2024-09-09 03:30:00

The approval of Law No. 27,743 on palliative and related tax measures establishing a special income tax regime for personal property (Reibp), This allows you to pay your taxes for the next five years in advance.

Complying with Reibp is a voluntary choice and includes uniform payment of personal property taxes corresponding to the period 2023 to 2027. Additionally, the rule clarifies that it covers any property taxes that may arise in the future and supersedes personal property taxes.

Taxpayers who elect Reibp will be excluded from all obligations under the personal property rulesincluding the obligation to submit a sworn declaration, calculation of tax base, determination of tax, payment of advances and other account payments.

Followers will enjoy financial stability until 2028. This means that by 2027, all wealth taxes will be covered, and from 2028, no wealth tax can exceed 0.25%.

If assets are incorporated into the estate If acquired through donation or at a consideration below market value, additional tax must be paid. In this case, the relevant notary must act as withholding agent.

If the goods are donated or purchased at a price below market value, additional taxes will apply.

People who received assets through inheritance will not have to pay personal property taxes until 2027 once the split account is approvedprovided that the inherited assets come from the person joining Reibp.

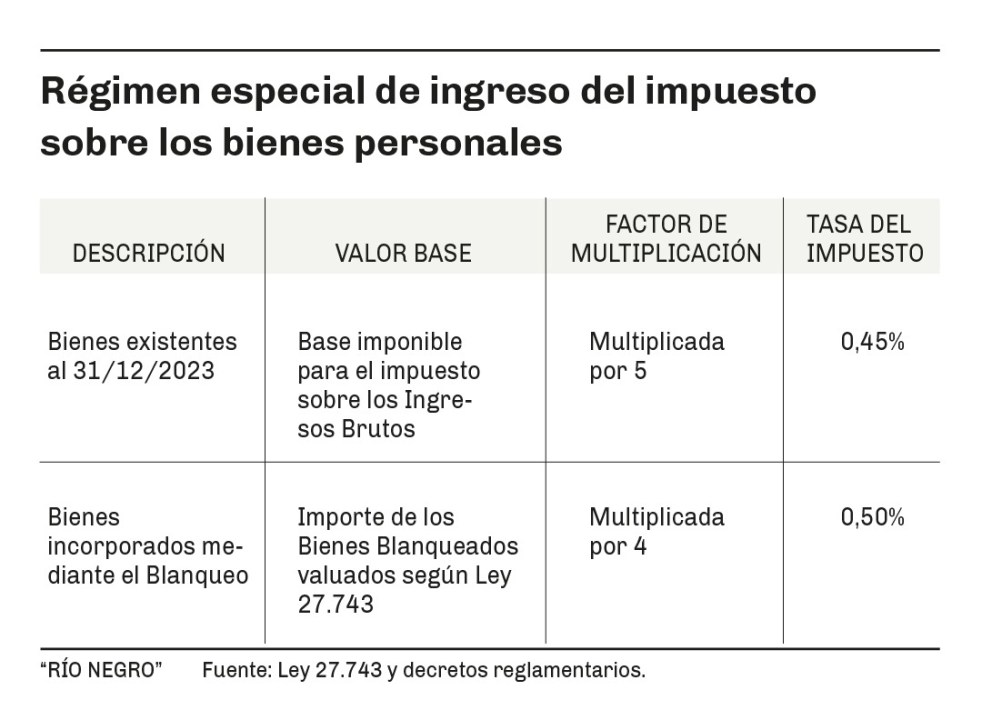

For the purposes of calculating the tax arising from this special regime on existing assets as of December 31, 2023, Taxpayers can obtain it by multiplying the tax basis of personal assets by 5 and applying a 0.45% tax rate to the result..

Those who insist on doing laundry can also enter Reibp to purchase washed goods.. In this case, the laundered asset base in pesos will be multiplied by 4 and an aliquot of 0.5% will be applied to the result. This can be seen in the attached table.

Decree Nos. 608 and 773 of 2024 regulate Law No. 27,743 and establish the key points for compliance with the special regime:

– Taxpayers can add to Reibp assets included in their assets from December 31, 2023, as long as the settlement of personal property taxes results in a certain amount of tax.

– If the liquidation does not result in specific taxes, they can add all their assets to Reibp.

– A person who decides to add assets existing as of December 31 to Reibp must also add assets obtained through money laundering to Reibp.

– Those who do not comply will not be able to do so with laundered merchandise.

The deadline to join Reibp is September 19-23and the requester must prepay 75% of the tax and complete the payment when submitting a sworn declaration. The deadline is September 30.

People who receive assets through inheritance will not have to pay personal property taxes until 2027 once the split account is approved.

For money laundered assets, membership options will be available from 7 October 2024. Once attached, up to 75% of the tax must be deposited into the account by March 31, 2025, and paid by April 30, 2025.

