Bitcoin’s price might potentially follow the gold fractal of the 1970s, the last time inflation in the United States slipped out of the Fed’s hands. At that time, the precious metal produced a rally of more than 700%. Will the same now happen with digital gold?

Bitcoin follows the gold price fractal of the 1970s

In the past week, both Bitcoin and gold prices have risen nicely in the market environment created by bank raids and bank failures. Gold is up roughly 10% since the start of the year, while BTC is up nearly 70%.

With banking stocks plummeting and leading cryptocurrencies rising by market cap, BTC has produced some of the most shocking and amazing price charts imaginable.

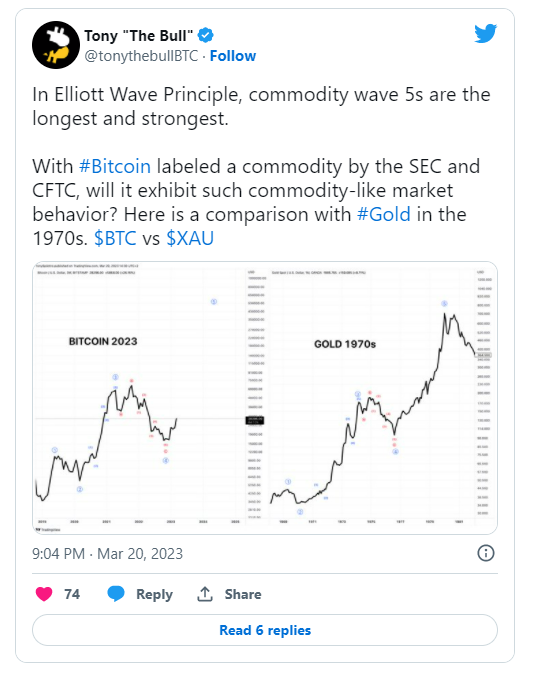

This shock and awe may continue if BTC’s fractal follows the gold march of the 1970s. In the 1970s, the United States inflation rate exceeded 10%, and double-digit values were not uncommon even in the early 80s.

During the worst period, gold rose more than 750% from $100 to $850 per ounce. Now, the same price fractal might potentially return for Bitcoin, and with it, soaring inflation might stay with us in the longer term.

The fastest horse in the race once morest inflation

During the 2020 bull run, billionaire investor Paul Tudor Jones said that Bitcoin might be the fastest horse in the race once morest inflation, referring to the gold rush of the 1970s.

Inflation first reached double digits in 1974, just three years following US President Richard Nixon announced that the US would no longer be able to convert dollars to gold at a fixed price of $35 an ounce.

Gold rose parabolically, first experiencing a minor decline in 1974 when inflation overheated. After a two-year correction, gold rallied more than 750% in the following years.

The price of Bitcoin also corrected hard when inflation first hit its head. But following two years, it starts to show flexibility. In the future, it might prove to be the digital equivalent of 1970s gold and help investors beat inflation or a banking crisis.

In the price fractal above, gold has completed a 5th wave following an extended flat correction according to the Elliott wave principle. In commodity markets, wave 5s are usually extended. Since BTC is classified as a commodity by the SEC and CFTC, might the crypto asset perform similarly?

If BTCUSD were to follow the same path with a 750% retracement from recent lows, Bitcoin might eventually rise above $132,000. We look forward to the coming months with great excitement.