2023-05-26 21:45:00

The French transport and logistics group presented its financial results for the first quarter of 2023 on May 26. The last European to do so following Maersk and Hapag-Lloyd, MSC abstaining. CMA CGM will not do better than its peers in this troubled situation. Some indicators even appear more degraded than for its direct competitors.

Third and last European carrier to present its financial results for the first quarter of the year (MSC abstaining), CMA CGM will not do better than its direct competitors, Maersk and Hapag-Lloyd, which communicated their underperformance there a few weeks ago already.

In this troubled environment, container ship owners are struggling, stuck between very low spot rates, below the break-even point on transpacific and Asia-Europe trades, and contractual rates negotiated last year at high rates but which will no longer serve as a shield for very long, the contracts coming to an end.

The Shanghai Containerized Freight Index (SCFI, average of spot rates from Shanghai to around 20 destinations) and the China Containerized Freight Index (which tracks average spot and contract rates for exports from China, CCFI) fell by 81 and 72% since January 2022.

In addition to freight rates, companies have a second problem to manage: pressure on demand is accompanied by pressure on supply, while a capacity of 6 to 7 MEVP will surge on the market from this year and until 2025. Over the last four years, the size of the container fleet will have increased by 16.9% (26.2 MEVP at the end of April), which is 3.8 MEVP more than in April 2019 .

Stalling indicators on all fronts

« The first quarter of 2023 was a continuation of the end of 2022 with a degraded market environment for the transport and logistics sector. The slowdown in demand for the transport of goods continued and resulted in an accelerated normalization of spot freight rates summarizes the press release from CMA CGM, collected in three pages, more sparing on the acts of this beginning of the year.

The group turnover amounted to $12.7 billion once morest $18.22 billion over the same period. AT 3,4 Md$l’Ebitda (operating income before interest, taxes and amortization) suffers a drop of 61,3 %. The marge settles in rwould be 21.7 points with its 27%. THE net profit ($2.01B) lost more than $5B.

The maritime, pillar of the tripod

While the group has well developed related activities since 2019 as part of its door-to-door strategy, the maritime activity continues to provide the group with the bulk of its resources. Revenues were $8.9 billiondown from 40,3 % compared to the same period in 2022 (nearly $15 billion).

The collapse of operating profit before financial items (- 64,3 %) is in line with that of the group for this ratio and nevertheless reached $3 billion. The margin is down 23.1 points but still within the sphere of 30% (34.4%).

CMA CGM does not communicate its Ebit, close to the operating result in French accounting, more meaningful for analyzing operational performance. Between the first quarters of 2022 and 2023, the average operating margin of the top ten carriers sank by 43.2 points to end at 13.1%. This is the fourth consecutive quarterly decline for the sector since the peak in the first quarter of 2022.

Volumes contained at 5 MEVP

The world number three regular line managed to more or less contain the erosion of its volumes to 5 MEVP, down 5.3% compared to the first quarter of 2022.

« This decline is due to several factors.says the press release. Household consumption of goods in Europe and North America fell sharply once morest a backdrop of price inflation and a rebound in services. Inventory adjustments continued, weighing on imports, particularly from Asia and in the retail sector. The relative dynamism of areas such as Latin America or Africa as well as the end of congestion have not made it possible to offset the declines on the main East-West links ».

Compared to Maersk and Hapag-Lloyd?

On a like-for-like basis, CMA CGM’s indicators are worse than its two direct European competitors in the world’s Top 5 liner companies.

Maersk, the world number two and direct competitor of CMA CGM, reported Ebitda of $3.97 billion (-56%), revenue of $14.2 billion (-26.4%) and net income of $2.32 billion $ (-65.9%). Four points separate the turnover of the Dane from that of the French while the gap between the Ebitda is 5.3 points and 6.14 points for the net results.

The gap is even bigger with Hapag-Lloydworld number five regular line, which posted the best financial profile of the world class during this first quarter.

The German carrier published an Ebitda down 53.2% to €2.5 billion, net income ($2.01 billion) down 54.5% and revenues (€5.61 billion) down down 29.61%, mainly due to an average freight rate down 27.9%. This means that there are eight points between the Ebitda of the French and the German and more than 17 points of difference between the net results.

Average revenue per TEU carried of $1,766

Profits and operating margins depended more than ever in this first quarter on the extent of the fall in volumes and freight rate levels, the financial challenge being to limit the erosion.

In terms of volumes transported, the three shipowners swim in the same waters. But CMA CGM’s average revenue per TEU ($1,766, down 37% from the same period in 2022) is below that of Hapag-Lloyd ($1,999/TEU) and far from Maersk which has reported an average rate of $2,871/TEU.