To pay tax according to Reibp, Taxpayers can calculate tax credits, advances, account payments and balances to receive any calculated tax for free. Compare this to the corresponding personal property tax balance for fiscal year 2023.

Decree 773/2024 allows the calculation of the free available balance of Reibp, transforming the system into an important tax planning tool, Allows you to tap into those balances that would otherwise not be available until next year.

CHINNI, SELEME, BUGNER and ASOC.

1725858430

#Personal #property #tax #special #system

Here is a question related to the topic ”Special Regime for Paying Personal Assets Tax in Argentina: Everything You Need to Know”:

Table of Contents

Special Regime for Paying Personal Assets Tax in Argentina: Everything You Need to Know

The Argentine government has introduced a new special regime for paying personal assets tax, known as REIBP (Régimen Especial de Inclusión de Bienes y Participaciones), allowing individuals to pay their taxes in advance for the next five years. This regime is part of Law No. 27,743, which aims to provide financial stability and encourage taxpayers to regularize their assets.

Key Benefits of REIBP

- Advance Payment: Taxpayers can pay their taxes for the next five years in advance, enjoying financial stability until 2028.

- Uniform Payment: Complying with REIBP includes uniform payment of personal property taxes corresponding to the period 2023 to 2027.

- Exclusion from Personal Property Rules: Taxpayers who elect REIBP will be excluded from all obligations under the personal property rules, including the obligation to submit a sworn declaration, calculation of tax base, determination of tax, payment of advances and other account payments.

- Financial Stability: By 2027, all wealth taxes will be covered, and from 2028, no wealth tax can exceed 0.25%.

Calculating the Tax

To calculate the tax arising from this special regime on existing assets as of December 31, 2023, taxpayers can obtain it by multiplying the tax basis of personal assets by 5 and applying a 0.45% tax rate to the result.

Inheritance and Money Laundering

- Inheritance: People who receive assets through inheritance will not have to pay personal property taxes until 2027

**What advantages does Law No. 27,743 offer to taxpayers in Argentina regarding wealth tax compliance?**

New Tax Regime in Argentina: Understanding Law No. 27,743 and Its Benefits

In a move to simplify tax payments and provide financial stability, Argentina has introduced Law No. 27,743, establishing a special income tax regime for personal property, also known as Reibp. This new regime allows individuals to pay their taxes for the next five years in advance, providing a sense of security and predictability for taxpayers. In this article, we will delve into the details of Law No. 27,743, its benefits, and how it works.

What is Reibp?

Reibp is a voluntary tax regime that enables individuals to pay their personal property taxes in advance for the period from 2023 to 2027. This regime is designed to simplify tax compliance and provide financial stability for taxpayers. By opting for Reibp, individuals can avoid the complexities of submitting sworn declarations, calculating tax bases, determining taxes, and making advance payments.

Key Benefits of Reibp

One of the primary advantages of Reibp is that it provides financial stability until 2028. By paying taxes in advance, individuals can avoid uncertainty and ensure that their wealth taxes are covered for the next five years. Additionally, Reibp taxpayers will be excluded from all obligations under the personal property rules, making tax compliance easier and less time-consuming.

Another significant benefit of Reibp is that it sets a maximum wealth tax rate of 0.25% from 2028 onwards. This provides a sense of security and predictability for taxpayers, knowing that their wealth taxes will not exceed this rate.

How Does Reibp Work?

To calculate the tax arising from this special regime, taxpayers can multiply the tax basis of their personal assets by 5 and apply a 0.45% tax rate to the result. For those who have acquired assets through inheritance, they will not have to pay personal property taxes until 2027, provided that the inherited assets come from a person who has joined Reibp.

Additional Taxes for Donated or Purchased Assets

In cases where assets are incorporated into an estate through donation or purchase at a price below market value, additional taxes will apply. The relevant notary must act as a withholding agent in such cases. This ensures that taxes are paid on the full value of the assets, preventing tax evasion.

Table for Calculating Tax

For a clearer understanding of how the tax is calculated, refer to the table below:

| Asset Value | Tax Rate | Tax Amount |

| — | — | — |

| Pesos | 0.5% | 0.5% of asset value |

| USD | 0.45% | 0.45% of asset value |

Conclusion

Law No. 27,743, also known as Reibp, is a significant development in Argentina’s tax landscape. By providing a voluntary tax regime for personal property, individuals can enjoy financial stability and predictability for the next five years. With its simplified tax compliance and capped wealth tax rate, Reibp is an attractive option for those seeking to minimize their tax burden. By understanding the details of this new regime, taxpayers can make informed decisions about their tax obligations and plan for a more secure financial future.

Keyword: Law No. 27,743, Reibp, Personal Property Tax, Argentina Tax Regime, Financial