“I don’t think there have been as many salespeople from pharmaceutical companies as there are these days.”

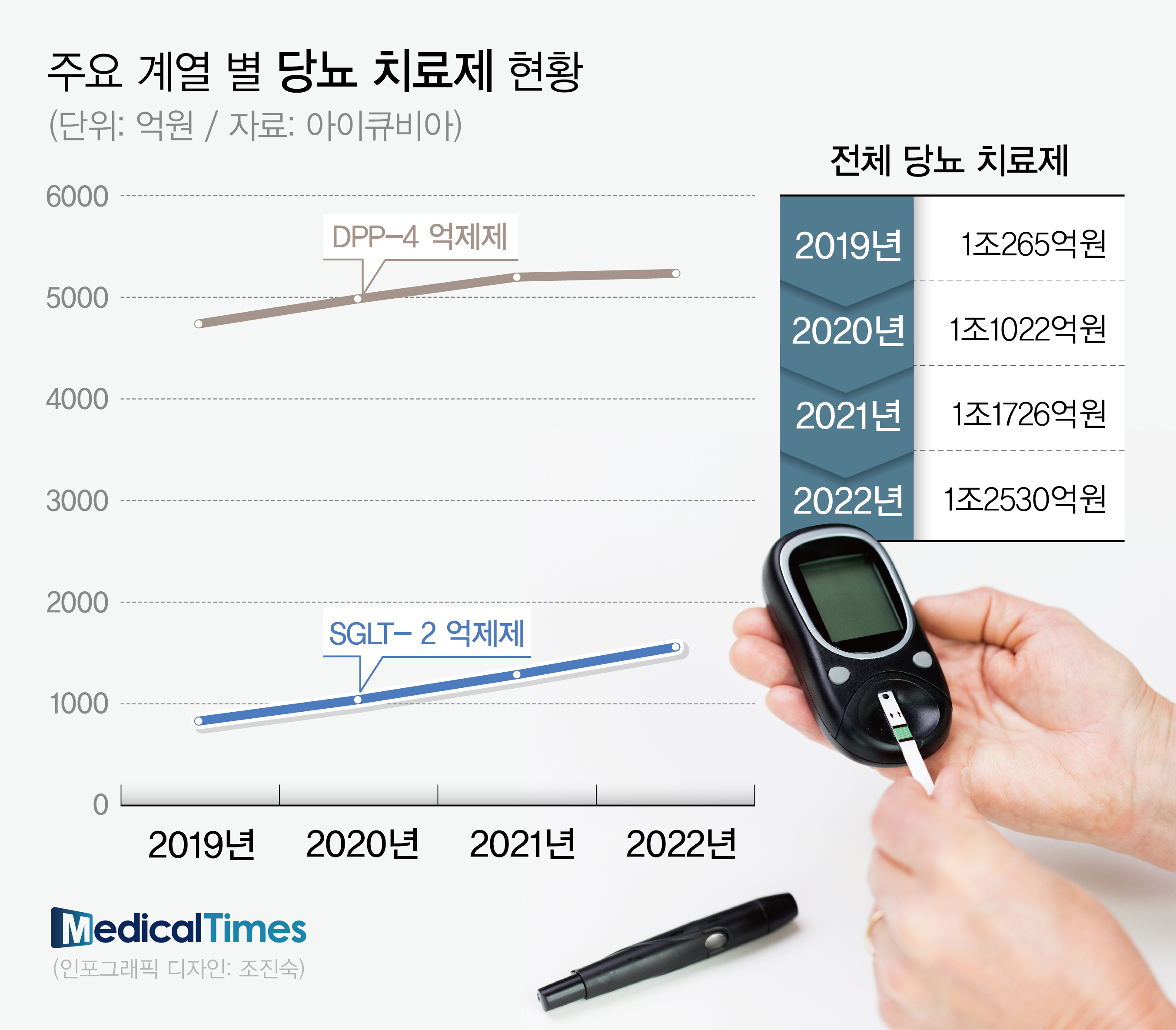

The diabetes treatment market, which has grown close to the total market of 1.3 trillion won, has faced a major change since April.

As the ‘expanding of concomitant benefits by diabetes treatment class’, which had been on hold despite the medical community’s request for several years, and the release of generic drugs following the patent expiration of major original items overlapped at the same time, pharmaceutical companies’ sales and marketing efforts to preoccupy the prescription market preoccupied the prescription market. There is a marketing war going on.

