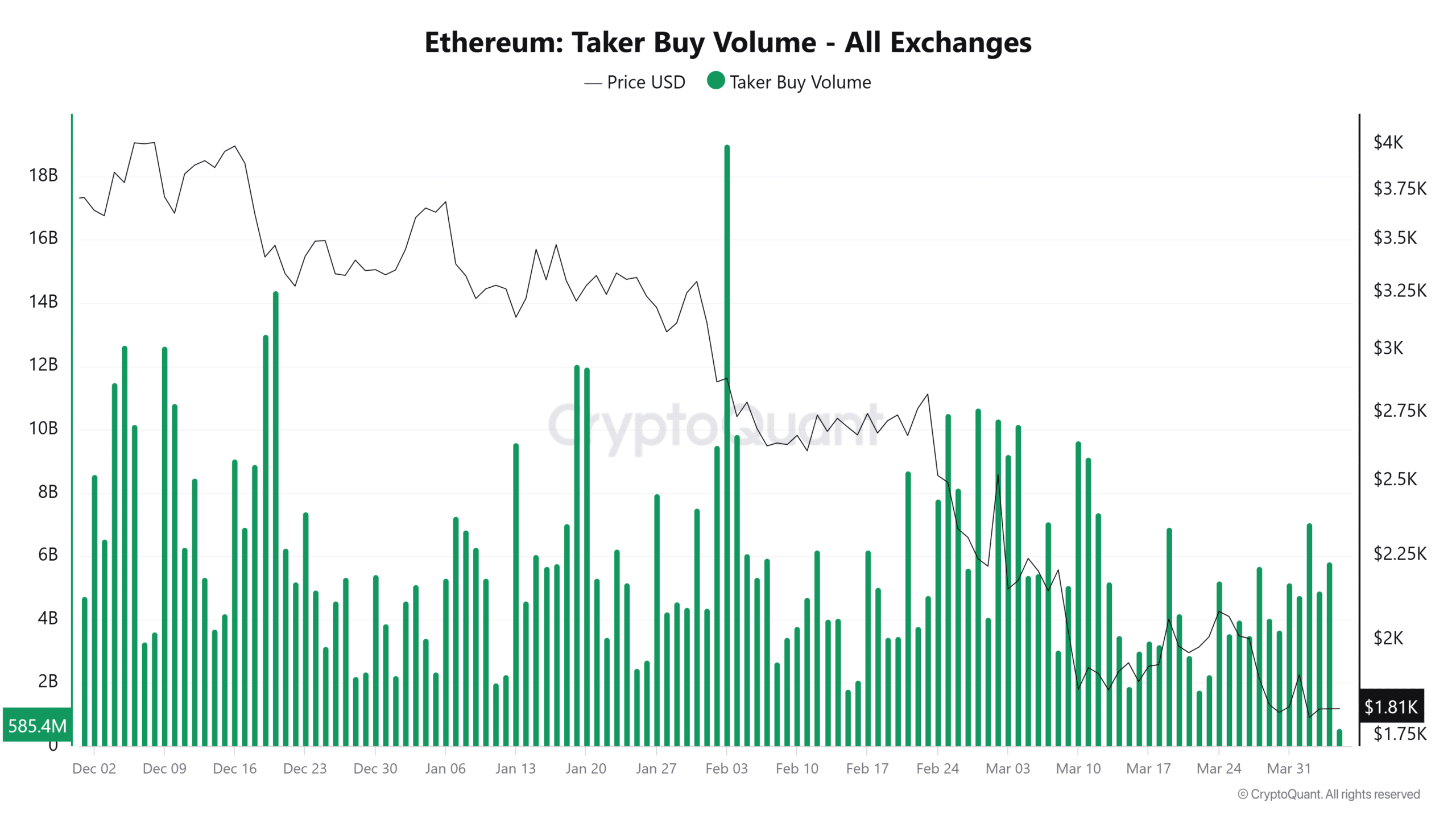

An examination of Ethereum’s Taker Buy and Sell Volumes between December 2024 and April 2025 adds further depth to this narrative.

For instance, on Feb. 3, 2025, the Taker Buy Volume on exchanges spiked to $19 billion while ETH traded around $2,882.93. Although this influx of buying didn’t trigger an immediate rally, it shows buyers were trying to stem the bleeding.By April 1, 2025, this volume dropped to $4.75 billion, with ETH priced lower at $1,905.17.

Concurrently,the Taker Sell Volume has been decreasing. At the end of December, sell volumes measured $601.6 million, surging to $17.6 billion in early February. By April 1, however, these volumes had decreased to around $4 billion, signaling a decrease in panic-driven selling.

Moreover, Ethereum’s exchange netflows provide additional insights into shifting market dynamics.

