2024-06-04 00:24:00

Change-traded funds (ETFs), as soon as criticized by particular person traders, have gained renewed consideration. That is in regards to the KBSTAR Rechargeable Battery High 10 Inverse ETF, which bets on the decline of rechargeable battery-related shares. When KB Asset Administration launched such merchandise final 12 months, particular person traders even known as for a boycott of KB Asset Administration.

However wanting on the price of return alone, it’s appropriate to guage the supervisor’s decisions at the moment. Nonetheless, some individuals identified that this product isn’t appropriate for long-term funding, as a result of it can solely profit from the long-term decline of secondary batteries.

Graphics = Jung Search engine optimisation-hee

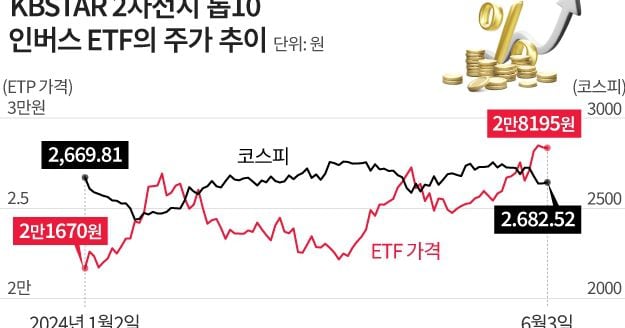

In response to a report by monetary data supplier Zeroin on the 4th, the yield price of the highest ten inverse ETFs of KBSTAR rechargeable batteries this 12 months is 32.06%. Take into account that the KOSPI index rose 1.02% over the identical interval, considerably outperforming the market.

This product is Korea’s solely secondary battery inverse ETF. There’s a story right here. Final 12 months, the chief in rechargeable batteries Ecology main (086520)Yeouido shared the problem of the corporate being overvalued when it was listed as an emperor inventory (a inventory price greater than 1 million gained per share). Nonetheless, till September of that 12 months, no asset administration firm had launched a product betting on the {industry}’s decline. This is because of worry of backlash from particular person traders.

At the moment, the primary traders in rechargeable batteries had been people led by monetary influencers (a compound phrase of finance and influencer), together with “Battery Man” author Park Quickly-hyuk. Subsequently, it’s troublesome for even safety analysts to make {industry} evaluation stories. That is as a result of private backlash poured into the corporate.

When Hana Securities launched its first “promote” opinion report, EcoPro broke its lengthy silence and have become the goal of assaults by retail traders. They filed a grievance with the Monetary Supervisory Service, accusing researcher Kim Hyun-soo, who wrote the report, of being associated to short-selling forces. Researcher Kim should clarify the state of affairs to the Monetary Supervisory Service. Late final 12 months, Researcher Kim was stopped and insulted by a person investor on his solution to work.

On account of this case, it’s troublesome for asset administration corporations to launch associated merchandise even when they know that the value of secondary batteries is excessive. On the time, an official at a serious asset administration agency mentioned there have been no plans to launch a chargeable battery inverse ETF, saying, “If we launch a product that causes quite a lot of noise available in the market, the corporate will probably be noisy.” One other official “There aren’t any profitable circumstances of industry-based reverse engineering,” he mentioned, including, “It is troublesome to succeed from the start as a result of we now have to coach the market that this {industry} won’t succeed.”

KB Asset Administration

Contemplating that secondary batteries are within the early phases of development and their inventory costs fluctuate tremendously, KB Asset Administration launched the {industry}’s first reverse funding product for secondary batteries. The product was listed with complete web property (AUM) of 10 billion gained, and as traders flocked to the market, the dimensions expanded to 94.6 billion gained. That is the most important of the inventory thematic reversals. The fee is 0.49%, which is increased than the common of all 868 ETFs (0.30%). This introduced in tons of of tens of millions of gained in charge revenue.

Response from particular person traders was lukewarm, however returns had been heat. It is because secondary batteries, which noticed enormous development final 12 months, are performing sluggishly this 12 months. As a number one secondary battery inventory, the inventory value as soon as rose to 629,000 gained. LG Power Options(373220)Final month it fell to the bottom value since its itemizing (326,000 gained), and Ecopro BM additionally recorded its lowest share value in almost a 12 months final month (181,500 gained).

Due to this, when the “TIGER Secondary Battery High 10 Leverage” and “KODEX Secondary Battery Business Leverage” of different corporations investing within the ahead course of secondary batteries have been halved, KBSTAR Secondary Battery High 10 Inverse is the one secondary battery Battery ETFs revenue

Former President Donald Trump, who was destructive regarding electrical automobiles, is more likely to make a comeback, which might even be excellent news for secondary battery inverse ETFs. That’s as a result of former President Trump predicted a fossil gasoline renaissance. Some individuals imagine that following the Trump administration takes workplace, the Inflation Discount Act (IRA) that gives subsidies for electrical automobiles produced in North America will probably be repealed, and manufacturing and consumption subsidies will probably be diminished.

The Korea Institute of Industrial Economics predicts that if Trump is elected, the expansion of the U.S. electrical car market will decelerate, by way of “the affect on the Korean {industry} and response plans primarily based on the course of the U.S. presidential election.” South Korea’s main secondary battery corporations nonetheless have room to be hit.

Nonetheless, there are recommendations that the highest 10 KBSTAR secondary batteries aren’t appropriate for long-term funding. That is due to the construction of inverse ETFs. The longer an inverse ETF is held, the higher the distinction between the ETF’s cumulative returns and the underlying index’s cumulative returns.

For instance, if the underlying index began at 1000, fell to 975 (-2.5%) the following day, following which instantly rose 2.56% and recovered to 1000, the ahead ETF would have a return of 0, however the inverse ETF would have a ultimate return of destructive ( – ) All 0.12%. On the day when the underlying index reached 975, the inverse ETF rose 2.5% to 1025, however fell 2.56% the following day to 998.8.

Taxes even have their downsides. Secondary battery ahead ETFs that embrace domestically listed shares aren’t topic to buying and selling revenue tax. Nonetheless, inverse ETFs are an artificial kind during which the supervisor solely obtains the return of the goal index by way of over-the-counter derivatives contracts with securities corporations. Artificial ETFs are taxed at 15.4% of the decrease of buying and selling income and the incremental tax foundation value (tax foundation value). The calculation of the tax foundation solely calculates the taxable quantity of the ETF’s income.

The HKMA warned that “inverse ETFs are extraordinarily dangerous merchandise and their costs and funding good points and losses might fluctuate considerably relying on market tendencies.”

1717467168

#Complaints #Administration #launches #secondary #battery #inverse #ETF.. #Thumbs #returns #fee #revenue