Permanent bulls and crash prophets represent the poles of the different stock market predictions, and no comparison is spared in order to give one’s own assessment more weight: The year 1929 plays in the predictions of the crash prophets, the beginning of the “Great Depression ‘, a prominent role. The makers of Game of Trades have dedicated a video on YouTube to this exciting topic and asked themselves how comparable the 20 years before the notorious “Black Friday” 1929 really are with the last 20 years of this century.

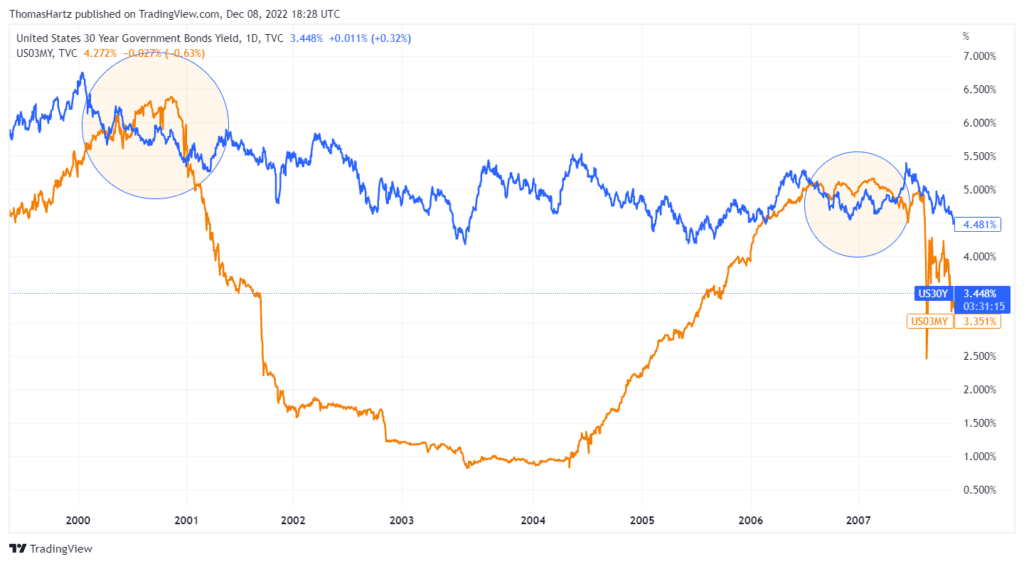

They also go to the current one inverted yield curve which many analysts interpret as an absolute harbinger of a coming recession and an approaching crash. An inverted yield curve means simplifiedthat short-term US Treasury bonds yield higher than long-term US Treasury bonds.

