XETRA DAX closing price on the previous day: 15942

DAX preliminary exchange: 16058

FDAX: 16048

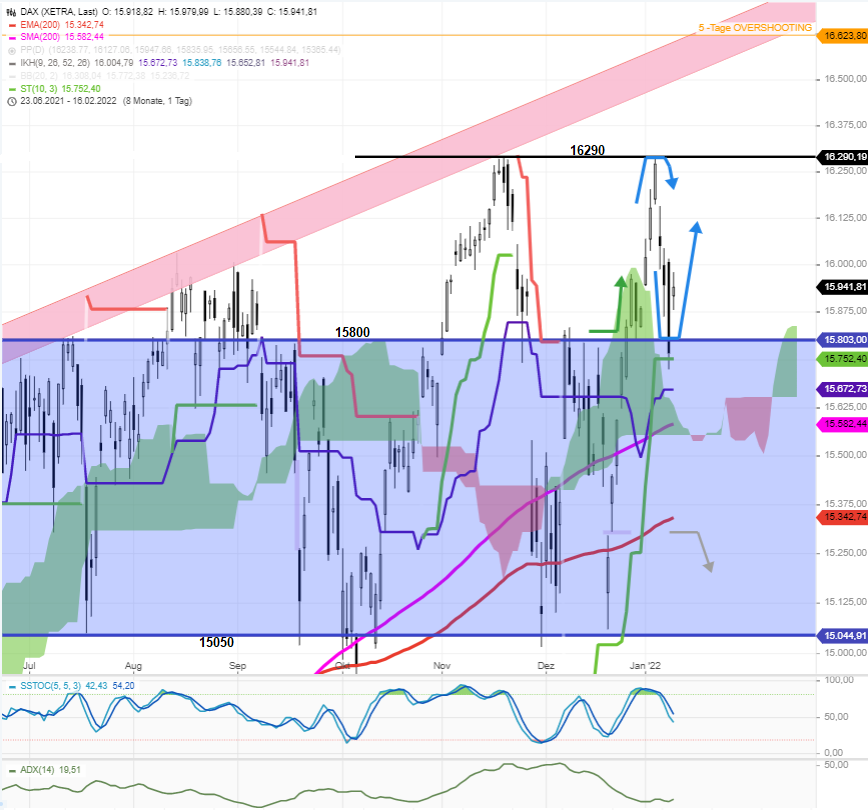

DAX resistors: 16044/16072/16087 + 16157 + 16290 + 16624

DAX supports: 16000/15975/15934 + 15884 + 15800 + 15752 + 15673 + 15582

DAX forecast:

- The DAX should fall from 16285/16290 to 15885/15800 in order to then have the chance to rise once more.

So far it looks pretty neat. The DAX had reached 15800, undercut slightly, and then left 15800 yesterday with a price jump upwards. Daily closing rate 15942.

- DAX hour candle chart:

The DAX pre-exchange clocks over 16,000, at approx. 16060. That is over 100 points more than at yesterday’s closing price.

After yesterday’s flag, which lasted several hours, the DAX is jumping once more today and pricing in a lot. - At 16044 a hurdle can be made out, the “h1 cloud”.

- The DAX brands 16044 (h1 / Wolke), 16072 (61.8% RT) and 16087 (R3) are today’s XETRA DAX daily targets.

Once once more, you don’t want to give any working 8/9 o’clock buyer the chance to start something sensibly. - In the DAX, pullbacks in the direction of 15975/15935 are to be expected from 16044/16072/16087 (R3), as the DAX rarely rises above the daily pivot R3 (today 16087). DAX pullbacks today are definitely buying opportunities between 16,000 and 15,935.

- Should the DAX, contrary to expectations, leave Pivot R3 behind at 16087, a quick “attack” on the 16157/16272 gap is to be expected, which would ultimately lead to the test of the all-time high 16290.

- Small DAX sell signals only occur below 15884 in the hourly candle chart.

- Incidentally, the FDAX has already managed to clear all hurdles in the hourly candle chart, including the annoying “h1 / cloud”! The XETRA DAX still has this process of change ahead of it.

- DAX daily candle chart:

The double candle combination represents a kind of “bullish harami”.

The DAX chart parameters in the daily candle chart all have a supportive effect, starting with 15800/15752 (horizontal / supertrend indicator) up to 15343 (EMA200). Accordingly, a significant decline in the DAX is unlikely.

However, the downward cycle of the stochastic indicator is not over yet. This indicator might keep the DAX sideways for a few more days, but the situation is at least not mature enough for new strong DAX gains.

- Any trade below 15800 would generally be a sign of weakness. For the time being, bearish consequences might easily be averted or prevented using the daily candle chart parameters at 15752 (ST), 15673 (Kijun) and 15582 (SMA200).

- Only following the DAX close of the day below the red EMA200 at 15343 would there be sell signals for the targets 15050/15015 and 14815.

- Conclusion: My expected DAX daily range is 16087 to 15934.

I wish you success!

Rocco Gräfe

Attention latecomers!

Now in hindsight my big annual outlook for 2022 the basic direction of the year with all index targets, buying opportunities and supports, many equity opportunities, as well as mine Year 2022 Top10 watch, including 11 bonus tracks.

XETRA DAX hour candle chart

XETRA DAX daily candle chart