Having idle money in just a short time, choosing short-term savings is more appropriate. So, which bank has the highest interest rate when depositing online with a one-month term?

People with idle money often tend to save medium and long term deposits to maximize the interest rate. However, many people have an idle amount in a short time, so choosing a short-term savings deposit is more appropriate.

Ms. Ha Hai Anh (Thanh Xuan district, Hanoi) said that she has an amount of 50 million dong to pay the rent at the beginning of next month. She chose to deposit online with a 1-month term as a way to keep money.

“The money in the card is very difficult to keep because maybe we spend too much, when there is a need, it is gone. Therefore, I choose to deposit online for a 1-month term for this fixed expenditure that I have not used yet,” said Ms. Hai Anh.

Thinking that short-term savings accounts will have the same interest rates for all banks, she pays little attention. Therefore, she chose to deposit money at Vietcombank with an interest rate of 4.7%/year. However, when the deposit was finished, she was told by friends that the difference in interest rates between banks was significant.

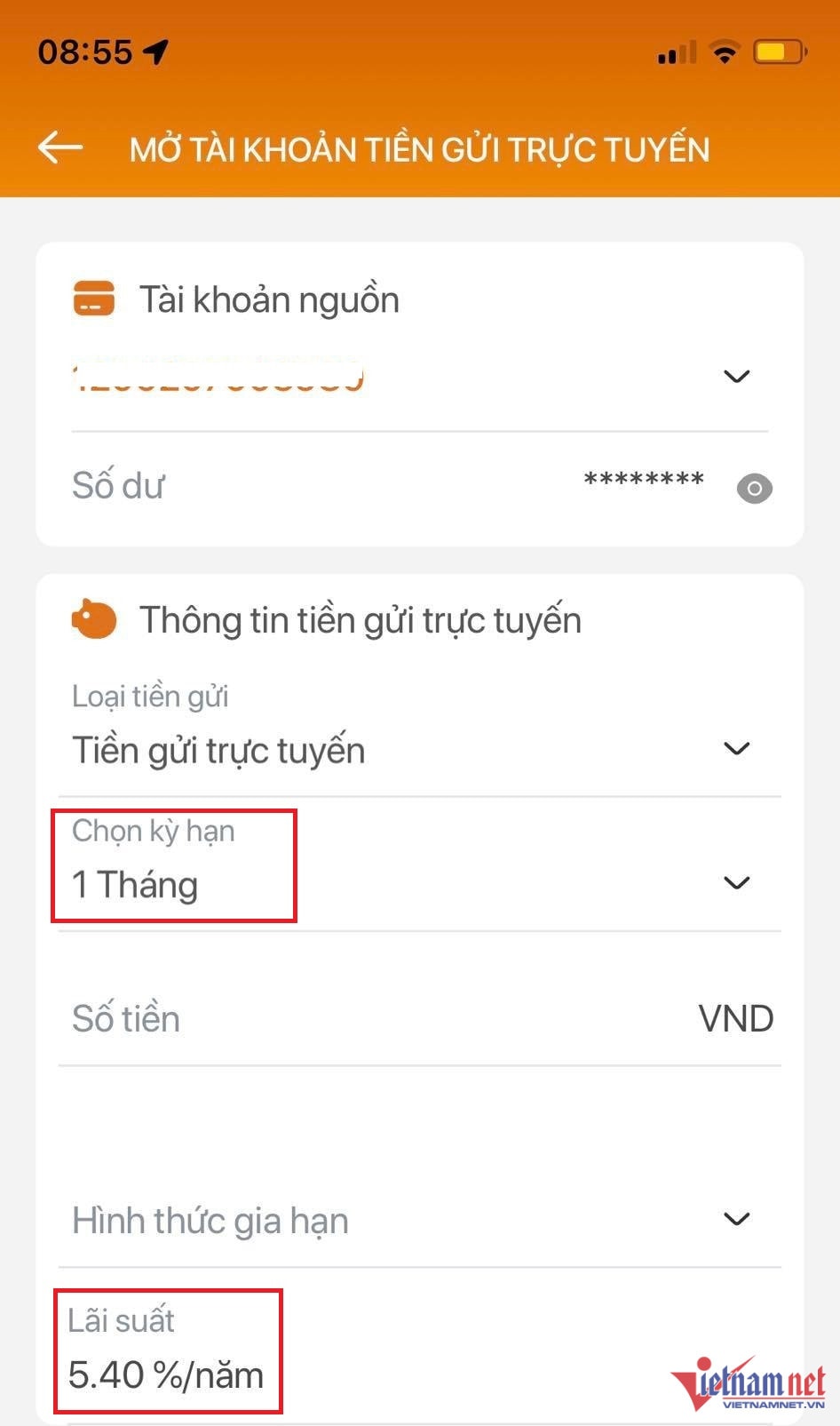

“Going to see the interest rate chart on Vietcombank website, the 1-month savings interest rate is 4.9%, but in fact, when I deposited it, it was only 4.7%. Meanwhile, a friend of mine deposited on the same day (January 31) at Agribank with a 1-month term and enjoyed an interest rate of 5.4%,” said Hai Anh.

Meanwhile, the 1-month term interest rate announced by Agribank on its website is 4.9%/year, equal to the announced figures of Vietcombank, VietinBank, and BIDV.

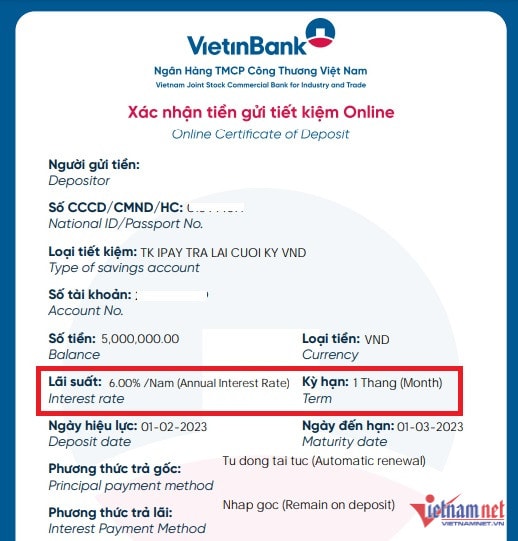

At VietinBank, although the 1-month term interest rate announced on the website is 4.9%/year, in fact, customers who deposit this term enjoy an interest rate of up to 6%/year.

At the VietinBank iPay app, the online savings feature shows the full interest rates for the terms. Specifically, the interest rate for terms from 1-5 months is 6%/year, increasing by 0.6-1.1%; deposit interest rate of 6-9 months is 7.8%/year, up to 1.8%; while interest rates for terms from 12-24 months increased by 0.8% to 8.2%/year. Depositing money online, customers are informed that the interest rate is added 1%/year.

According to statistics on 1-month savings interest rates listed by joint stock commercial banks, the banks that are paying the highest interest rate of 6%/year include: VPBank, PVCombank, HDBank,…

LienVietPostBank is at an asymptotic level, with a published interest rate of 5.95%/year. TPBank announced an interest rate of 5.95%/year, while Sacombank and SeABank both have an interest rate of 5.7%/year.

ACB pays lower interest rate, 5.5%/year, while SHB is surprisingly the bank that pays the lowest interest rate for 1-month term at 3.8%/year.