July 14, 2022

image source,Archyde.com

China’s real estate industry has developed rapidly in the past two decades, and the housing prices in first-tier cities such as Beijing and Shanghai have become the most expensive in the world. According to the World Bank report, the real estate industry accounts for regarding 30% of China’s GDP.

Affected by the “zero” policy of the new crown epidemic, the economy of many places in China is facing a severe situation. At the same time as housing prices are falling, there are news in many cities that home buyers are refusing to pay mortgages for “unfinished buildings”.

Since the suspension of loans for “unfinished buildings” is closely related to the stability of the banking and financial system, the Chinese and foreign media have paid great attention.

What issues have the media reported on?

On Wednesday (July 13), Bloomberg quoted the latest report on real estate prices in China released by Citigroup Inc., saying that a total of 35 real estate projects in 22 cities in China were “unfinished” or housing prices fell sharply, and the purchase of houses decided to stop paying the mortgage.

Bloomberg’s analysis believes that, in fact, the problems of China’s real estate industry are spreading to banks. Mortgage defaults underscore the extent to which the storm engulfing China’s real estate industry is now affecting China’s middle class and posing a threat to social stability. China’s banks, already grappling with the challenge of liquidity pressure from developers, now have to prepare for homebuyers breach of contract.”

There are more “unfinished building” projects in China’s internal statistics. It is said that as many as 52 owners of unfinished or unfinished buildings have issued notices of suspension of loans, involving regarding ten developers including Evergrande.

This week, the Chinese media “First Financial” reported that recently, the owners of unfinished buildings in many places have issued a statement that they will forcibly stop loan repayments until the relevant projects are fully resumed. The cities involved include Zhengzhou, Shangqiu, Xinxiang, Henan Province, Nanyang, Zhoukou, and cities in Shanxi, Jiangsu, Jiangxi, Hunan, Hubei, Guangxi, Shaanxi and other provinces.

According to China’s statistics, as of the end of 2021, the total construction area of unfinished buildings in 24 key monitoring cities that have not yet been delivered is nearly 25 million square meters, accounting for 10% of the total transaction area of commercial housing in 2021.

What rescue measures does China have?

In addition to the “unfinished” problem of residential buildings under construction, a new rescue measure called “group purchase of houses” has also appeared in many places in China. According to incomplete statistics from The Paper, since June, at least Taiyuan in Shanxi, Zhongshan in Guangdong, Shenyang in Liaoning, Tonglu in Zhejiang, Tongling in Anhui, Pu’er in Yunnan, Bazhong in Sichuan, Huanggang in Hubei, Changchun in Jilin and other places have released policies related to “group purchase” or activity.

image source,Archyde.com

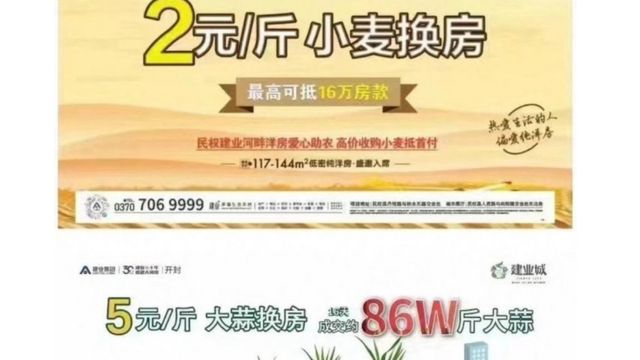

Prior to this, statistics said that more than 300 rescue measures were issued across China, including “wheat house replacement” and “garlic house replacement”.

Some commentators warned that if the wave of homebuyers refusing to pay mortgages on unfinished buildings spreads, it will not only affect China’s real estate, but also affect the stability of China’s banking system.

The economic proportion of real estate in China

Over the past 20 years, China’s real estate industry has developed rapidly and has become one of the main engines of economic growth. The housing prices in first-tier cities such as Beijing and Shanghai in China are among the most expensive in the world. The ratio of housing prices to residents’ income is far higher than that of major cities in the world such as New York, Paris, Tokyo, and London.

So, what is the proportion of real estate in China’s economy?

The World Bank’s China Economic Brief, released in June, concluded that by the end of 2021, China’s real estate investment accounted for 13% of GDP, compared with only 5% in OECD countries; “If supply chain inputs are considered The real estate industry accounts for regarding 30% of China’s GDP.”

“Therefore, a disorderly adjustment in the real estate industry will have significant economic consequences.”

The plan put forward by the World Bank for China to solve the current real estate problem is: the goal of the policy in the short term should be to stabilize the market and create conditions for the orderly reorganization of the market.

The protest by depositors of rural banks in Henan was another major event that raised concerns regarding China’s financial stability, before the issue of mortgage loan cuts by owners of “unfinished buildings” attracted widespread attention.

To this end, the State Council Information Office of China held a press conference on July 13. Sun Tianqi, director of the Financial Stability Bureau of the People’s Bank of China, said at the meeting that the Bank of China is stable and financially stable.

He said that China’s “financial risks are restrained and generally controllable”, and 99% of banking assets are within the safe boundary; by the end of 2021, the total assets of banking institutions will account for 90% of the total assets of the entire financial industry, “banks are stable and financial stable”.