Crash: The stock market years from 1909 to 1929

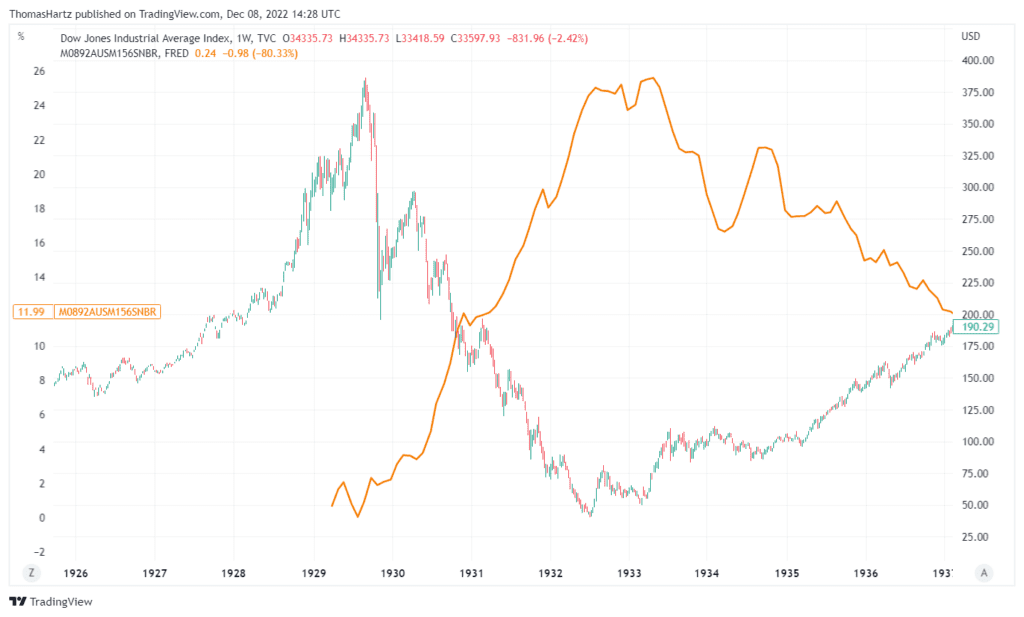

So if you analyze the period from 1909 to 1929 – there are some parallels to today. Even looking at the historical chart of the Dow Jones, one notices that there were two major corrections (1916-17 and 1919-1921) that resulted in a long upswing that peaked in 1929. This was an increase in the Dow Jones from 63.90 (August 1921) to 386.10 points (September 1929). Applied to the present day, this is comparable to the dot-com crash of 2000 and the financial crisis of 2008.

Since then, prices have risen from 6,470 (March 2009) to 36,950 points (January 2022). If you place the inflation index over the historical chart, you can see that the upswing from 1922 to 1929 was accompanied by moderate inflation (zero to two percent), which enabled the central bank to pursue an expansive monetary policy.

A similar situation to that between 2010 and 2020, because inflation was also between zero and two percent there and central bank policy was very expansive. With the recent inverted yield curve hinting at a coming recession, many investors are concerned that this is just the beginning of the downturn and that the big stock market falls are yet to come. In 2000 and 2006, the inverted yield curve had already indicated the coming sell-off. Here is a chart of the 30-year and 3-month US Treasury yields, the circled areas are the periods with an inverted yield curve:

Game of Trades: So why should it be any different this time?

The answer requires a look at the yield curve between 1910 and 1930, according to Game of Trades analysts. For as early as December 1927 an inverted yield curve was forming, as it was almost 80 years later in July 2006. But the market, although already very vulnerable and extremely fragile, continued to rise in 1928-29 and between 2006-2007. What is the situation today, is a similar time lag to be expected before prices actually dip?

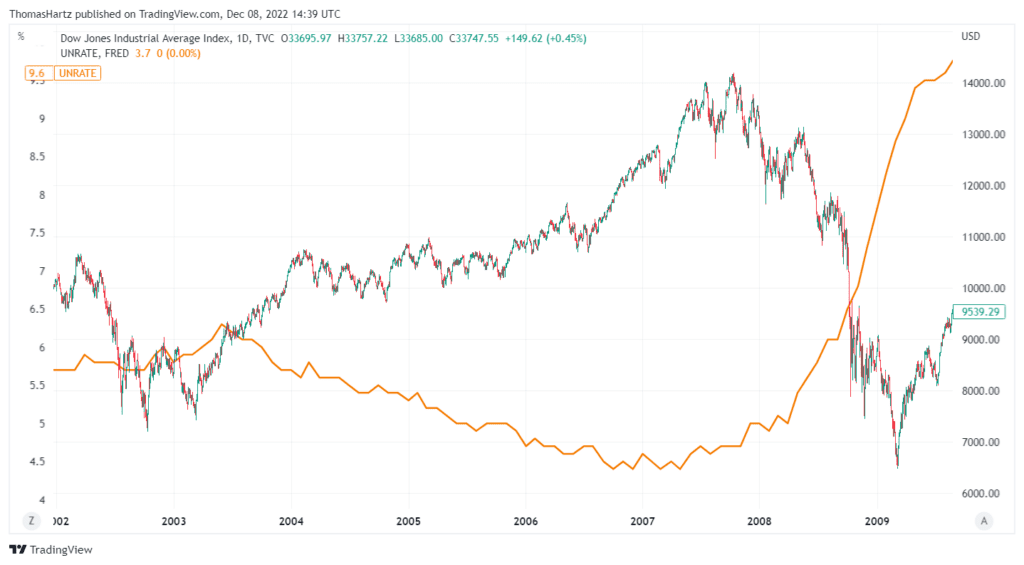

According to Game of Trades analysts, the answer to this question can be found in the unemployment figures, shown here in the chart above the Dow Jones:

Inverted yield curve does not trigger an immediate crash

Although the yield curve inverted as early as December 1927, the stock market downturn began with a delay in September 1929, almost two years later. And only when the unemployment figures rose significantly. The takeaway that Game of Trade analysts draw from this is that an inverted yield curve does not necessarily result in an immediate sell-off in the stock market. Historically, the stock market only collapsed when unemployment rose. The same situation holds true for 2006, when markets continued to bull despite an inverted yield curve until unemployment started to rise. In July 2006, the Dow Jones was listed at around 10,800 points. The high before the outbreak of the financial crisis was in October 2007 at around 14,200 points. Here is the Dow Jones chart with unemployment figures for the period from 2002:

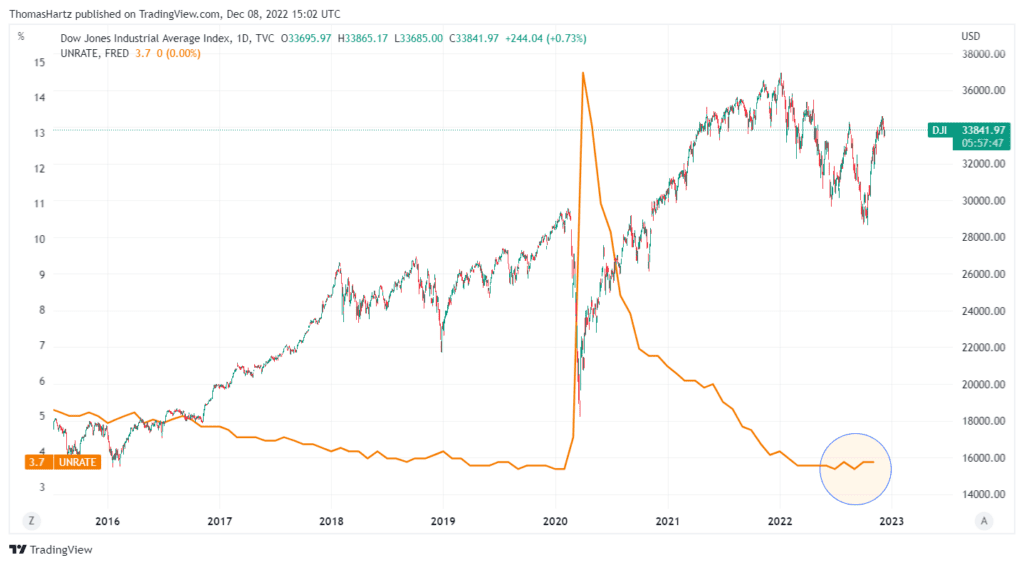

Looking at today, the unemployment rate is still pretty far down. Can’t really speak of an increase.

As long as the unemployment figures do not rise significantly, a collapse of the financial markets is unlikely, according to analysts at Game of Trades. As explained in the previous Game of Trades videos, there are some important indicators that can show a trend in the stock market early on. In addition to unemployment numbers, some of the most watched metrics include the homebuilder index, the US dollar index, junk bond yields, yield spreads between US and non-US bonds, the volatility index, and inflation data Game of Trade makers use for their analysis.

course data https://de.tradingview.com

Disclosure according to § 80 WpHG for the purpose of possible conflicts of interest:

The author of this publication declares that he can invest in any of the financial instruments mentioned and analyzed or commented on at any time. This may result in a conflict of interest. However, the author assures that every analysis and every market commentary has been prepared in compliance with journalistic due diligence requirements, in particular the duty of truthful reporting and the required expertise, care and conscientiousness.

This publication does not constitute investment advice. It is also not a recommendation to buy or sell securities or other financial instruments. Past performance is no guarantee of future results. The analyzes provided are for information only and cannot replace individual investment advice. Liability for indirect and direct consequences of these suggestions is therefore excluded.