Logistics, terminals and aircraft

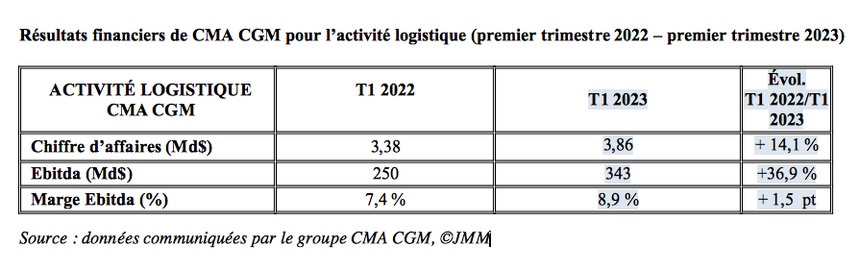

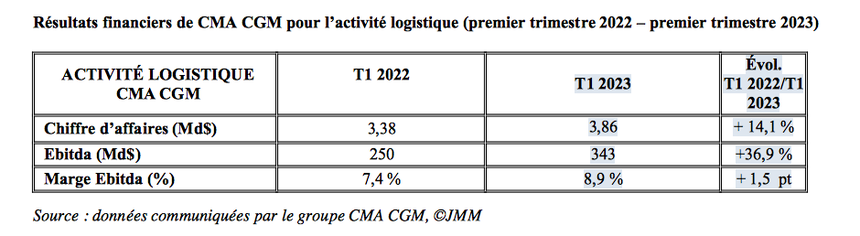

Outside the maritime sector, the French group’s activities are progressing, driven by the entry into its scope of the recently acquired activities, Ingram CLS, Gefco and Colis Privé.

The turnover of the logistics activity rose at $3.9 billion in the first quarters (+14.1% vs. 2022). At $343 million, theYield of bonds is 36.9 %.

The operating profit of the other businesses – category in which CMA CGM classifies its port terminals, its air fleet CMA CGM Air Cargo, and its media division regarding to get its hands on the Tribune – have unscrewed by 47%, pulled down by port handling.

While in early April, CMA CGM and Air France-KLM kicked off their 10-year alliance, the airline subsidiary of the shipping company (four A330-200s and two B777s; two 777s and four A350s on order) recently redeployed its aircraft to Asia and the Middle East, withdrawing from the United States.

This is not the first time that the company has suspended its flights across the Atlantic. It had lifted its operations to Chicago and Atlanta at the end of last year, preferring to charter two A330s from Qatar Airways and DHL Express, before resuming flights to Chicago and Miami at the start of the year.

CMA CGM Air Cargo, which provides regular services to Abu Dhabi, United Arab Emirates, and Guangzhou, China, announced in recent days a new service four times a week to Mumbai from Paris-CDG.

What a feeling for 2023

In terms of outlook, CMA CGM is not making any major swerves and is careful not to share its macro-economic impressions for 2023. In the current context of a degraded environment for the sector, the first quarter should be the best of the year”indicates the group, which is nevertheless confident in its ability to understand the inverted cycle “ thanks to its strategy combining transport and logistics, and its financial strength ».

Cash net of debt was $6.2 billion as of March 31, up $1.5 billion from December 31, 2022.

stay right

Against a very real 70-80% drop in freight rates and a worsening balance between supply and demand, liner operators have so far managed to keep rates at higher than before the pandemic. They are still 32% higher than in 2019, according to the latest data from Bimco.

According to Xeneta, which relies on real-time tariff data provided by major shippers, the Asia trade is the only one where spot rates are currently below 2019 levels. from South America are currently 96% more expensive than in 2019, and 47% to the Middle East.

On the other hand, carrier margins were still preserved in the first quarter of 2023 due to pre-negotiated contractual rates, but will no longer be in the second part of the year. Xeneta estimates that deals signed in the last three months have averaged 45% less than the highest prices set last year. The declines range from 26% for traffic to the Middle East to 59% for short-haul to the Mediterranean.

Be that as it may, compared to difficult precedents, carriers have a few billion ahead of them which should allow them to “live better” on prolonged losses.

Adeline Descamps

Container: why European carriers are doing better than Asians

Container: spot rates are still 32% higher than in May 2019

Times are tough for shipowner airlines

While still exceptional, Maersk’s profits fall by more than half in the first quarter of 2023

Hapag-Lloyd expects profits to halve in 2023

1685165250

#CMA #CGMs #net #income #fell #billion #year