DOJ Disbands Cryptocurrency Fraud Task Force Amid Shifting Political Winds: Are U.S. Investors at Risk?

The Department of Justice is restructuring its approach to cryptocurrency enforcement, raising questions about investor protection in a volatile market.

Key Developments

In a significant shift in policy, the Department of Justice (DOJ) has disbanded its national Cryptocurrency Enforcement Team (NCET), a unit established in 2022 under the Biden governance to combat cryptocurrency-related cybercrime and money laundering. According to an internal memo issued Monday night, this decision reflects a change in strategy regarding the regulation of digital assets. this action has triggered a wave of discussion about the future of cryptocurrency regulation and its potential impact on American investors.

Deputy Attorney General Todd Blanche stated the work performed by the team was “a reckless strategy of regulation by prosecution, which was ill-conceived and poorly executed.”

The DOJ will now prioritize investigations into “individuals who victimize digital asset investors, or those who use digital assets in furtherance of criminal offenses such as terrorism, narcotics and human trafficking, organized crime, hacking, and cartel and gang financing.”

Political Undercurrents

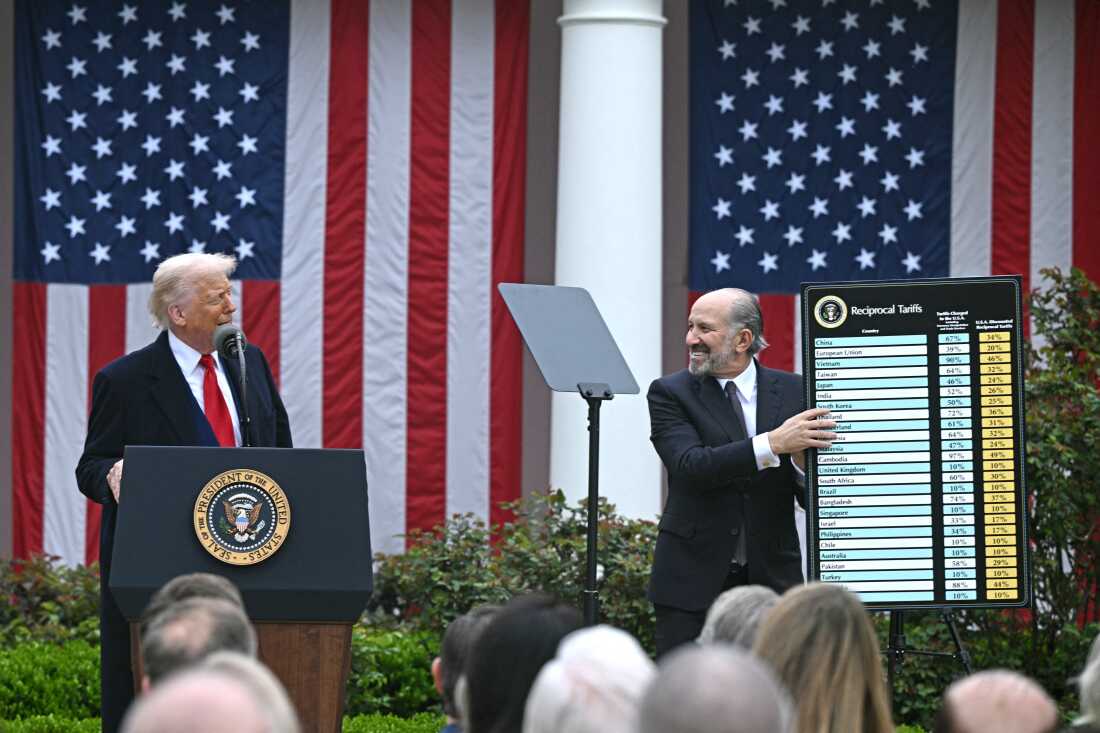

This move aligns with President Donald Trump’s publicly stated intention to foster the cryptocurrency industry within the United States. Trump has pledged to make the United States the “crypto capital of the planet,” a promise that has garnered support from some figures in the technology sector.

Trump’s connection to the cryptocurrency world extends beyond policy pronouncements. He and his family “now have an interest in the industry,” marked by the launch of “meme coin” tokens $TRUMP and $MELANIA ahead of his 2025 inauguration. The Trumps also reportedly claim 75% net revenues from token sales from crypto business World Liberty Financial.

Rising Cryptocurrency Scams: A Cause for Concern?

The timing of this policy shift raises concerns about the potential for increased cryptocurrency-related scams. The FBI reported that Americans lost over $5.6 billion in 2023 due to investment scams and cybercrimes associated with bitcoin, ether and tether cryptocurrency — up 45% from 2022. The $5.6 billion in losses made up nearly half of the total amount Americans lost to financial crimes.

“Over the years, cryptocurrency’s widespread promotion as an investment vehicle, combined with a mindset associated with the ‘fear of missing out,’ has led to opportunities for criminals to target consumers and retail investors,” reads the FBI report.

