A sluggish demand

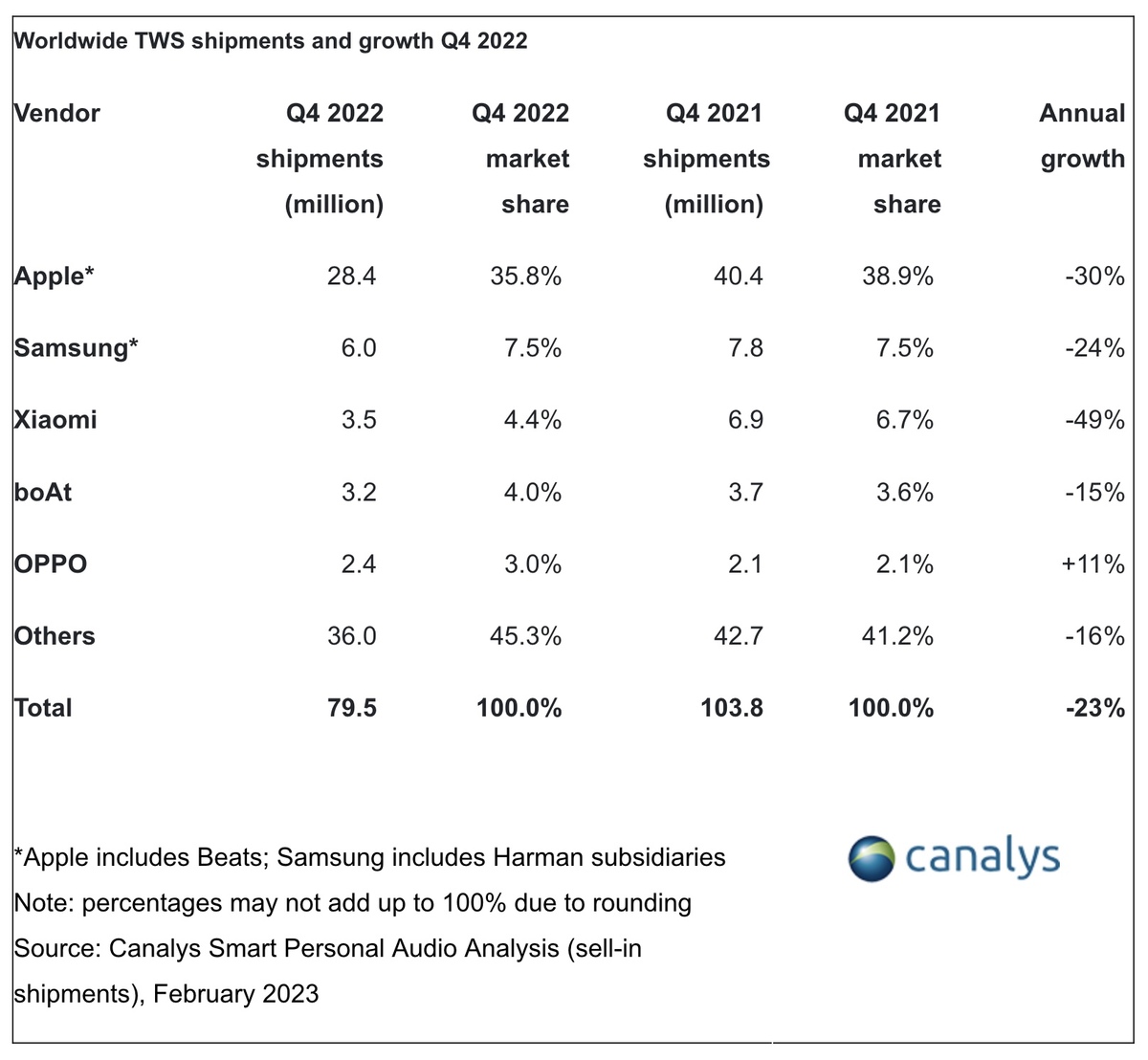

In its latest study, Canalys does not see life in yellow, finally pink. In fact, the market for True Wireless Stereo would have started a downward slope towards the end of the year, and would record only 79.5 million units sold in the fourth quarter (-23%). Over the whole of 2022, the situation is smoothed thanks to the sales of AirPods which limit breakage (-1%), total shipments would have fallen by 2% to reach 287.7 million units.

Apple would have had a complicated end to the year with a 30% drop year over year, and 28.4 million headphones sold, AirPods and Beats combined. This situation should be put into context, strong shipments in the fourth quarter of 2021 with the postponed release of the AirPods 3.

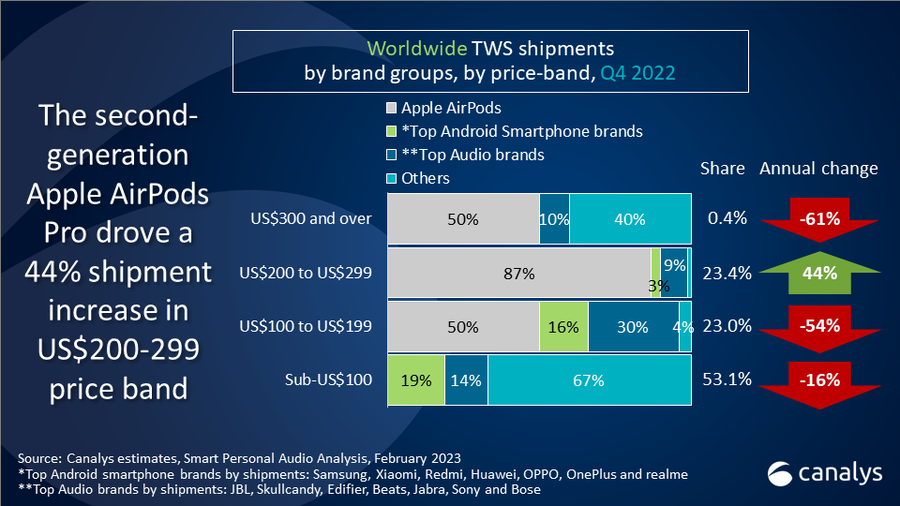

At the same time, AirPods Pro 2 would still have kept Cupertino ahead, contributing 63% of all Californian TWS shipments. Consequently, its market share eroded a little, dropping from 38.9% to 35.8% in one year.

Is there still a place for Apple in a sector in crisis?

In terms of competition, it is hardly brilliant, and the difficult macroeconomic context was no exception. Samsung (including JBL and other Harman subsidiaries) and Xiaomi also saw steep declines of 24% and 49%, respectively, despite a more aggressive strategy and more accessible pricing.

We note in passing that the entry-level models (price below 100 dollars) would however represent 55% of market share, once morest 48% a year ago. which is far from the target pursued by Cupertino.

But the firm should have a card to play, that of Health, to boost sales of its headphones (and justify their price). Last November, a study by iScience argued that AirPods Pro can – in some cases – work just as well as some much more expensive hearing aids.

On the same subject, the editorial staff advises you: