700 billion loan extension was urgently turned off

Conflicts in shopping malls and price disputes continue

▲Dunchon Jugong Complex, Gangdong-gu, Seoul. (Cho Hyun-wook reporter gusdnr8863@)

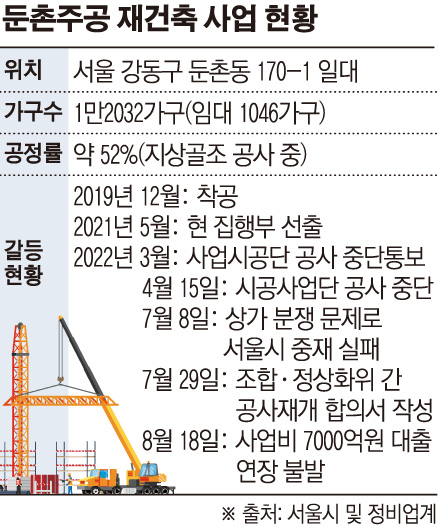

The reconstruction project of Dunchon Jugong, Gangdong-gu, Seoul met with bad news once more. As the existing lenders (a federation of financial institutions that lent money) refused to extend the business expense loan scheduled for the 23rd, the union must put out the ‘light in the foot’. First, the union plans to raise funds through multiple securities companies, and in the long term, establish a new lending group through the construction project group (Hyundai E&C, HDC Hyundai Development, Daewoo E&C, and Lotte E&C). However, as core conflicts such as discussions on increasing construction costs are continuing in response to the opposition from the Dunchon Jugong Shopping Mall Association, business uncertainty is expected to continue for the time being.

According to the maintenance industry on the 21st, the lending group of 24 financial companies, including NH Nonghyup Bank, notified the Dunchon Jugong Reconstruction Association on the 18th that it was impossible to extend the 700 billion won project loan due to expire on the 23rd. The loan extension for business expenses must be decided by the lenders unanimously, but it is known that regarding ten financial institutions, including the second financial institutions, opposed the extension.

In response to the Dunchon Jugong Union’s refusal to extend the loan extension, it plans to put out an urgent fire by issuing short-term securitized securities (asset-backed electronic short-term bonds, ABSTB) guaranteed by the project construction company. To this end, the union held an emergency meeting of delegates on the 20th and decided to issue short-term securitized securities.

Issued securities companies include BNK Investment & Securities, SK Securities, Bukuk Securities, and Kiwoom Securities. Electronic short-term bonds are a type of commercial paper, and the maturity is set at a maximum of 3 months. The association issues short-term securitization securities as a guarantee of the construction group. The term of the bond is 66 days, from the 23rd to the 28th of October. The interest rate is 4.47%, which is the level of the existing project cost loan interest rate.

(Graphic = Reporter Son Mi-kyung sssmk@)

It is known that some of the construction companies affiliated with the construction group initially opposed the issuance of securities due to concerns regarding a credit rating downgrade, and then pursued subrogation of the project cost (the transfer of the rights to the debt held by the creditor to the payer). However, in the end, all four construction companies supported the issuance of short-term securitized securities, and the extreme situation in which the Dunchon Jugong complex went to auction was avoided.

After raising short-term funds, the cooperative forms a new lending group and starts loaning business expenses. Considering the period of business suspension and inflation, the new loan is expected to reach up to 800 billion won. A union official said, “After consulting with the construction project group, we will proceed with refinancing with a financial company that has approved the extension of the existing project cost loan.”

Dunchon Jugong has been adrift without resolving the elements of business anxiety even following the normalization of the reconstruction project last month. Although the issue of repaying the 700 billion won project was overturned right away, the maturity was delayed until October 28, and in the end, the fundamental problem can only be solved by forming a new lending group.

The spark of conflict between the Dunchon Jugong Shopping Street Association and the construction project group still lingers. The members of the shopping malls are in the position that “the agreement on normalization of the business agreed on by the cooperative and the construction project team on the 29th of last month cannot be recognized as it is an agreement with the exception of the shopping mall.”

In addition, the cooperative and the construction project team must solve various problems of increase in construction costs, such as the re-verification of the existing contract construction cost, verification of the cost of loss due to the suspension of construction, and the re-calculation of the sale price.

An official from the maintenance industry said, “This short-term issuance of securitization securities is not a solution to the problem, but a delay following the general meeting for construction resume in October. can,” he said.