From December to March, while ETH tumbled 45%—from $3,278 to $1,810—withdrawals from exchanges increased.

For instance, the 21st of February saw a net outflow of 257,700 ETH, with the price sitting at $2,661.

Having saeid that, there was one notable exception.

On the 10th of March, 120,900 ETH flowed into exchanges as the price dropped to $1,866.

broader Trend Leans Toward Strategic Accumulation

Technically, Ethereum remains in a downtrend, with its price struggling below the Simple Moving Average (SMA) since January 2025. failed rallies to $2,700 in February and $2,000 in March indicate persistent overhead resistance.

However, Ethereum has consistently defended the $1,800 support level, rebounding during tests in March and April. This resilience, coupled with decreasing volume during price dips, could suggest that sellers are losing influence.

Factors like the flattening On Balance Volume (OBV), exchange outflows, and declining Taker Sell Volume indicate that $1,800 may be an accumulation zone.

If Ethereum reclaims the $2,000-$2,200 range, it could confirm a trend reversal.For now, $1,800 remains the central battleground.

Expert Opinions and Market Sentiment

Industry analysts are divided on Ethereum’s near-term prospects. Some believe that the current market conditions present a buying chance for long-term investors, while others remain cautious, citing regulatory uncertainty and macroeconomic factors.

Such as, Linda Jones, a cryptocurrency analyst based in Chicago, notes, “Ethereum’s ability to hold the $1,800 level is encouraging, but we need to see sustained buying volume and a break above the $2,200 resistance to confirm a bullish reversal.”

Potential implications for U.S. Investors

The potential trend reversal in Ethereum’s price could have significant implications for U.S. investors. Ethereum is the backbone of many DeFi applications, including lending platforms, decentralized exchanges, and stablecoins. A recovery in Ethereum’s price could boost confidence in the DeFi sector and attract further investment.

Though, U.S. regulators continue to scrutinize the cryptocurrency market, and regulatory actions could impact Ethereum’s price. Investors should stay informed about regulatory developments and potential risks before making investment decisions.

what are Dr. Reed’s thoughts on Ethereum’s role in the future?

Ethereum’s Potential Reversal: An Interview with Crypto Market Analyst, Dr. Evelyn Reed

Archyde News – April 6, 2025

archde News Editor: Welcome, Dr. Reed, and thank you for joining us today. Ethereum’s recent performance has been a hot topic. Can you give us a broad overview of what’s been happening in the Ethereum market and what the key indicators are hinting at?

Dr. Evelyn Reed: Thanks for having me. Certainly. Ethereum has experienced a notable downturn over the past 14 months, dropping from roughly $4,000 in February 2024 to around $1,800 by April 2025. Though, recent analysis, especially from CryptoQuant, suggests that the massive selling pressure is beginning to ease. We’re seeing signs of a potential market bottom forming.

Archde News Editor: That’s a crucial shift. Can you elaborate on those key indicators, particularly regarding the Net Taker Volume (NTV) and the volume breakdowns you’ve analyzed?

Dr. Evelyn Reed: Absolutely. One of the most compelling signals is the behavior of NTV. Previously, NTV hit lows reflecting strong selling pressure. Now, despite Ethereum’s price fluctuations, we’re observing NTV forming higher lows. This divergence is a key signal that sellers might be losing their grip. Also, the analysis of Taker Buy and Sell Volumes reveals captivating dynamics. We saw surges in buy volume in early February 2025, which demonstrates that buyers where present during this decline.

Archde News Editor: The data points to strategic accumulation, doesn’t it? What are the technical levels investors should watch closely?

Dr. Evelyn Reed: Precisely. Technically, the $1,800 level appears to be a critical support zone. Ethereum has consistently rebounded from this level, suggesting it’s an area where buyers are stepping in. The flattening on Balance Volume (OBV) and decreased taker sell volume support this. The reclaiming of the $2,000-$2,200 range would be a strong confirmation of a trend reversal.

Archde News Editor: We see that the market’s future outlook is divided. What is your general view and the implications this may have for U.S. investors?

Dr. Evelyn Reed: I believe that the ongoing downtrend for Ethereum is not the full picture. One notable exception has been the 10th of March where 120,900 ETH flowed into the exchanges as the price dropped to $1,866. This points to the need for the observation of future actions in crypto markets.

For U.S. investors, a potential Ethereum recovery could substantially boost the entire DeFi sector. however, investors must remain informed about regulatory developments. regulatory changes can greatly impact the crypto market. Staying aware of potential risks is paramount.

Archde News Editor: Thank you for your time and insights, dr. Reed. It’s a complex picture,but your analysis provides valuable context.What are your thoughts on Ethereum’s role in the future?

Would you agree with those analysis, and why or why not? Comment below.