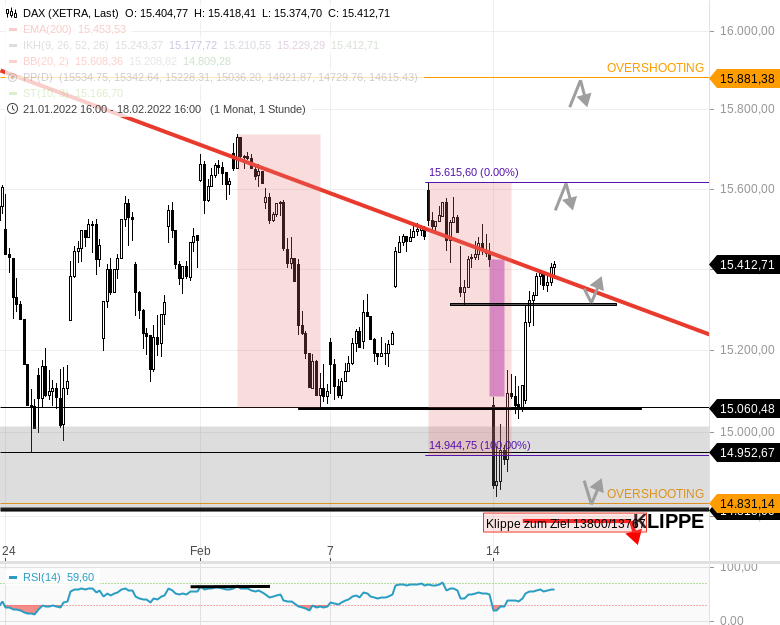

Underlying value/ current price: XETRA close 15413 (XDAX pre-exchange ~15420)

current resistances: 15460 + 15555 + 15615/15625 + 15650 + 15881(R3)

current supports: 15325 + 15275 + 15235 + 15060 + 14839/14831 (S3) / 14815 (Klippe)

Key statement: DAX collapse below the “cliff” 14815 is no longer an issue for the time being!

suitable derivative:

- only with me in the premium service “ADT”

detailed description

The DAX caught on Monday following a -600 DAX point slide still above the cliff 14815, which might send the DAX down another 1000 points if activated.

In the meantime, the DAX has made up for all of Monday’s losses, the previous week’s close was at 15425. Pre-market today: ~15420.

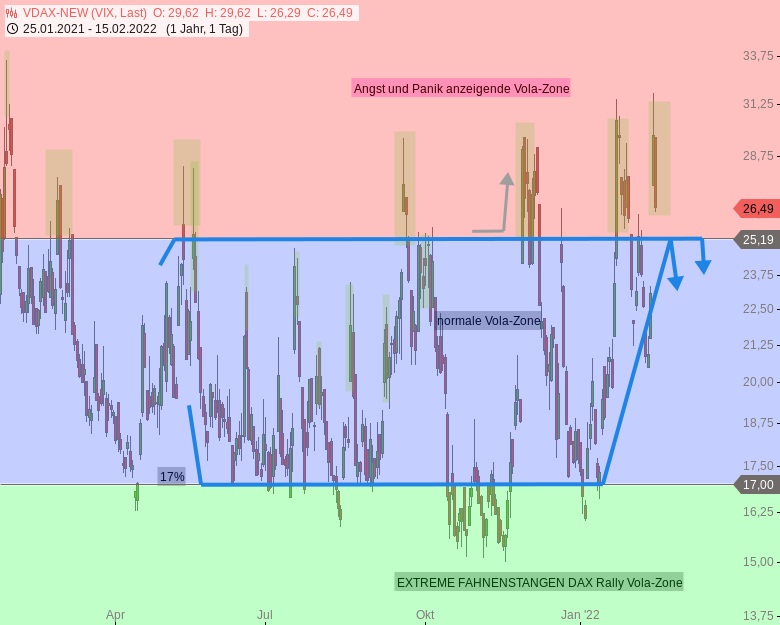

the VDAX New calmed down a bit yesterday, which has a supporting effect on the DAX. The VDAX fell 11% to 26.5%.

The DAX has clearly moved away from the dizzying “cliff 14815”.

A DAX slump below 14815 is no longer an issue for the time being!

On the upside, the DAX still has a lot to do this Wednesday before it has a clear path.

Between 15467/15769 almost everything that has rank and name is due to DAX parameters, Kijun, SMA200, cloud, super trend indicator of the daily candle chart and Kijun of the weekly candle chart.

The larger DAX “Börsenampel” is still on “YELLOW” (see daily candlestick chart with traffic light logic).

The “traffic light” only becomes “RED” under 14815.

“GREEN” is the stock exchange light above 16290.

The short-term DAX route:

The DAX starts friendly today and moves in the narrower daily range between 15625 and 15235.

It would be interesting if the DAX first falls from 15460(15425) to 15325/15275 and then rises to 15615/15625.

In the extended daily range, DAX swings between 15881 and 14831 are also inferred, but only infrequently, with the lower target below 15060 being activated.

I wish you success!

Rocco Grafe

Premium-Service ADT REVIEW: This was traded Thursday + Friday last week…

ADT REVIEW – SHORT DAX 15415 bis ~15300/15275

ADT REVIEW – SHORT NASDAQ100 14760 to 14375 (the best also to 14190)

ADT REVIEW – SHORT DOW JONES 35270+35400 bis 34800

ADT REVIEW – MICRON Technology LONG from 31.1. until 10.2. ($78.50 to $90.05)

Citi products for EUR 0 order fee at Consorsbank

Trade all Citi products at Consorsbank now permanently for an order fee of EUR 0. The promotion is valid from an order volume of 1,000 EUR. Below EUR 1,000 you pay the reduced order fee of EUR 3.95. Please note that the promotion can be ended early at any time. More information.