Before the God of Wealth day, today’s domestic gold price fluctuates strongly. Meanwhile, world gold increased slightly once more before President’s Day.

Gold price today February 17: World gold recovers above the support level of 2,000 USD/ounce

As expected, world gold markets fluctuated following US inflation data this week, with the only significant move being a sharp drop in prices on Tuesday morning following stronger-than-expected January CPI data. Spot gold increased to 2,030 USD/ounce in a few minutes then plummeted to 1,991 USD in just an hour and a half.

After that, prices largely traded in a tight range above $2,000 until the PPI was released on Friday morning, triggering a smaller sell-off. This was followed by a strong but shallow recovery, following which gold prices rose steadily over Presidents’ Day weekend. April gold futures prices ended the week at 2,013.10 USD/ounce, up 0.45% on the day.

Evolution of world gold prices. Source: Tradingeconomics

The gold market remains under pressure but continues to hold support above $2,000 per ounce as US consumer sentiment remains relatively stable near multi-year highs. Friday, the University of Michigan said the country’s preliminary consumer sentiment index increased to 79.6, up slightly from 79.0 in January. The data was roughly in line with expectations, with economists predicting the number to be around 80.

Consumers continue to express confidence that slowing inflation and labor market strength will continue, Joanne Hsu, director of consumer surveys at the university, said in the report.

At the same time, inflation expectations remain unchanged in their range. The report said consumers see inflation rising 3% by this time next year. Expectations are only slightly higher than the 2.9% reported in January.

Ole Hansen, head of commodity strategy at Saxo Bank, said Chinese investors will return following a week of holidays following welcoming the Year of the Dragon. Gold is likely to struggle in the short term as interest rate cut expectations are tempered, he said, looking forward to seeing how Chinese investors react to slightly lower prices next week. .

US inflation – CPI and PPI – was slightly stronger than expected, said Marc Chandler, Managing Director at Bannockburn Global Forex. This has helped lift the dollar and US exchange rates. Chandler pointed out that this week the market received news that the Japanese and British economies contracted for the second consecutive quarter in Q4 2023. While US retail sales and industrial output fell in the month 1. Data in the coming days is unlikely to blunt the new divergence. He thinks the dollar will peak soon. DXY has increased in price 6 times in the past seven weeks. The US Dollar Index (DXY) measuring greenback fluctuations with 6 major currencies (EUR, JPY, GBP, CAD, SEK, CHF) increased, at 104.59 points. According to him, the gold price in the range of 1,950-65 USD is an attractive price range.

Gold price today February 17: Domestic gold fluctuates strongly before the God of Wealth day

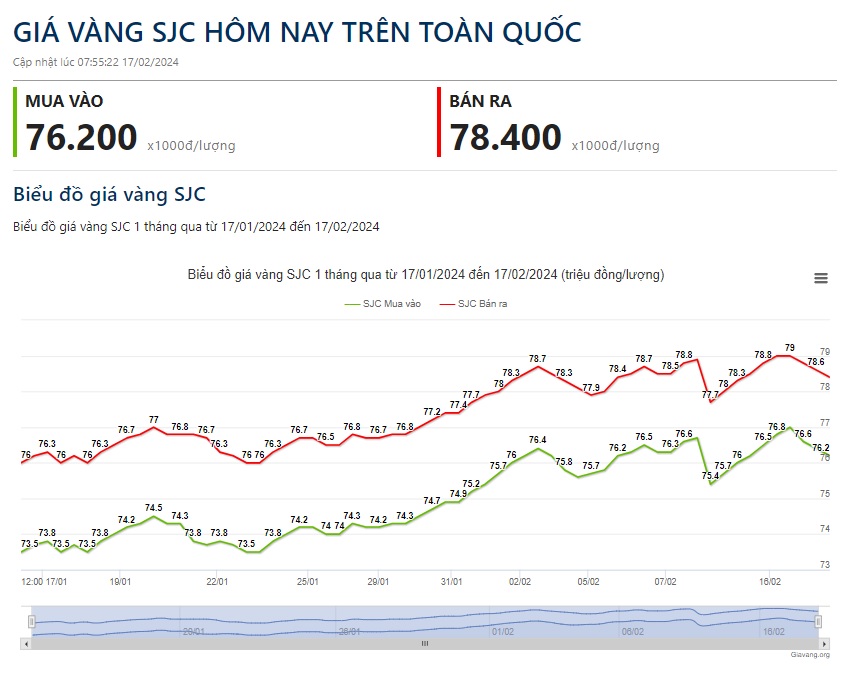

Before the God of Wealth day, domestic gold prices fluctuated strongly. SJC gold prices nationwide are currently listed specifically as follows:

SJC gold price in Hanoi and Da Nang area is listed at 76.2 million VND/tael purchased and 78.42 million VND/tael sold. In Ho Chi Minh City, SJC gold is still buying at the same level as in Hanoi and Da Nang but selling is 20,000 VND lower. Thus, compared to yesterday morning, SJC gold price has been adjusted down by 300,000 VND on the buying side and 400,000 VND on the selling side.

SJC gold bar price is currently listed by Phu Quy at 76.3 million VND/tael purchased and 78.3 million VND/tael sold, down 400,000 VND in both directions.

Meanwhile, PNJ is buying at 76.6 million VND/tael and selling at 78.8 million VND/tael, an increase of 550,000 VND on the buying side and 800,000 VND on the selling side compared to yesterday morning.

DOJI adjusted the price of SJC gold bars by 200,000 VND on the buying side and 400,000 VND on the selling side to 76.15 million VND/tael and 78.35 million VND/tael, respectively. In Ho Chi Minh City, DOJI is buying and selling 50,000 VND lower than in the Hanoi area, down 150,000 VND on the buying side and 350,000 VND on the selling side.

The Bao Tin Minh Chau brand is buying and selling at 76.35 million VND/tael and 78.25 million VND/tael, respectively, down 350,000 VND on the buying side and 450,000 VND on the selling side.

The difference between domestic and world gold prices is over 18 million VND.

Domestic SJC gold price developments. Source: giavang.org

Unit: x1000 VND/tael