2024-03-17 16:00:00

This sharp decline in Bitcoin wiped out nearly $565 million in market value, impacting both long and short traders.

Long Position Traders Lose More Than $400 Million

The crypto market slowdown caught bullish traders off guard, leading to losses exceeding $400 million for this cohort in the past day alone.

According to CoinGlass data, price speculators recorded a total loss of $565 million during this period. Long traders bore the brunt of the $438 million loss, while short position traders faced a $126 million liquidation.

Notably, long Bitcoin traders took the biggest hit, losing $153 million, followed by Chainlink followers with $94 million in losses. Ethereum and Solana traders also lost over $130 million combined.

These events impacted over 200,000 traders, over 50% of whom trade on the Binance and OKX exchanges.

To find out more: How to buy Bitcoin? Everything you need to know

Liquidation of the crypto market. Source : Coinglass

This decline can be attributed to the brief fall in the price of Bitcoin, which fell below $65,000, its lowest level since the beginning of March. As a leading digital asset, BTC price movements generally dictate the trajectory of the entire market. As a result, major market cryptos like Ethereum, Avalanche, BNB, Cardano, and Chainlink have seen significant price drops.

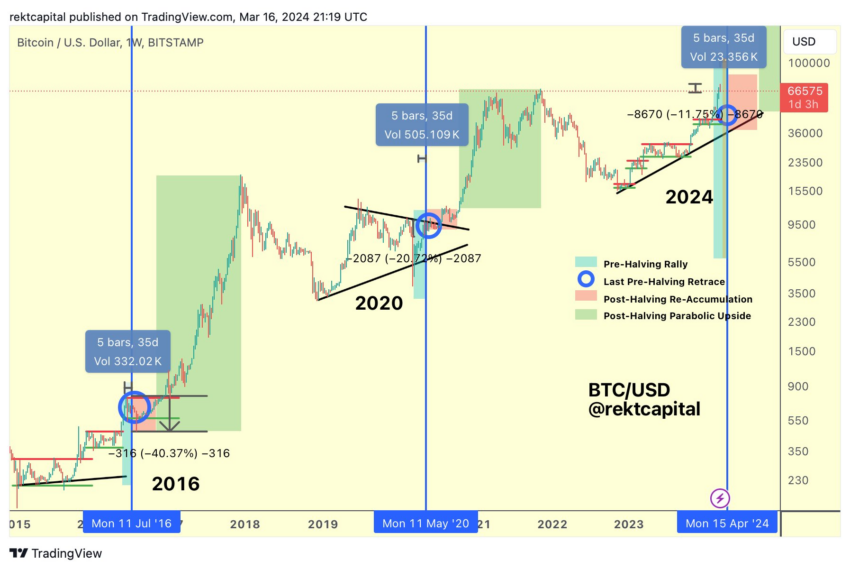

Meanwhile, several crypto analysts interpreted this decline as predictable market behavior. According to Rekt Capital, despite the introduction of spot Bitcoin exchange-traded funds (ETFs), the current bull market remains susceptible to a pre-halving retracement. These pullbacks typically occur 14 to 28 days before Bitcoin halving.

To learn more: Bitcoin Prediction 2024/2025/2030

History of Bitcoin pre-halving retracements. Source: Rekt Capital Rekt Capital

History of Bitcoin pre-halving retracements. Source: Rekt Capital Rekt Capital

Comparing previous cycles, the analyst notes that BTC’s current 11% pullback in the 31 days following the halving resembles past patterns where pullbacks were 20% and 40% in 2020 and 2016, respectively.

“Bitcoin will retrace deep enough to convince you that the bull market is over. Then it will resume its upward trend,” concludes Rekt Capital.

As such, the analyst warned that BTC would enter the “danger zone” in the next three days and urged traders to be cautious.

Moral of the story: Bitcoin fans need to exercise their faith every once in a while.

Disclaimer

Disclaimer: In accordance with The Trust Project guidelines, BeInCrypto is committed to providing unbiased and transparent information. This article aims to provide accurate and relevant information. However, we encourage readers to verify the facts on their own and consult a professional before making any decision based on this content.

1710711054

#panic #grips #crypto #market