2024-06-08 00:00:00

Two main banks are contemplating promoting their cross-holdings in Toyota Motor Corp, signaling a rising development amongst Japanese corporations to unwind cross-holdings. From an organization’s perspective, this additionally means the lack of secure shareholders, and shareholder conferences that have been as soon as seen as a formality might grow to be a extra fiercely aggressive venue than earlier than.

Mitsubishi UFJ Monetary Group (MUFG) and Sumitomo Mitsui FG to promote Toyota shares for greater than 1.3 trillion yen – sources

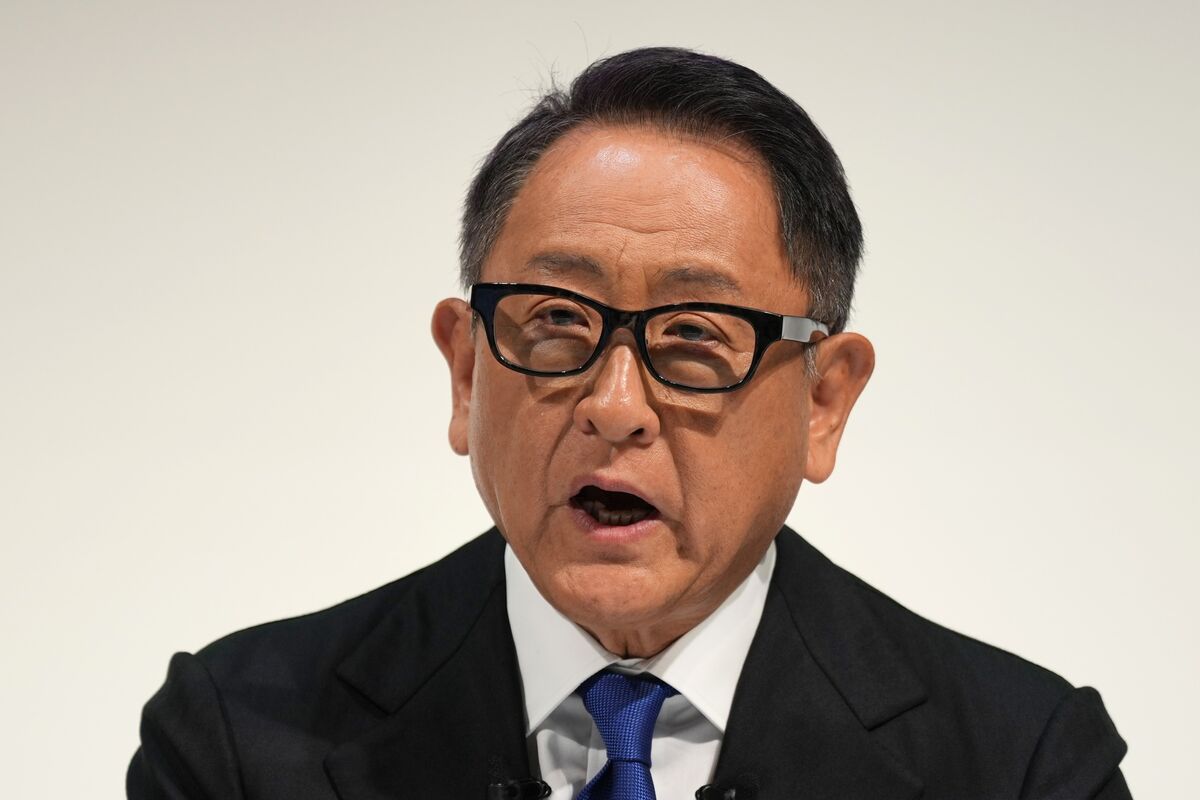

Chairman Akio Toyoda

Photographer: Toru Hanai/Bloomberg

The impression of unwinding cross-shareholdings between two main banks will not be felt till subsequent yr on the earliest, however Toyota administration will maintain this yr’s shareholder assembly amid issues regarding certification fraud.

The corporate has submitted three proposals to the shareholders’ assembly to be held on the 18th at Toyota’s headquarters in Toyota Metropolis, Aichi Prefecture. The main target might be on the election of 10 administrators, together with Chairman Akio Toyoda.

In Might, main U.S. proxy voting consulting corporations Institutional Shareholder Companies (ISS) and Glass Lewis each advisable voting towards Akio Toyoda as a director at this yr’s shareholder assembly. ISS reversed its advice final yr to oppose the transfer, saying Mr Toyota had an obligation to clarify a collection of frauds at Daihatsu and different Toyota group corporations. Later, Toyota’s personal certification fraud was found, and the blow to the administration workforce might intensify.

A Toyota spokesman didn’t reply to a request for remark.

Akio Toyoda, the grandson of founder Kiichiro Toyoda, was appointed president in June 2009. As a automobile fanatic, he labored to enhance the product’s attraction and overcame tough occasions such because the Nice East Japan Earthquake and the coronavirus pandemic. Working revenue exceeded 5 trillion yen within the final fiscal yr (ending March 2019), and the inventory value has greater than quadrupled since he took workplace, partly pushed by the weak yen.

Regardless of how good the efficiency is

Nevertheless, regardless of the corporate’s good efficiency, assist for Mr. Toyoda’s appointment as a director at shareholder conferences has continued to say no lately. In 2020, it was 98.30%, the best since 2010, however in 2023, it was 84.57%, the bottom amongst director candidates, down regarding 11 share factors from the earlier yr.

Julie Boot, an analyst at British analysis agency Pelham Smithers Associates, famous that Toyota’s approval score relies on the concept that the federal government shouldn’t be doing sufficient to assist electrical autos (EVs). Because the electric-car growth stalls, focus turns to the problem of board independence, highlighted by a collection of fraud scandals inside Toyota Group this yr.

Mitsubishi UFJ Monetary Group (MUFG) and Sumitomo Mitsui Monetary Group (FG) plan to promote their Toyota shares in phases. Together with the holdings of 4 non-life insurance coverage corporations which have introduced strategic shareholding zeroing insurance policies, a complete of three.2 trillion yen might be bought, or greater than 6% of the present market worth.

What to anticipate from particular person traders

Toyota can also be working to remove cross-shareholdings inside the group. Based on Bloomberg knowledge, Toyota Motor’s father or mother firm Toyota Industries holds 7.55% of the shares, and firms akin to Denso, Toyoda Gosei, and Toyota Boshoku maintain a minimum of 10% of the shares. If the components maker continues to promote shares sooner or later, it’s going to imply Toyota will lose secure shareholders, similar to monetary establishments.

Mr. Boot of Pelham Smithers believes that Toyota’s fraud is because of the certification system altering with the occasions, and this example is not going to shake the corporate’s administration basis. The corporate expects Toyota to win re-election with the assist of a majority of shareholders at this yr’s shareholder assembly, however stated Toyota might also be extra cautious in deciding on administrators sooner or later.

Iwai Cosmo Securities analyst Taku Sukawara stated the variety of secure shareholders will certainly lower because of the dissolution of cross-shareholdings and the introduction of the brand new NISA (small funding tax exemption system). The variety of shareholders who might be referred to as followers is prone to enhance, and the variety of shareholders who might be referred to as followers will enhance to a sure extent.

associated articles:

1717829340

#Dissolution #crossshareholdings #accelerates #shareholder #conferences #flip #battles #main #banks #plan #promote #Toyota #shares #Bloomberg