At 24, Dylan was the victim of a major identity theft. It was following the theft, this summer, of his identity papers that everything began. The young man now finds himself over-indebted and stuck at the National Bank because of numerous loans opened in his name on the basis of his simple identity card. It is totally distraught that he pushed the orange button Alert us with the hope of getting out of this case.

Last summer, Dylan was the victim of an identity theft with serious consequences. The 24-year-old was out at a party with friends when he lost his bag, which contained all his identity documents. “Within a few seconds, I lost my attention and found myself without a bag, without having seen anyone take it from me. At the very moment, I thought it was a friend who wanted prank me”he recalls.

Naïve, he did not immediately take steps to report the loss of his identity and bank cards. “I didn’t really realize it was a theft. I continued my evening because the most important thing is that I always had my mobile phone on me. I thought that at my age , I would have no problem”he admits, without imagining for a second the horror he was regarding to experience.

He receives a Visa card, then a MasterCard!

A few days later, however, things took an unexpected turn for the young man. “I received a VISA Gold card by post, even though I had not applied for it. Then I received a Platinum MasterCard. But it didn’t stop there, I also received invoices from several mobile operators telling me that I had opened a telephone credit to acquire an iPhone 12 Pro Max of 500 GB. Obviously I had not asked for any of this”testifies our interlocutor.

He then quickly blocked his identity card but not his bank card. “I thought that if I didn’t have any money in my account, we mightn’t debit anything.” And yet… Dylan was not yet at the end of his surprises.

The crooks buy a car for 40,000 euros, in the name of Dylan

“I received a letter from Cardoen informing me that I owned a car following a loan of 40,000 euros opened in my name at a Jaguar and Land Rover dealership. not the driver’s license or the theory”insists the Montois, totally helpless. “I am told that the monthly payments are 468.06 euros and that I will be debited from my bank account from September 12, 2021 and until August 12, 2026”he continues.

I was part-time and on a three-month fixed-term contract, so a loan of 40,000 euros should never have been accepted on my behalf.

By inquiring regarding this car financing, Dylan learns that the loan was granted by the organization AlphaCredit, a subsidiary of BNP Paribas Personal Finance. “At that time, I was part-time and on a three-month fixed-term contract, so a loan of 40,000 euros should never have been accepted on my behalf”, underlines our witness. He also discovers that the various telephone credits have also been spent with this same company. “As I inquired regarding them, I saw that they are apparently well known for this sort of thing…”

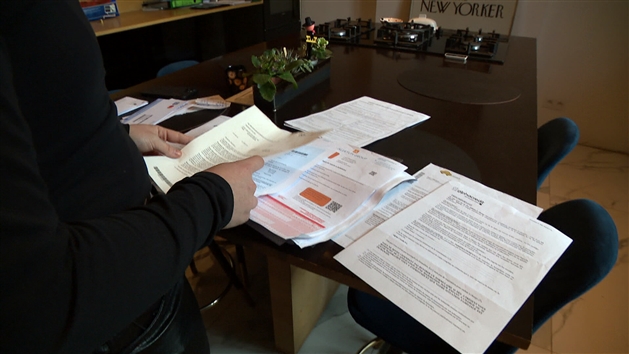

Despite the complaint to the police, formal notices and threats from bailiffs began to arrive at his parents’ home. “I obviously contacted AlphaCrédit but their only response was to say that until proven otherwise, these credits were in my name”, regrets Dylan. This whole situation has created a lot of anguish for the young man who no longer knows what to do. “I feel really bad, every day, I stress and I think regarding it. I’m afraid when I get up in the morning to discover a new bill. a for more than 42,000 euros without counting the telephone credits”, he confides. He is now stuck at the National Bank and desperately awaits an evolution in this file. “It’s been 7 months and it hasn’t changed yet. I’m afraid that there will be seizures by bailiffs at my parents’ home and that it will affect them directly… I’m still receiving formal notices”:

If there is one piece of advice that Dylan absolutely wants to give today, it is to quickly block all your cards when you are the victim of paper theft. “You have to report the theft directly, block everything to prevent things like that from happening”, alerts our interlocutor. This is precisely what the Belgian Financial Sector Federation will advise you to do. “When you lose or have your identity card stolen, our first recommendation is to file a complaint directly with the police to record the date of the theft or loss. You must also have your identity card blocked by the police”, says Rodolphe de Pierpont, the spokesperson for Febelfin. In this way, it will be easier to challenge any contract made in your name following the date of the declaration of theft.

Detection mechanisms exist

For this representative of the financial sector, there are rules to regulate the opening of bank accounts. “A bank, before opening a bank account, will necessarily check your identityhe says. She will check the photo, need your ID to check her. It’s a first barrier if we see that the card has been blocked.” Unfortunately, some frauds still manage to slip through the cracks. “We see, for example, situations where a person looks like the person on the stolen identity card”concedes Rodolphe de Pierpont.

To apply for a bank loan, the principle is the same as for opening an account: your documents will also be checked. “The organization or the bank will first request payslips, which are the documents that certify income before being able to examine the repayment capacity of borrowers”, continues the Febelfin spokesperson. In the case of Dylan, false payslips were therefore probably used to open the credit of 40,000 euros with AlphaCredit. “Again, there are detection mechanisms: payslips are analyzed but it happens to slip through the cracks.”

Despite these detection systems, we can see that, in some cases, it is not sufficiently controlled. Samuel Rosenblatt is a lawyer specializing in criminal law and is regularly confronted with this type of fraud. “This is a problem that we often encounter. It happens very often that people are victims of fraud and what is crazy is the ease with which you can obtain credit on the Internet in just a few clicks”, he observes. However, the Febelfin spokesperson confirms it to us, whether it is a question of steps in agency or online, the precautionary rules remain exactly the same. But this lawyer often faces contracts full of errors, especially at AlphaCredit. “Sometimes, there are totally aberrant things on the contracts: for example, the signature on the credit contract does not resemble that on the identity card. Or it is regarding a lady but it will be noted Sir on the contract. It also happened that it was noted that a person was single and retired while working and married…”explains Samuel Rosenblatt.

You must file a complaint with a civil action in the hands of an investigating judge once morest X.

For him, these frauds are generally organized by professionals, which this lawyer qualifies as association of criminals. The perpetrators will rarely be apprehended because they do not appear in the proceedings and often resort to what are called financial mules to obtain the large sums of money. Once the money has been obtained, the perpetrators generally disappear into thin air and the victims must then engage in a veritable obstacle course to have their identity theft victim status recognized. “A simple complaint to the police will not be enough.says Samuel Rosenblatt. You have to file a complaint with a civil action in the hands of an examining magistrate once morest X. This is called setting the public action in motion. On the basis of this, almost systematically, the credit companies agree to suspend their collection process once morest the victim of the fraud.

“Very often, credit companies are very difficult to reach. On the other hand, they very quickly begin recovery procedures via bailiffs once morest the person, who is in reality only a simple victim of usurpation of identity”, adds our interlocutor. This is what Dylan faced. But AlphaCredit informs us that their “fraud department is awaiting the conclusions of the police investigation before providing a response to the customer” before adding that “the subject is marginal and the cases of fraud are all the subject of an analysis and in the event of doubt on the origin of the fraud, the doubt is always in favor of the customer.”

This subsidiary of BNP Paribas Fortis ensures that it actively fights once morest fraud using advanced tools and technologies. “Nevertheless, despite our identification processes, we cannot 100% identify fraudulent credit applications and we cannot talk regarding our techniques and mechanisms to fight once morest fraud, under penalty of seeing fraudsters – on permanent watch – learn from this information to develop new criminal techniques”tells us this financial institution.

Checks before opening a loan

To obtain a loan credit from AlphaCredit, the applicant is obliged to provide a number of documents in order to prove his identity and his income. “His identity is verified. We also verify borrowing capabilities on the basis of the identification of the person and on the basis of the documents of proof of income”insists the banking organization, which specifies that this applies both to online requests and to an intermediary.

According to our interlocutor, AlphaCredit also has filters and detection devices to block fraudulent requests and money laundering. “Fraudsters being very inventive, our detection system is constantly updated. The company invests heavily and regularly in the development of its tools and technologies for combating and detecting.”

The advice of this banking subsidiary is to react quickly when you consider yourself a victim of fraud. It is also necessary “to collaborate with the internal investigation and with the police in order to be cleared and, therefore, released from all credit-related obligations”, points the company. Note that the victim of fraud is always entitled to contest a registration with the National Bank.

In order for Dylan’s situation to be regularized and for the formal notices to cease, it will therefore be necessary to wait until the conclusions of the investigation. “If it is proven that the client is innocent and a victim, he will be released from any obligation and no file will be recorded”, concludes AlphaCredit. With regard to the reimbursement of the credit, it will be up to the author of the fraud – if identified – to reimburse the money. If it is not identified, the financial institution will take it at a loss.