Metastatic PDAC: Treatment & Survival Disparities

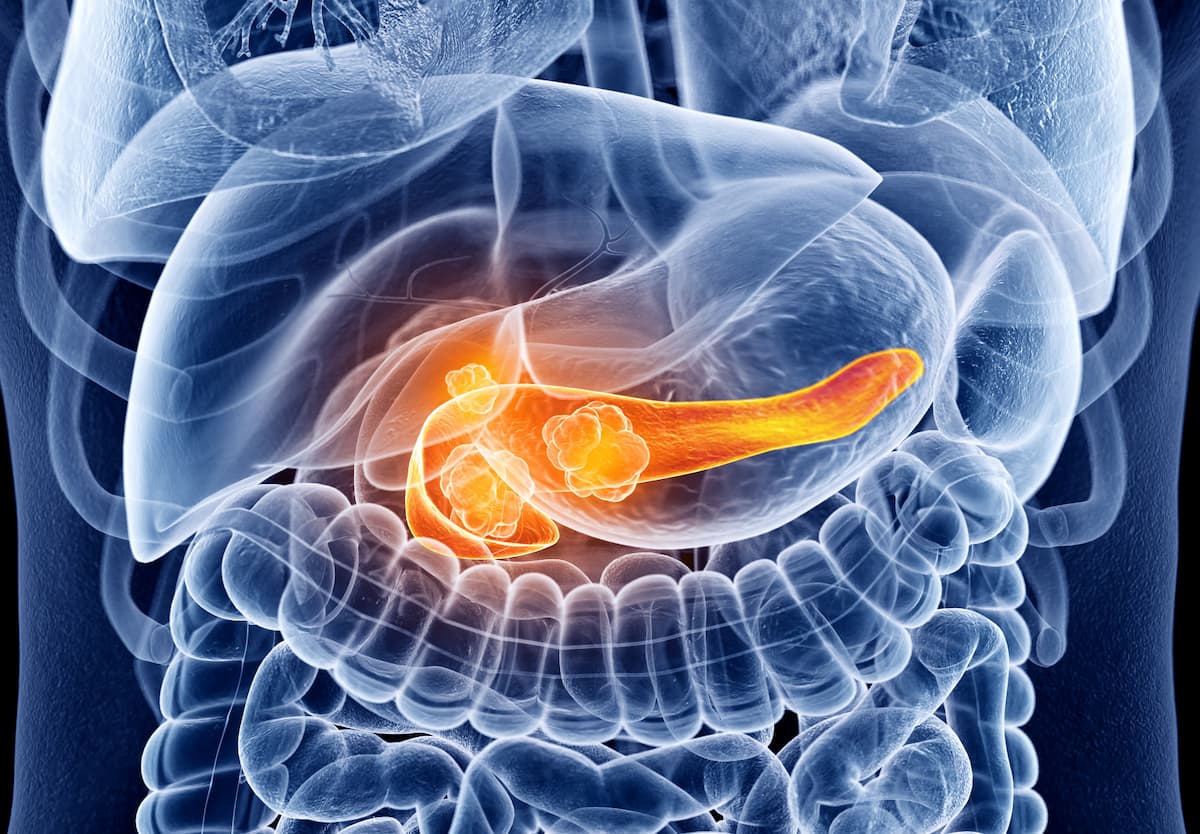

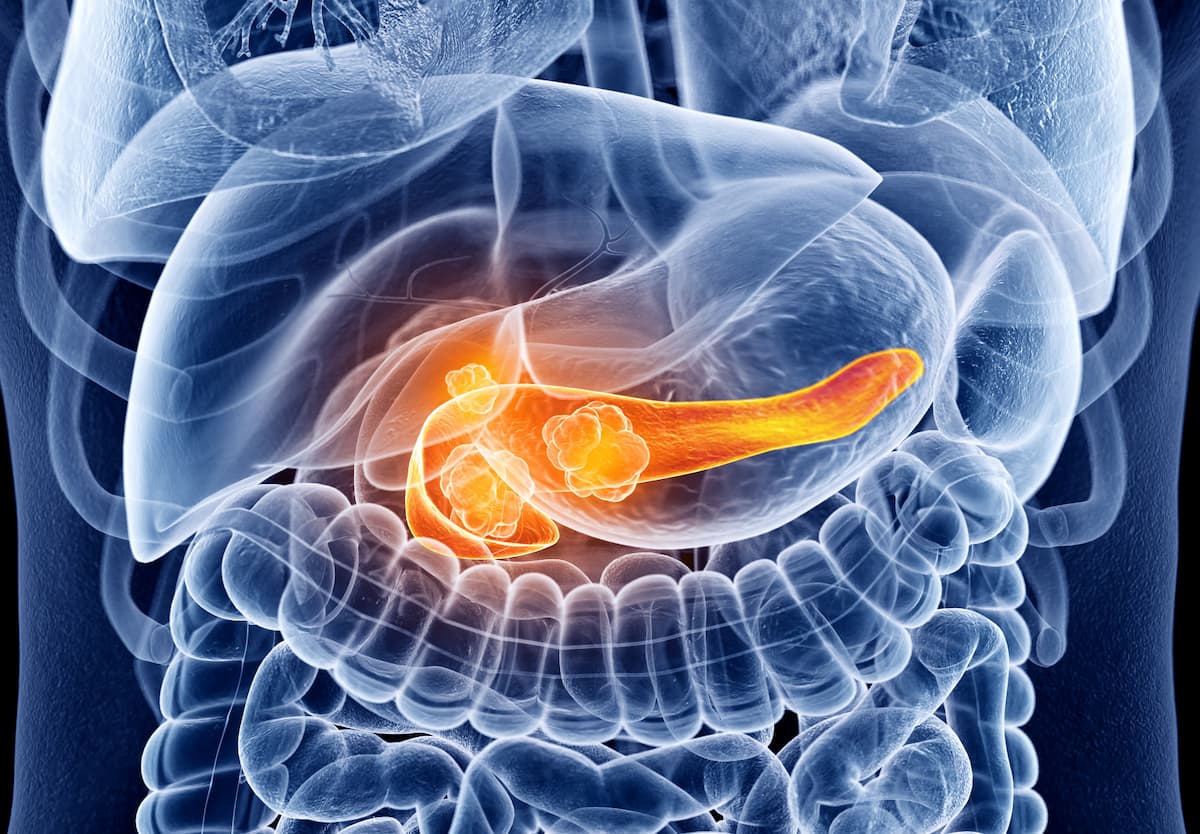

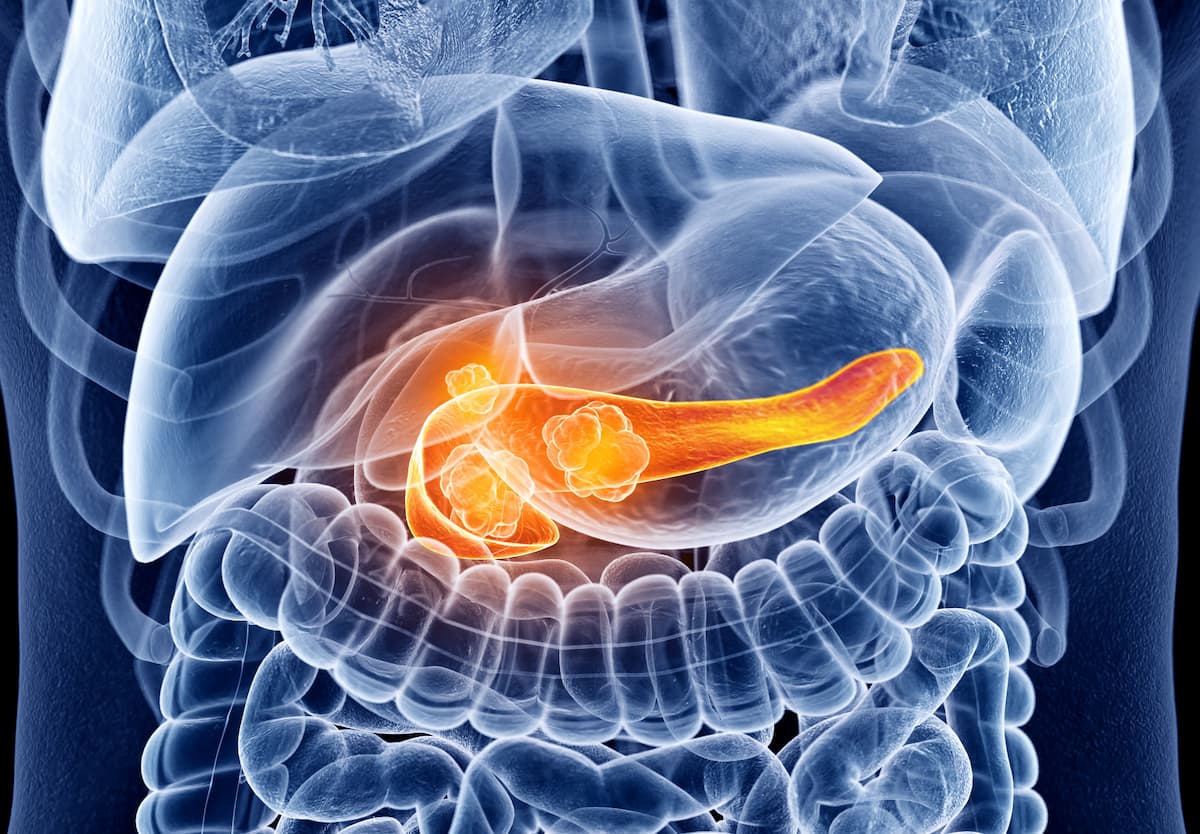

Study Reveals Disparities in Pancreatic Cancer Care Impact Treatment and Survival New research highlights how social vulnerability affects the quality of care for metastatic pancreatic

Study Reveals Disparities in Pancreatic Cancer Care Impact Treatment and Survival New research highlights how social vulnerability affects the quality of care for metastatic pancreatic

Columbus Blue Jackets’ Playoff Hopes Hinge on Philadelphia Flyers Showdown as Canadiens loom By Archyde News Team Published: April 15, 2025 The Columbus Blue Jackets’

From Pixels to Plastic: The AI Action Figure Craze Sweeping the Nation By Archyde News Journalist May 2, 2025 “Life in plastic, it’s fantastic,” Barbie

Kim Dae-ho’s Solo Journey Sparks Reflection on ‘The Great Guide 2’ Exploring the Allure of Solo travel adn Personal Revelation April 15, 2025 On April

Study Reveals Disparities in Pancreatic Cancer Care Impact Treatment and Survival New research highlights how social vulnerability affects the quality of care for metastatic pancreatic

Columbus Blue Jackets’ Playoff Hopes Hinge on Philadelphia Flyers Showdown as Canadiens loom By Archyde News Team Published: April 15, 2025 The Columbus Blue Jackets’

From Pixels to Plastic: The AI Action Figure Craze Sweeping the Nation By Archyde News Journalist May 2, 2025 “Life in plastic, it’s fantastic,” Barbie

Kim Dae-ho’s Solo Journey Sparks Reflection on ‘The Great Guide 2’ Exploring the Allure of Solo travel adn Personal Revelation April 15, 2025 On April

© 2025 All rights reserved