Rising domestic steel prices due to growing demand… International prices are already rising.

The surge in iron ore prices is a burden… Up to $40 per ton in two months

Expectations for earnings improvement in the domestic steel industry are growing as international steel prices are starting to rebound on the back of China’s economic recovery.

According to the steel industry on the 23rd, the domestic distribution price of hot-rolled steel sheet (SS275) produced by POSCO and Hyundai Steel maintained around 1.05 million won per ton for a month until the 13th.

The price of hot-rolled steel sheet rose to 1.25 million won at the end of September and then showed a downward trend.

At the beginning of last month, it fell to 1.05 million won, but now it seems to have entered a steady state.

The price of heavy plate (SS275) of POSCO and Hyundai Steel has also been on a downward trend since September of last year, but has been maintaining at 1.15 million won per ton since the end of November.

The industry predicts that domestic steel prices will stop falling and a movement to raise them will become visible.

Park Seong-bong, a researcher at Hana Securities, said in a report, “Steel demand before the Lunar New Year holiday is a wait-and-see situation, but domestic steel prices are expected to rise along with the rise in imported prices.”

Imported hot-rolled steel sheet and heavy plate prices have already entered an upward trend.

The price of imported hot-rolled steel sheet, which fell to 920,000 won per ton at the beginning of last month, rose to 950,000 won as of the 13th.

Imported heavy plates, which maintained around 900,000 won per ton in November and December, rose to 950,000 won in the first week of January and 980,000 won in the second week.

Last year, the domestic steel industry suffered from a contraction in demand due to the global economic slowdown. However, profitability is expected to improve this year as steel prices rise thanks to China’s reopening (resumption of offline activities) and the recovery of the construction market.

Steel prices in major countries have already shown signs of rising since the beginning of the year.

According to the Korea Iron and Steel Association, steel prices in China rose from the previous week in all items last week (9th to 13th), and the rise in the United States and the European Union (EU) also expanded due to strong atomic ash prices and steelmakers’ price hikes.

Posco, which suffered from flooding due to Typhoon Hinnamno last year, is expected to give impetus to improving business conditions as all factories have resumed normal operation from the 20th.

POSCO suffered an operating loss of regarding 370 billion won in the fourth quarter of last year due to production suspension and restoration costs at the Pohang Steelworks, but the observation that it will turn to the black in the first quarter of this year is weighted.

However, soaring iron ore prices are expected to weigh on the domestic steel industry.

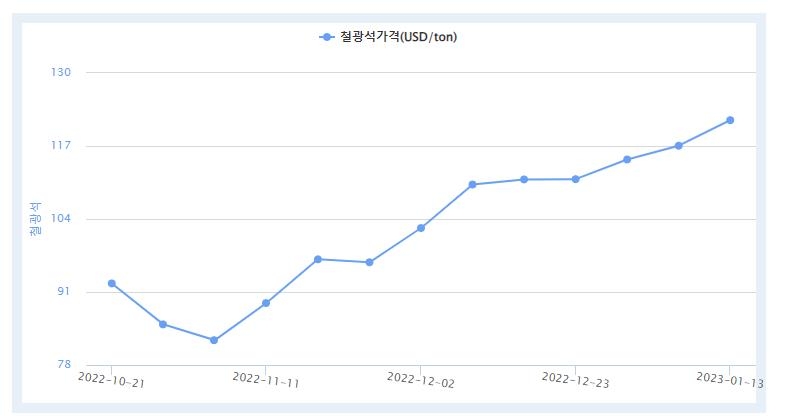

According to the Korea Resources Information Service, the price of iron ore soared by regarding $40 per ton in two months since November of last year, reaching $121.6 as of the 13th.

Compared to the previous month’s average, it rose by 11.8%, continuing a steep rise.

An official in the steel industry said, “If the price of iron ore rises, the price of representative steel products rises, so it is also a factor that improves profitability.” It is true that it is difficult to reflect the change in the value of ashes at any given time.”

Bituminous coal (coking coal) prices are also on an upward trend.

Last week, bituminous coal prices rose 45.2% from the previous month’s average to $307.3 per ton.

/yunhap news