In the clinical field, there is concern regarding the chaos caused by such changes. Treatments are pouring in like a flood and benefits are expanding at the same time, and the treatment market is expected to grow rapidly.

Concerns regarding confusion amid major changes in the diabetes treatment market in April

According to the pharmaceutical industry on the 8th, from this month, the criteria for accreditation of diabetes treatment drugs have been significantly eased. The key is that various drug combinations are possible without specifying the SGLT-2 inhibitor component.

In the meantime, only dapagliflozin among SGLT-2 inhibitors was recognized as a combination of a sulfonylurea-type drug and a second drug, making it difficult to use SGLT-2 inhibitor-type ingredients except for dapagliflozin.

With this revision, SGLT-2 inhibitors such as ipragliflozin, empagliflozin, and ertugliflozin can be reimbursed when used together. Currently, the metformin + SGLT-2 inhibitor + DPP-4 inhibitor combination and the metformin + SGLT-2 inhibitor + thiazolidinedione combination are also recognized if the HbA1C is 7% or higher even if the two-drug regimen is administered for 2 to 4 months or more.

In addition, on April 8, the patent of Forxiga, the original dapagliflozin product, expires, and 149 late-breaking drugs will be released simultaneously. There are 89 single drugs and 60 combination drugs.

In addition, drugs that require salt change data, such as Boryeong Trudapa and Hanmi Pharmaceutical Dapalon, will be released simultaneously.

In other words, a change in the perception of the diabetes treatment market is happening at the same time in April.

In the clinical field, it is expected that the diabetes treatment market will grow rapidly due to such a great change. The prevailing view is that it will not be easy for the Health Insurance Review and Assessment Service to reduce medical expenses because the criteria for combined use are divided by class (group) rather than by specific item.

A professor of endocrinology at a university hospital who requested anonymity said, “We revised the reimbursement standards for each class without restrictions on drugs. This is where confusion can arise.”

“Since the reimbursement standards for each class have been relaxed, it has become possible to combine various drugs in addition to the existing combinations,” he said. It is possible to use it without worrying regarding salary, so I think it will cause confusion.”

‘Mun Jeon Seong-si’, a salesperson for a pharmaceutical company at a medical institution

Then, what kind of changes did the clinical sites centered on clinic-level medical institutions where prescriptions are actually made?

First of all, the biggest change is that since the end of last month, salespeople from domestic pharmaceutical companies have been visiting in a row. Forsy visits to request a prescription for its own medicines in view of the fact that generics are expected to pour in following the expiration of patents.

The main evaluation of the clinical field is that there are no characteristics other than frequent visits because the sales and marketing points of pharmaceutical companies are uniform in that they are generics.

Director A, an executive of the Korean Association of Internal Medicine, who requested anonymity, said, “I felt like pharmaceutical companies put a lot of pressure on salespeople.” It’s hard to find,” he said.

He said, “They didn’t conduct clinical trials and released generics, so there’s not much left in my memory.”

However, in the clinical field, it was commonly expected that the SGLT-2 inhibitor market would grow rapidly.

It is in contrast to the DPP-4 inhibitor market, which is staying at the 500 billion won level in the prescription market.

In fact, according to IQVIA, a pharmaceutical research institute, while the domestic DPP-4 inhibitor market is staying at around 500 billion won, SGLT-2 inhibitors have gradually grown to reach close to 200 billion won. It is also the reason for the greater growth of SGLT-2 inhibitors in the wake of the expansion of coverage in that they are effective not only in blood sugar control but also in weight control.

Another professor of Endocrinology B, an executive officer of the Korean Diabetes Association, said, “The biggest reason for the difficulty in using SGLT-2 inhibitors in clinic-level medical institutions is the lack of intimacy, but the problem of salary.” I think the market will grow explosively to focus on.”

“SGLT-2 inhibitors are the third drug, and the biggest stumbling block, the reimbursement, is resolved, so it is likely to benefit the most among drugs in each class,” he said. “The market growth will be steeper.”

Kwak Gyeong-geun, vice president of the Korean Association of Internal Medicine (Seoul Internal Medicine), said, “One of the reasons the DPP-4 inhibitor market is large is that there are not a few patients who are sensitive to weight loss.” It is true that there is room for additional use of 2 inhibitors, which is a positive factor for sales growth. However, given that some patients complain of discomfort in the urinary tract, we need to watch for changes in sales of the treatment between the two classes in the future.”