This increase in losses highlights the vulnerability of investors, notably those who are new to the cryptocurrency market. The absence of a dedicated task force like the NCET could perhaps embolden scammers and make it more challenging to recover lost funds.

| Year | Cryptocurrency Investment Scam Losses (USD) | Increase from Previous Year |

|---|---|---|

| 2022 | $3.86 Billion | – |

| 2023 | $5.6 Billion | 45% |

Mitigating Risk: Practical Steps for U.S. Investors

Given the evolving regulatory landscape and the prevalence of scams, U.S. investors need to exercise caution and take proactive steps to protect themselves.

- Be wary of unsolicited communications: Don’t engage with messages from people you haven’t met in person, including people who claim to represent yoru bank or government agencies. Research the institution and the individual who is messaging you. If you can’t tell if the message is legitimate, try calling the organization, or don’t respond at all.

- Verify website legitimacy: Be careful of what sites you visit on the Internet and what information you give them. Some sites will impersonate businesses and banks.Check domain names and watch out for spelling errors. These are signs of illegitimacy. A common scam involves creating fake cryptocurrency exchanges that steal users’ credentials and funds.

- Resist “Fear of Missing Out” (FOMO): Beware of FOMO, or the “fear of missing out” mentioned by the FBI report. It’s very tough to get rich quickly — and fraudsters are happy to use this knowledge against you. If an investment chance sounds to good to be true, it just may be.”Pump and dump” schemes, where scammers artificially inflate the price of a cryptocurrency and then sell their holdings for a profit, leaving other investors with losses, are a prime example of FOMO-driven scams.

The Path Forward

The disbanding of the NCET represents a significant shift in the U.S. government’s approach to cryptocurrency regulation. While the DOJ will continue to pursue individuals who use digital assets for criminal purposes, the reduction in dedicated enforcement efforts could create opportunities for scammers. U.S. investors must remain vigilant and educate themselves about the risks associated with cryptocurrency investments.

What practical steps can investors take to protect themselves from increased cryptocurrency scams in light of the DOJS shifting priorities?

Archyde Interviews: Navigating the New Cryptocurrency Landscape: Investor Risks and Protections

Archyde: Welcome to Archyde. Today, we’re discussing the recent disbanding of the DOJ’s Cryptocurrency Enforcement Team and its implications for U.S. investors. Joining us is Professor Anya Sharma,a leading expert in financial crime and digital asset regulation at the University of Economic Policy. Professor Sharma, thank you for being with us.

Professor Sharma: Thank you for having me. Its a crucial time to discuss these developments.

The DOJ’s Shift in Strategy: Understanding the Changes

Archyde: The DOJ’s restructuring signals a significant pivot. What are the key takeaways from the disbanding of the NCET, and what should investors understand about this new approach?

Professor Sharma: Essentially, the DOJ is moving away from a dedicated task force focused on broad cryptocurrency enforcement. Instead, they’re now prioritizing cases targeting criminal activities *using* cryptocurrencies. This includes terrorism, narcotics, and other serious offenses, but it means less direct focus on general cryptocurrency-related fraud, possibly impacting investor protection.

Political Influence and the Crypto Market

Archyde: The article mentions political undercurrents, particularly President Trump’s stance on cryptocurrency. How might this shift in policy align with his stated goals, and what does this signify for the future of cryptocurrency regulation?

Professor Sharma: President trump’s openly pro-crypto stance is clear. This policy shift very much reflects an effort toward a more hands-off approach to foster the crypto industry in the US. This could lead to less stringent oversight of the sector, potentially attracting more investment but also increasing the risk of scams and fraudulent activities. The launch of the Trump and Melania meme coins adds a new dimension by potentially creating a conflict of interest.

Rising Cryptocurrency Scams: Investor Vulnerabilities

Archyde: The FBI’s data shows a significant increase in losses due to cryptocurrency scams. Could the DOJ’s changes exacerbate these risks, and what specific vulnerabilities should investors be aware of?

Professor Sharma: Absolutely. The timing is concerning. The disbanding of a dedicated anti-fraud unit coinciding with rising scam activities is not ideal. New investors,in particular,are vulnerable. The lack of specialized enforcement might make it easier for scammers to operate. Investors need to be exceptionally cautious, aware of phishing attempts, fake exchanges, and the seductive appeal of “get-rich-quick” schemes.

Protecting Your Crypto Investments: Practical advice

archyde: The risks are apparent. what are some practical, actionable steps investors can take to protect themselves in this evolving landscape?

Professor Sharma: First and foremost, be extremely skeptical. Verify the legitimacy of any investment opportunity, scrutinize websites, and resist FOMO (fear of missing out). Don’t respond to unsolicited communications. If an offer seems too good to be true, it almost certainly is. Verify the authenticity of platforms and the individuals involved.

The Path Forward: The Consequences of Policy Shifts

Archyde: This shift from the DOJ signals a potential change of hands. Are there other U.S.government agencies or groups stepping in to provide greater investor protection?

professor Sharma: The situation remains very uncertain.Investors must stay updated and verify information from a variety of reliable sources to stay on top of new risks to their assets. There is a clear need for increased due diligence amongst consumers.

Archyde: Thank you for your invaluable insights, Professor Sharma. Our readers are encouraged to share their thoughts in the comments section below – we want to know: how has the shift in this regulatory landscape affected the way you approach cryptocurrency investments?

Professor Sharma: It’s been my pleasure.