2023-06-15 13:16:19

15 jun 2023 om 14:40Update: 22 minuten geleden

The interest rate of the European Central Bank is going up for the eighth time in a row, reaching 3.5 percent. In this way, the ECB hopes to bring inflation under control. On the same day, the US central bank umbrella announced a pause in interest rate hikes, fearing a recession.

Foods, among other things, are still clearly rising in price in European countries. That is why the ECB feels compelled to intervene once more.

Although inflation in the eurozone is declining, policymakers at the ECB are not moving fast enough. The average inflation of the euro countries was 6.1 percent in May. At the beginning of this year, it was still above 8.5 percent. The ECB wants to use the interest rate rises to bring inflation back to 2 percent in the first half of 2025.

The idea behind it is that European banks also raise their interest rates so that borrowing money becomes more expensive. This slows down the number of investments. A new mortgage will also become more expensive due to the higher interest rate.

At the same time, it pays to save when interest rates are higher. This is not yet happening at the major banks in the Netherlands, such as ING, Rabobank and ABN AMRO. They have now raised their interest rates to 1 percent. Smaller banks are trying to lure savers with higher interest rates.

If more is saved and less is invested, inflation will decrease. Due to declining demand, the eurozone is now in a mild recession.

United States ahead of EU

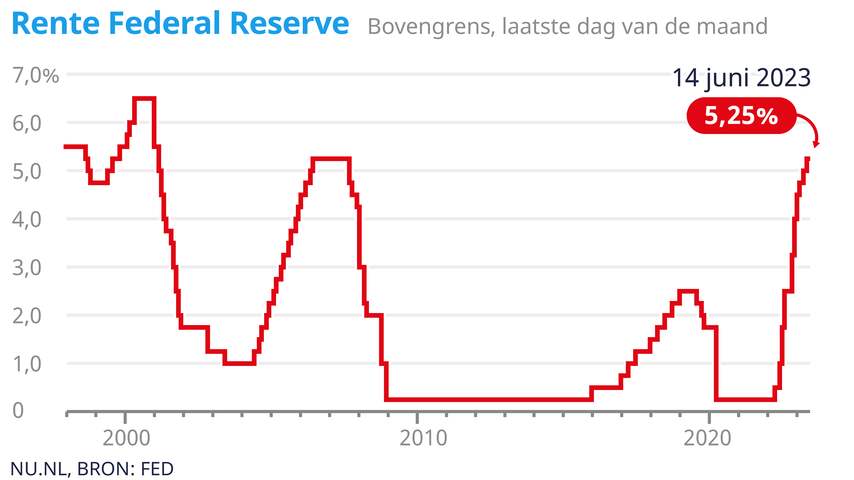

It is precisely for this reason that the central banking umbrella of the United States, the Federal Reserve (Fed), is taking a break from interest rate hikes. After ten consecutive interest rate increases, the interest rate there remains the same, at 5.25 percent. That is the highest level in sixteen years.

When asked whether the eurozone is ready for a break, ECB President Christine Lagarde responded in the negative. “We’re not there yet,” she said, referring to the ECB’s target of 2 percent inflation.

The US is ahead of the EU when it comes to interest rate policy, says Bill Diviney, economist at ABN AMRO. “The Fed has already made more interest rate hikes in recent times, so there is now a sense that they can take a break,” says Diviney.

The effects of the interest rate rises take some time. “The Fed wants to wait and see what the effect of all interest rate hikes will be.” Interest rates are likely to rise once more in July. According to the economist, this is a delay in the process, not so much the end.

On Tuesday it was announced that inflation in the world’s largest economy had cooled to 4 percent in May. Core inflation, which excludes volatile energy and food prices, remains higher and stood at 5.3 percent.

The ECB’s raison d’être is to keep inflation in check, explains Diviney. According to the economist, the fact that the eurozone is in a slight recession due to the policy is of minor importance. In addition, unemployment is low. Diviney expects the recession to last for a few more quarters.

1686836318

#ECB #raises #rates #highest #level #Fed #pauses #Economy